ECB Policy Meeting Arrived! More Stimulus Actions to Take Place? BoC Main Rate on Hold

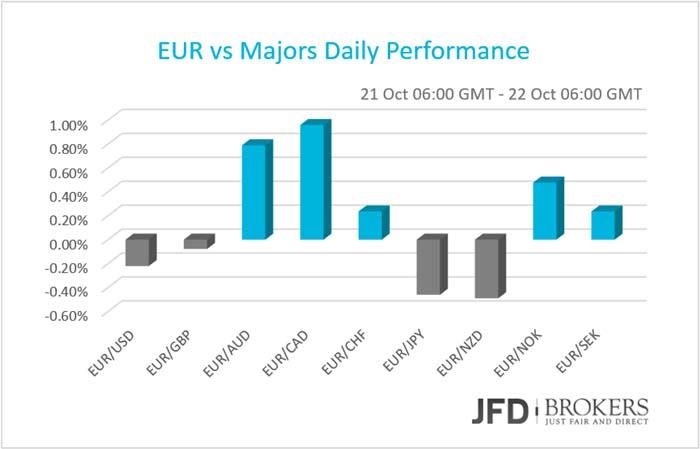

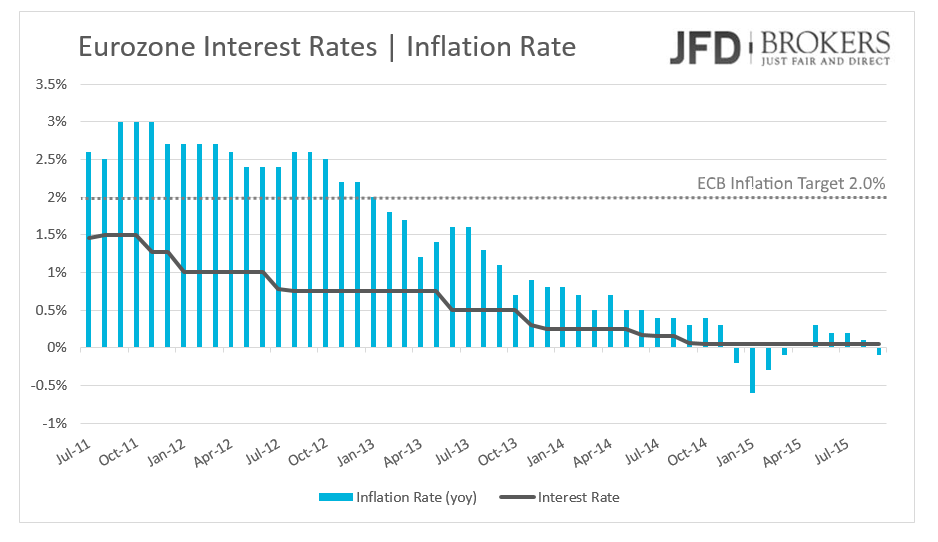

The single currency is traded mixed versus the G10 currencies on Wednesday and early Thursday ahead of the European Central Bank policy meeting. The bank is expected to keep monetary policy unchanged however changes in the asset purchasing program or further economic stimulus are on the table.

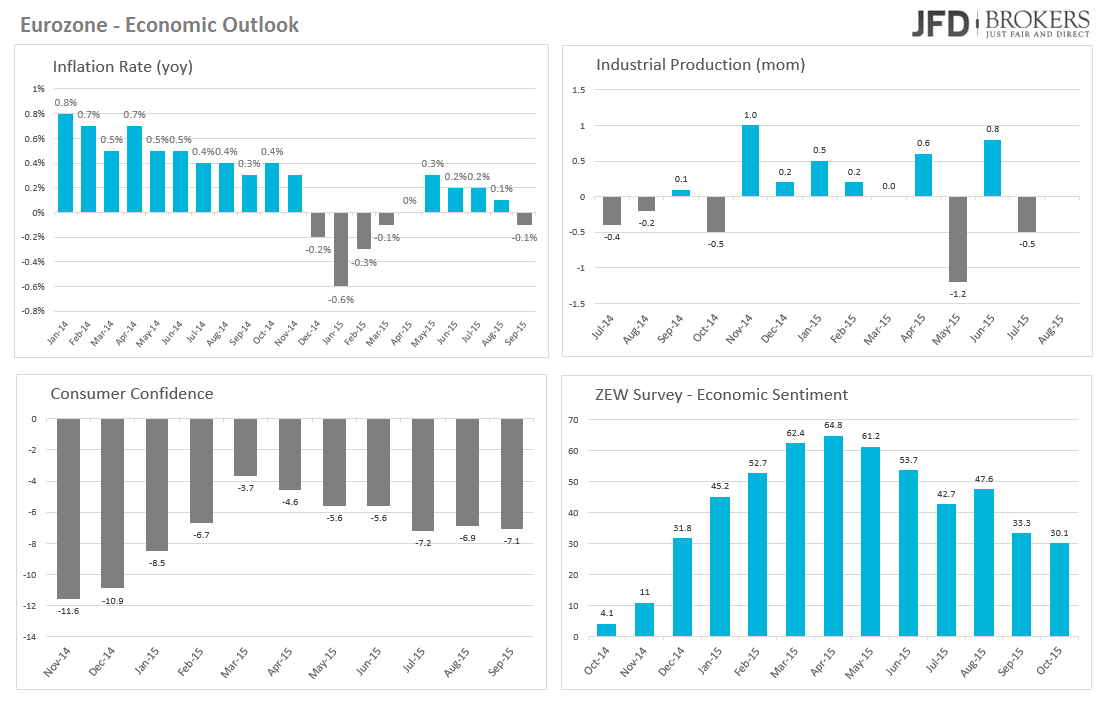

Both the Eurozone’s and German economies have deteriorated since the last policy meeting. Moreover the external global risks that act deflationary forces in the euro area continue to lurk. In September, Eurozone’s economy as a whole, entered the deflation territory again, on the year-over-year basis, while the consumer prices in Germany remained stagnant. Manufacturing activity in Eurozone declined for the fourth month in a row in September and Industrial production contracted by 0.5% in August month-over-month (last available figure). The confidence among the consumers and the business continue to weaken in the whole Euro Area and in its largest economy as well.

