EUR/USD

4 hour

The EUR/USD continued its bullish breakout to higher levels as part of an impulsive wave C (green). The resistance levels (red) and Fibonacci targets could be points on the chart where price could reverse.

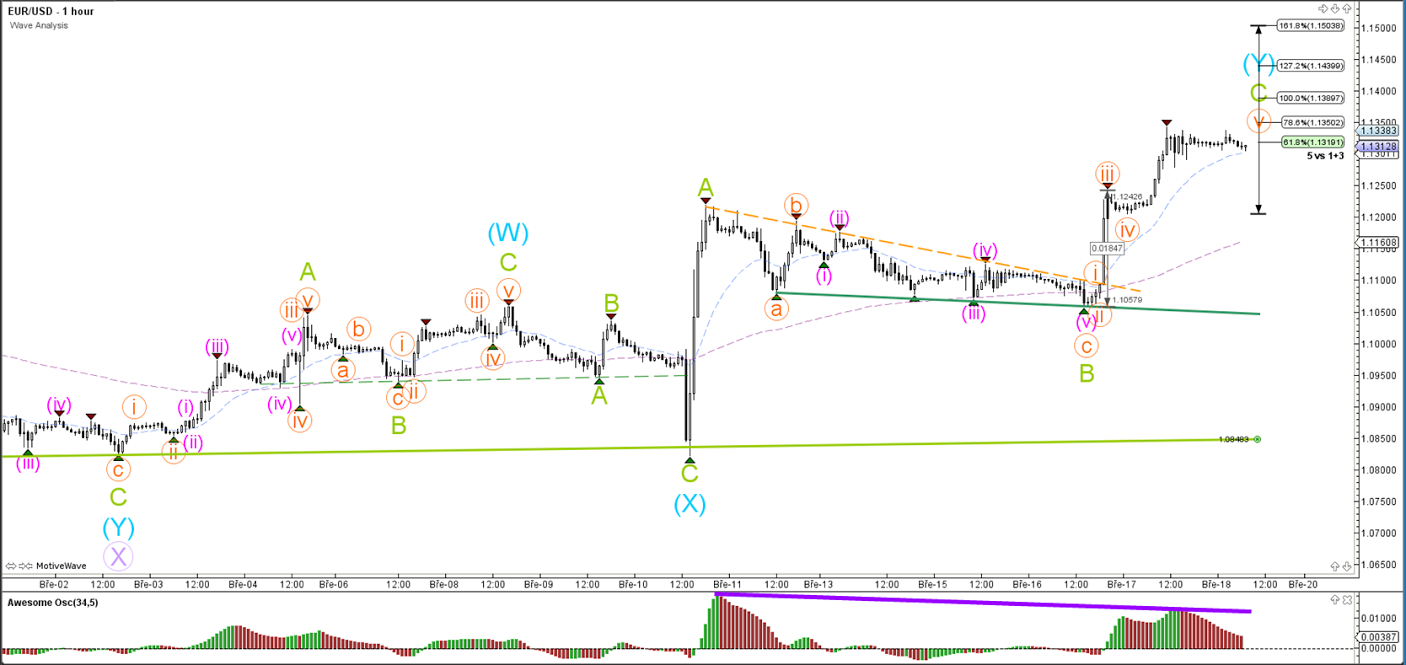

1 hour

The EUR/USD seems to be in the 5th wave (orange) of wave C (green). Once the 5th wave is completed (which could potentially already be completed), price could see the start of a bearish retracement due to the divergence (purple line).

