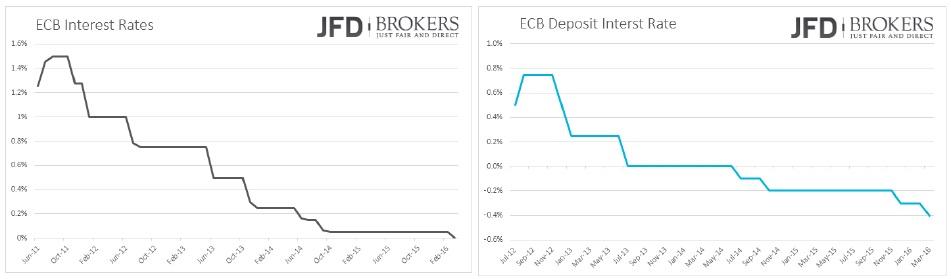

The ECB surpassed expectations on Thursday by cutting the overnight rate to zero from 0.05% as well as the deposit rate by 10 basis points to ‐0.4% — the rate used by banks to borrow from the ECB overnight. The shared currency tumbled sharply to 1.0822 versus the U.S. dollar after the announcement but recovered all the losses and gained a lot more during Mario Draghi’s press conference.

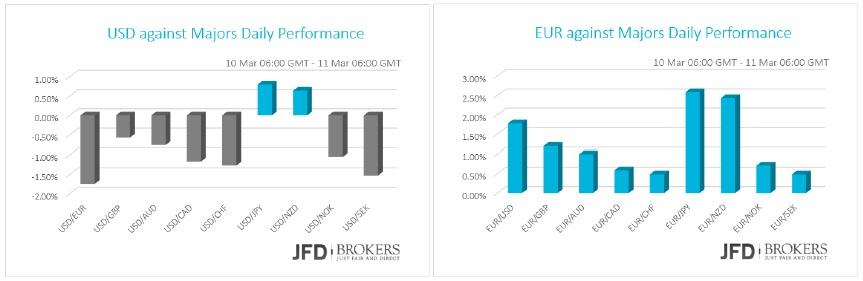

The ECB President announced the expansion of the QE asset buying programme to 80 billion euros from 60 billion euros per month and hinted that this could be the end of the easing cycle. On Thursday and early Friday the euro recorded significant gains against all the major currencies on recording more than 1.50% versus the U.S. dollar and 2.5% versus the Japanese Yen.

In contraction to the euro, the greenback slumped versus all the G10 currencies except the Japanese yen and the New Zealand dollar despite the good news for the country’s budget deficit. The gap between the government spending and revenue contracted near a‐seven‐and‐a‐half year low in February. The Monthly Budget Statement for February was $193.00B reversing market expectations of $‐200.00B.

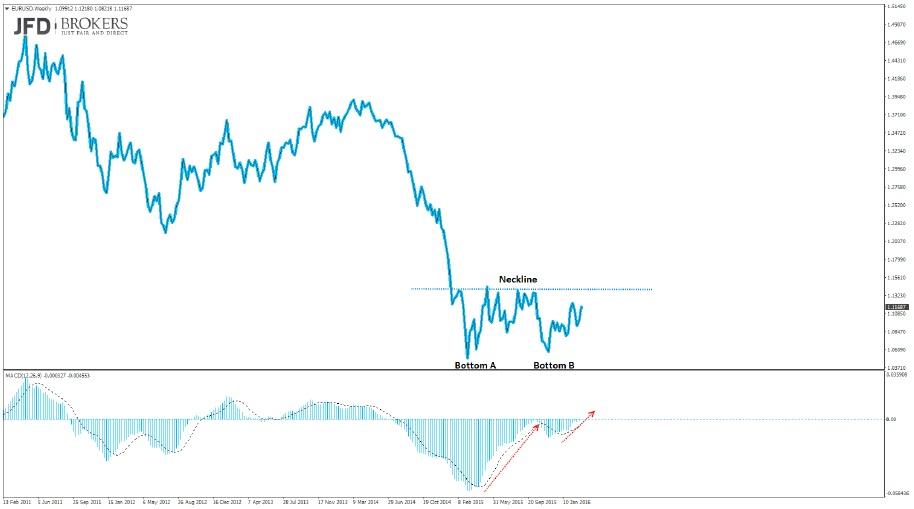

EUR/USD Profits Locked before Draghi’s speech! Double Bottom Formation

The EUR/USD pair plunged immediately after the rate announcement and penetrated successfully the suggested targets, first at 1.0920, then at 1.0900 and then at 1.0825, ending the day in profit (100 pips)!Following the rate announcement by the European Central Bank – lowered its deposit rate by 10 basis points to ‐0.4% and shaving the marginal lending rate to 0.25% from 0.3% – the pair recovered heavily and surged above the significant level of 1.0900 to end the session near 1.1200.

Technically, the EUR/USD pair has made a double bottom – weekly chart – before its reversal to take out various import levels of resistance, with the neckline around 1.1400 – 1.1500 area and bottom at 1.0500. Should we see a break through the neckline, it could prompt a move towards 1.2000, based on the size of the double bottom projected above the neckline. This is roughly a 50% retracement of the move from 1.4000 high to the low at 1.0450. The key between 1.1500 and 1.2000 is 1.1700, August high.

What to watch today

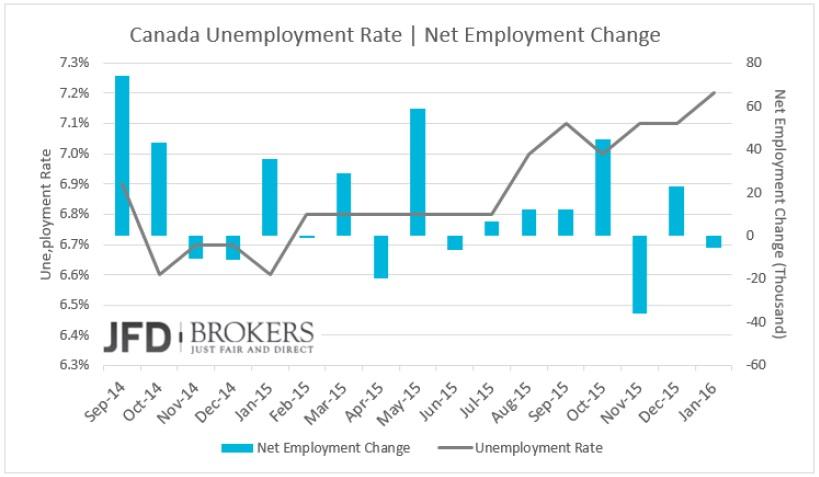

Early on Friday, the German inflation rate will be out. In UK the only notable macro‐update is the trade balance number. In Canada, February’s employment report will be published. The unemployment rate is expected to remain stable at 7.2% while the net change in employment to add 5.5k from ‐5.7k the previous month.

In U.S., the flash University of Michigan Consumer Sentiment Index for March will be out, as well as February’s export and import prices indexes.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.