Until last week, the Australian dollar and the euro were evenly matched, being stuck in a sideways consolidation channel for weeks. But eventually, the Aussie dollar gained the upper hand and pushed EUR/AUD lower. We expect there is still downside left in the pair and this article provides a suggestion on how to trade it.

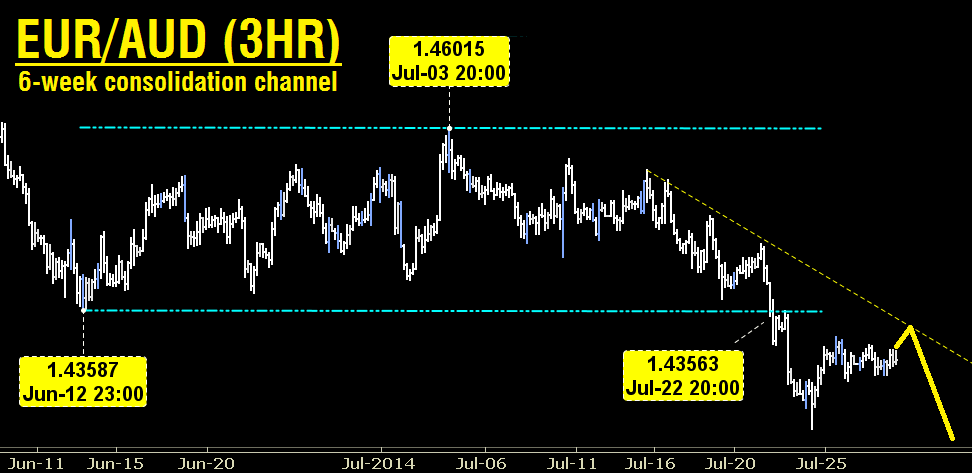

Since January 2014, EUR/AUD has been falling from 1.5830 to last week’s low near 1.42. While it was stuck for six weeks in a consolidation channel from 1.4356-1.4601 in June, it was always favoured to break below the channel and last week, it did. Towards the end of that channel, it also began forming a downtrend (see yellow dashed line) which has capped recent rises. For those who only want details of the trade, we’re looking at:

Short Setup for EUR/AUD

Trade: Sell at (or above) 1.4325.

Stop Loss: Place stop at 1.4385.

Take Profit: The two take profit levels are 1.4205 and 1.4175.

Trade Management: a) Cancel the orders if price reaches 1.4205 without triggering the entry; and b) If the trade is active, move the stop to the entry level if price reaches 1.4205.

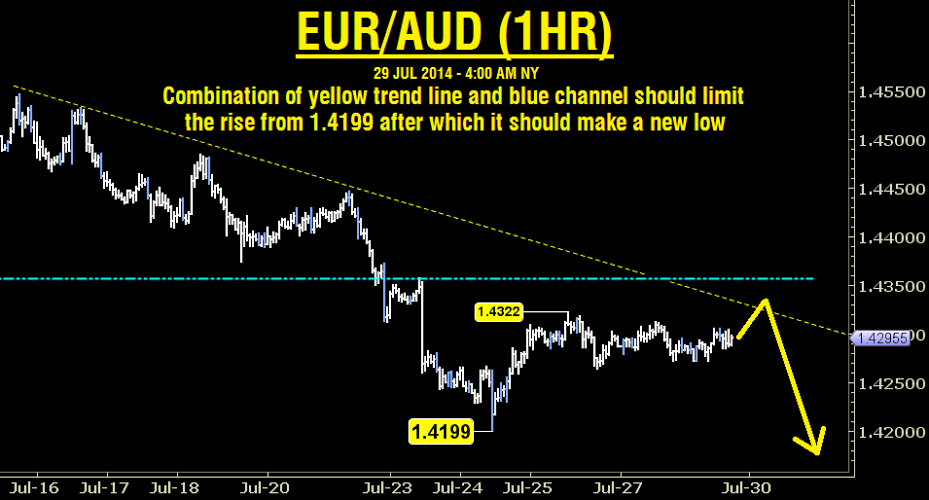

This one hour chart zooms in on the most recent price action. Some people will be a little surprised to see that both charts show no Elliott Wave labels. This is our primary form of analysis, and while the charts provided show no wave labels, rest assured that the basis for this trade is the underlying wave count. In part, we will reference Elliott wave theory during this explanation.

The one hour chart shows the price action since the mid-July downtrend. Earlier, we mentioned that EUR/AUD has been moving lower since late January, so the recent lower prices since mid-July shouldn’t be a surprise as they are an extension of an existing trend. This is one reason we believe there is more downside left in the pair as no price action suggests the downtrend has ended.

The underside of the blue channel provided support for EUR/AUD for weeks. Now that price has broken below the channel, it alone should act as resistance should price attempt to pierce the bottom of the channel. However in this situation, there is the added advantage of the yellow downtrend line. The combination of the downtrend line and the bottom of the channel together should limit the current rise from last week’s 1.4199 low.

From an Elliott Wave perspective, price action moving in the direction of the main trend is generally described in groups of five waves while price action moving against the main trend is counted in groups of three waves. The price action above 1.4199 is countertrend so it should be described in three waves. The first corrective wave above 1.4199 ended at 1.4322. After 1.4322, price action has been sideways suggesting a likely second wave triangle. As the second wave retracement was shallow (less than 61.8%), the third corrective wave should extend about 61.8% the length of the first corrective wave. That should end the entire correction from 1.4199 in the mid-1.43s and price should move impulsively (in groups of five waves) to a new low.

Therefore, we’re looking to short EUR/AUD before this correction from 1.4199 is likely to end so our entry is at 1.4325. Our stop is at 1.4385 (60 pips away). The two ‘take profit’ levels will be 1.4205 (before we make a new low) and at 1.4175 resulting an average risk/ reward of 2.25.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.