GBP/USD

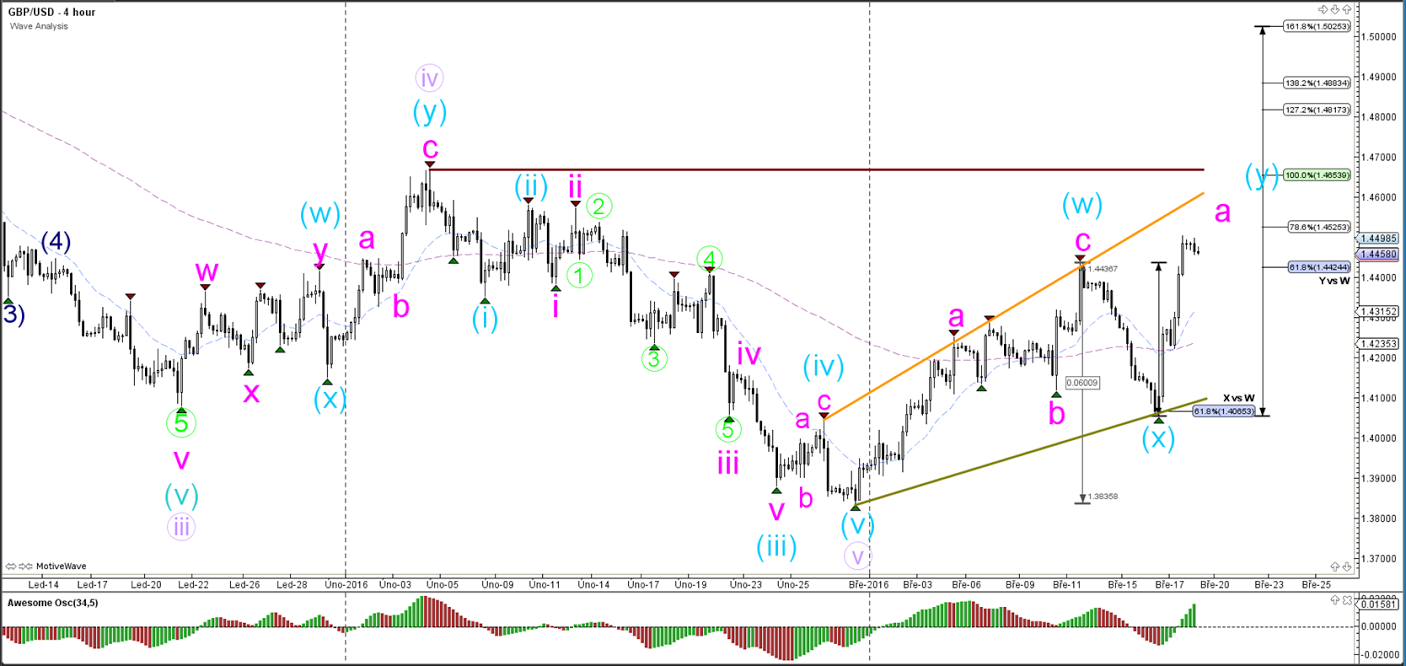

4 hour

The GBP/USD continued its bullish bounce at the 61.8% Fib to higher levels as part of an impulsive wave A (pink). There is divergence on the daily chart between the 2 most recent bottoms, which could lead to a larger correction as indicated by WXY (blue).

