The US Dollar is in a Bull Market

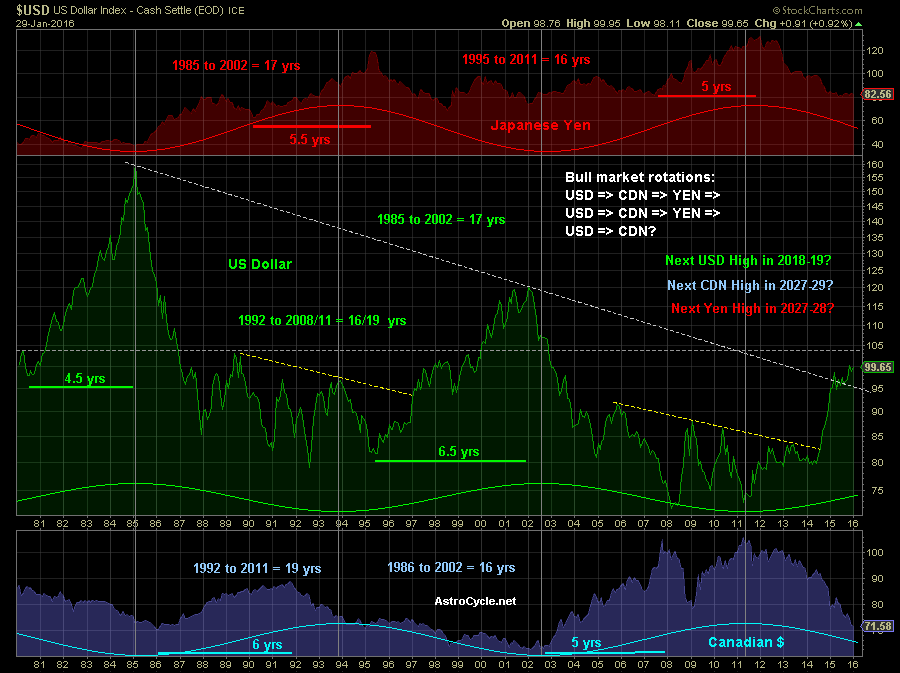

The US Dollar will most likely drive much of the moves in other currencies, since it has the largest monetary base and is used to price so many materials. In this chart we look at the other two major currencies which is the Japanese Yen and Euro. We also look at the Canadian Dollar which is one commodity related currency and almost tracks the Australian Dollar.Most Currencies are driven by a 16 to 17 year cycle

The 17 year cycle is the Cicada reproductive cycle, and has been puzzling scientists for many years. Besides being a Prime number, 17 years is also 6,209 days long which is an octave of the well known Fibonacci ratio as in 0.62 x 10,000 = 6,200, but it is also close to π or 3.14 x 2,000 = 6,280. The 16 year cycle is visible in the Canadian Dollar since 1921, and probably as far back as 1860, but the US return to the Gold standard in 1879 kept the exchange rate flat for 32 years and another multiple of 16 years.Typical Bull Markets in Currencies last 5-7 years

Previous bull markets in the US Dollar have lasted 4.5 to 6.5 years, and we can find the same range in previous bull markets in the Yen and Canadian Dollar. Since the US Dollar started its bull market in 2011, then we would expect it to last until January 2016 to January 2019 which is a big range and needs to be fine tuned.The little known Rotation in Currencies

The last two cycles unfolded in a rotation from a US Dollar bull market, to a Canadian Dollar bull market and then a Japanese Yen bull market. This makes some sense, since a strong US Dollar is often driven by a strong economy. This increases demand for commodities and their currencies like the Canadian Dollar. There is also the indirect effect of Asian manufacturing first increasing its purchases, and then its currency surging from the increasing exports of manufactured goods. Today, most manufacturing is done in Asia, and this should magnify this rotation, but the Yuan will likely be the next beneficiary after the commodity currencies have their bullish run.

The US Dollar is mirroring the period between 1988 and 2002

From the early 1988 low to the fourth and final low in mid 1995, we saw three rallies of about 20-25% each over 7.5 years. A similar behavior can be seen from the early 2005 low to the to the fourth and final low of mid 2011, we saw three rallies of of 15-25%. From the final low of 1995, we rallied from about 0.80 to 1.20 or 50% higher in 6.5 years. Should the current US Dollar rally behave the same, we should reach about 0.70 x 1.5 = 1.05 which is the strongest resistance left before 1.20 is even possible. From the current level of 1.00, this leaves little room for a move higher, and is probably why the US Dollar is struggling. Once we pull back to 0.90 or so, the risk/reward will be better and speculators will be more inclined to buy for the 15% move up to 1.05.There is a relationship which could send us to the 2002 high of 1.20

The move up from 1995 low near 0.80 paused twice at the 1.5 and 3 year mark before the final rally of 3 years into 1.20 in 2002. We see something similar from the 2011 low, except that the first pause was 3 years later in 2014, and we could see the second pause 3 years later which is mid 2017. The moves are lasting twice as long today, and if we reach 1.05, then the gains will be double as well or 50% today vs. 25% in 1998. This suggests that we could extend the US Dollar rally from a 2017 low to a 2020 high near 1.20 for a gain of 70%. The probability of this happening is low considering the length of previous bull markets, but a move above 105 that lasts will increase its probability significantly.The Yen ended a 61 year Bull Market and should decline for a decade or two

The Yen started a bull market in 1950 lasting 61 years and rising over 10 times which suggests a move down lasting at least 8-9 years into 2020, but probably 25 years into 2036. The price targets are at least 50% of 120 points or 0.70 and more likely the 62% level and post WWII high near 55. It could even be worse with the Japanese facing a serious demographic problem as soon as 2030 when two working Japanese will have to support one elderly. Unless they change their deep rooted aversion to immigration, there is little that robots and women joining the work force can do to help this worsening problem each year.

AstroCycle Research is not a Registered Investment Advisor or Financial Planner. All Information is provided for educational purposes only, and does not constitute Financial Advice. Trading involves substantial risk, and past performance is no guarantee of future results.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD tumbles out of recent range, tests below 1.0770 as markets flee into safe havens

EUR/USD slid below the 1.0670 level on Tuesday after an unexpected uptick in US wages growth reignited fears of sticky inflation, chopping down rate cut expectations and sending investors into safe haven bids.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Ethereum slumps again as long liquidations exceed those of Bitcoin

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

No tap dancing around inflation concerns

Tuesday saw U.S. stocks closing considerably lower as investors grappled with economic indicators indicating increasing labour costs and a decline in consumer confidence, all coming ahead of a crucial Fed policy meeting aimed at determining the trajectory of interest rates.