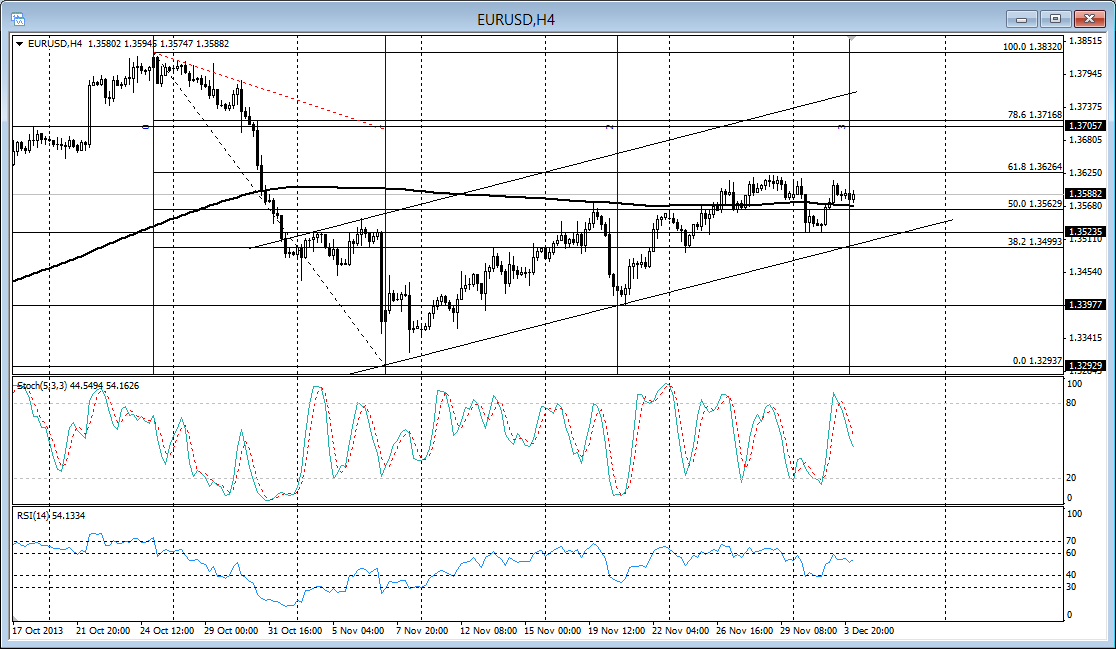

EUR/USD 4H Chart 7:35AM ET 12/4/2013

61.8% Retracement: After falling from 1.3832 to 1.3293, EUR/USD has been able to climb back to about 61.8% retracement (1.3626) of that dip. The rally started to stall under 1.3626 at the end of last week, and continues to trade under it so far this week. Also note the fibonacci time expansion, showing EUR/USD at a projected 3rd cycle low. However, the dynamics may be changing, especially ahead of some key US data this week.

Key data ahead: Today (12/4), we get the ADP Non-Farm employment data. Jobless claims data and GDP numbers will be posted Thursday (12/5), and the Non-Farm Payroll release is this Friday (12/6).

Also, the BoE and ECB have their respective monetary policy meetings Thursday. These event risks can provide some volatility indirectly to the USD and more directly in the EUR/USD and GBP/USD.

Squared up: As the market trades between 50% and 61.8% retracement, it is essentially squared up at a “neutral” price level relatively to the recent couple of months. The fact price is around a flat 200-4H SMA also reflects the “neutral” mode of price action.

A break above 1.3626 opens up the 1.3705-1.3715 (78.6% retracement) and pivot area and more aggressively the 1.3832 high. If we get great GDP and jobs data, we should probably see the USD gain. This would also continue a bullish outlook already established in the daily chart.

However, let’s say EUR/USD instead falls below 1.3520 and breaks a rising support. We should consider the bearish continuation scenario, with 1.34, then 1.33 as short-term targets.

RSI: If the 4H RSI falls to 30, it would reflect loss of bullish momentum, and possibly start of bearish momentum. A return above 60 in the 4H RSI would reflect maintenance and continuation of bullish momentum.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.