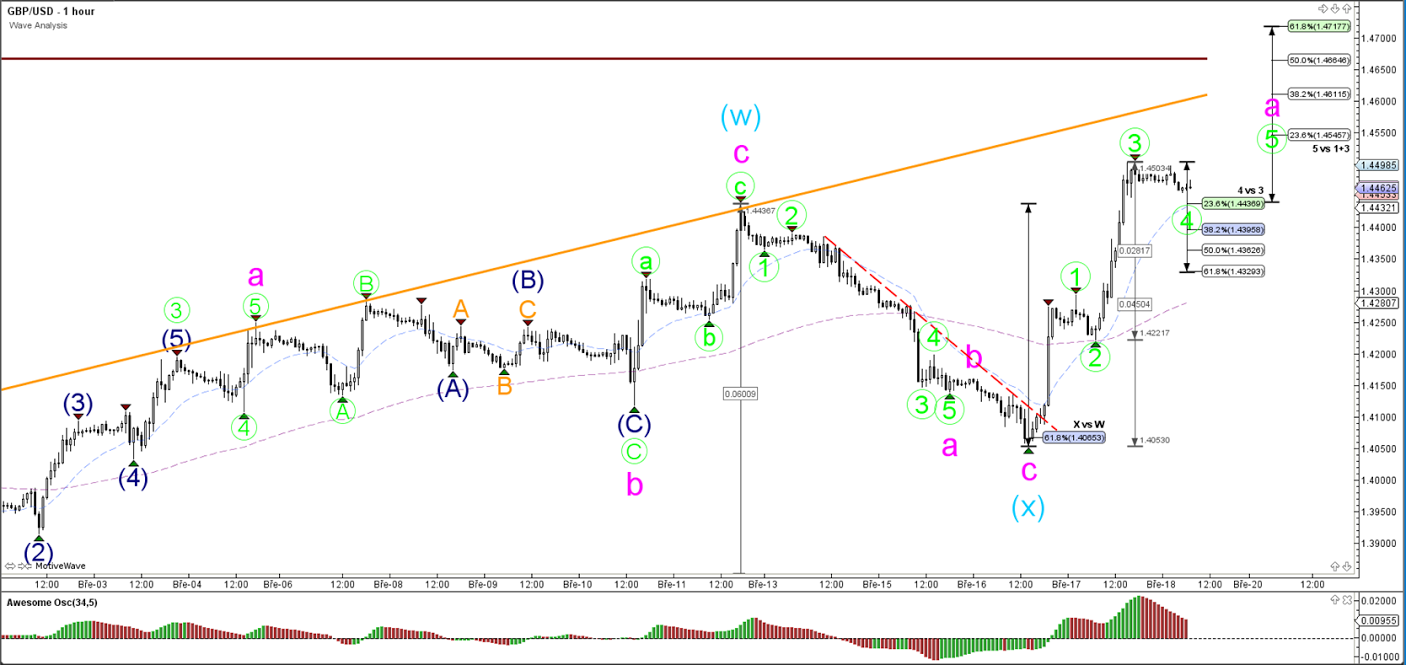

1 hour

The GBP/USD showed most likely a strong wave 3 (green) yesterday. A wave 4 (green) retracement should not go below the 61.8% Fibonacci level or it would invalidate the current wave count.

USD/JPY

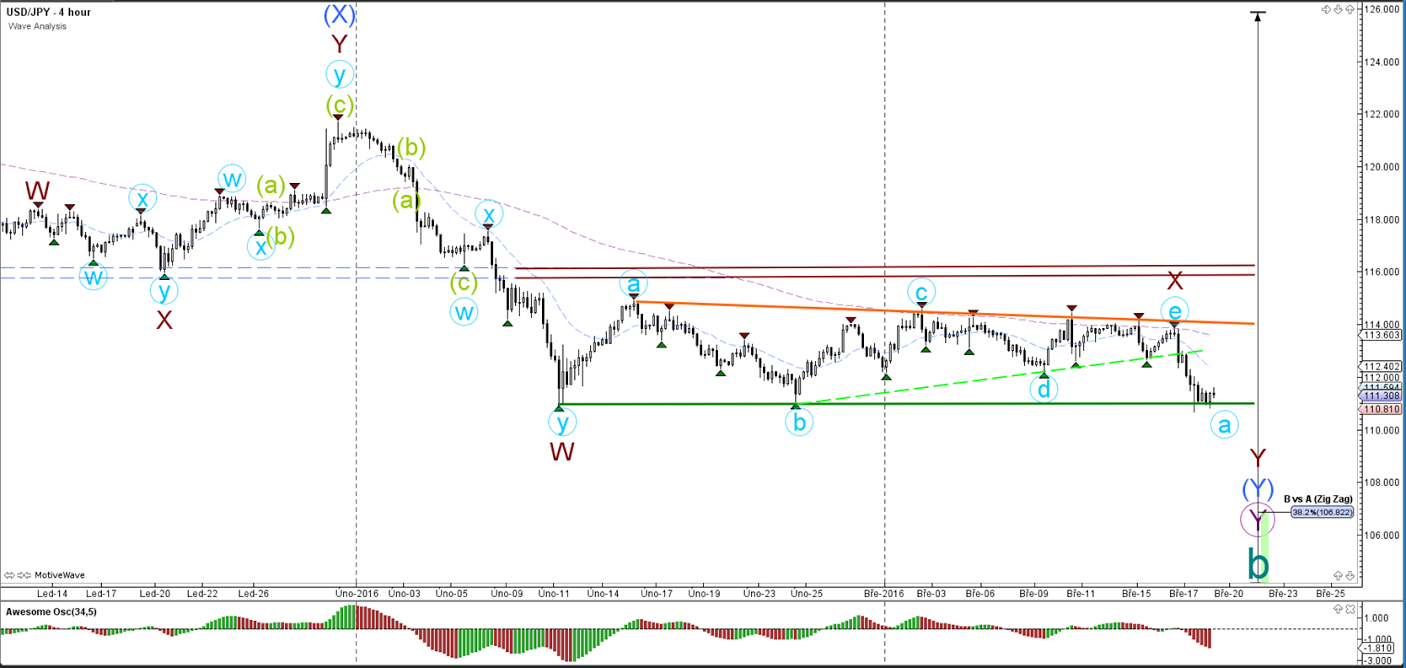

4 hour

The USD/JPY is testing the bottom of the larger contracting triangle (orange/green). A break below the support trend line (green) would provide more confirmation of a completed a wave E (blue) of wave X (brown).

1 hour

The USD/JPY seems to have completed 5 bearish waves as part of a large ABC bearish zigzag (blue). A bullish retracement could potentially find resistance at the wave B Fib levels.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.