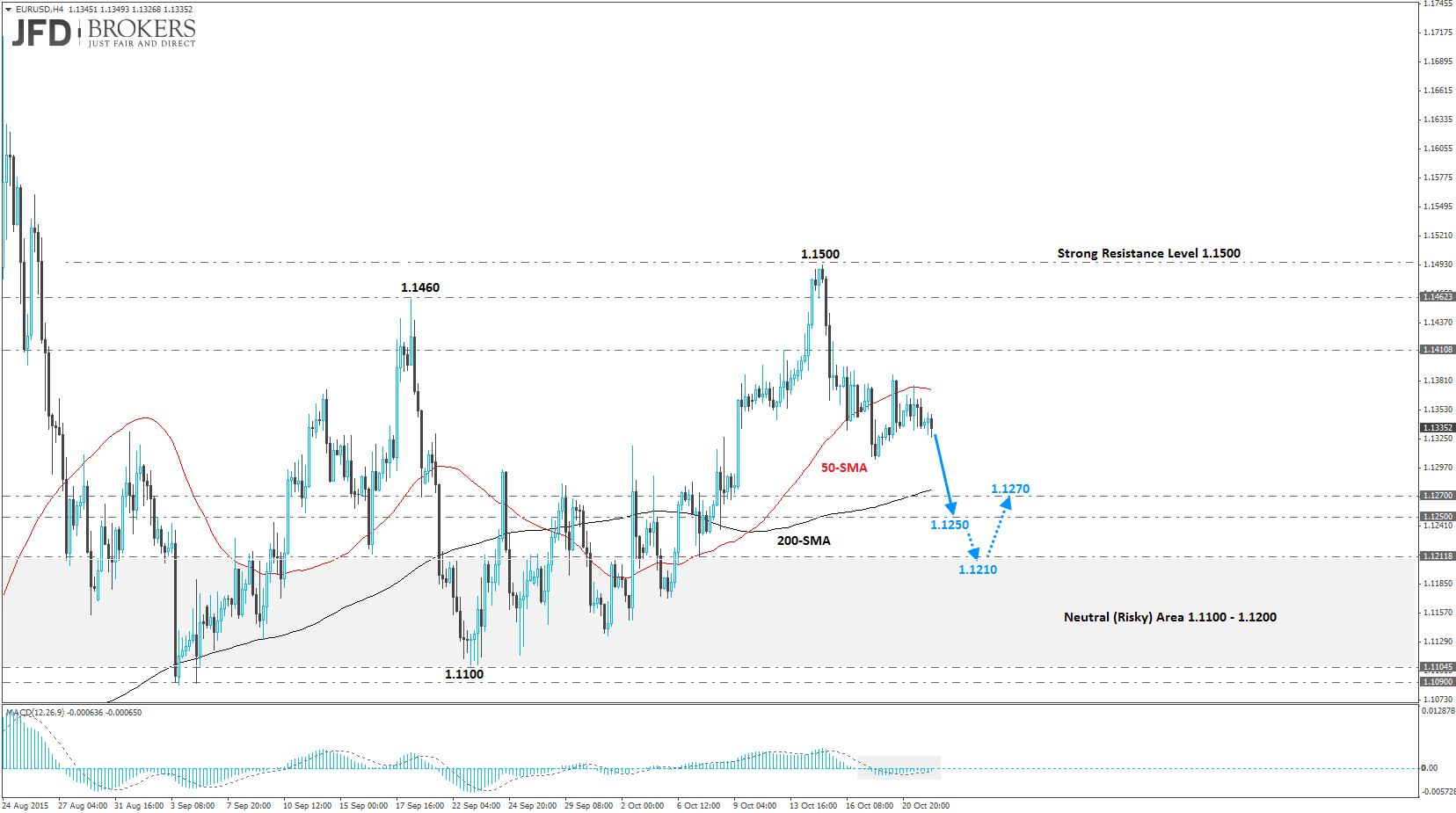

Over the last few days, the EUR/USD has established and traded within a trading range roughly around the key level of 1.1340, as we did not have any significant event or a technical point to push the direction either way. The pair has begun to consolidate below the psychological level of 1.1500, following a strong recovery late last week. Currently, the price is moving below the 4-hour 50-SMA, as well as below the weekly 50-SMA.

As mentioned in the previous analysis, these levels, as well as the crosses from the moving averages in several timeframes, is crucial to determining whether we are going to see the pair push higher or roll over and thus the resolution of this sideways price action will have longer term implications. However, with the ECB policy meeting ahead of us, which I expect the validity to pick up, I would expect the pair to test the 200-SMA on the 4-hour chart (intraday move), around the 1.1250 level. From there, I would expect a battle to take place, but still it’s not clear at this stage who has the upper hand, the bulls or the bears.

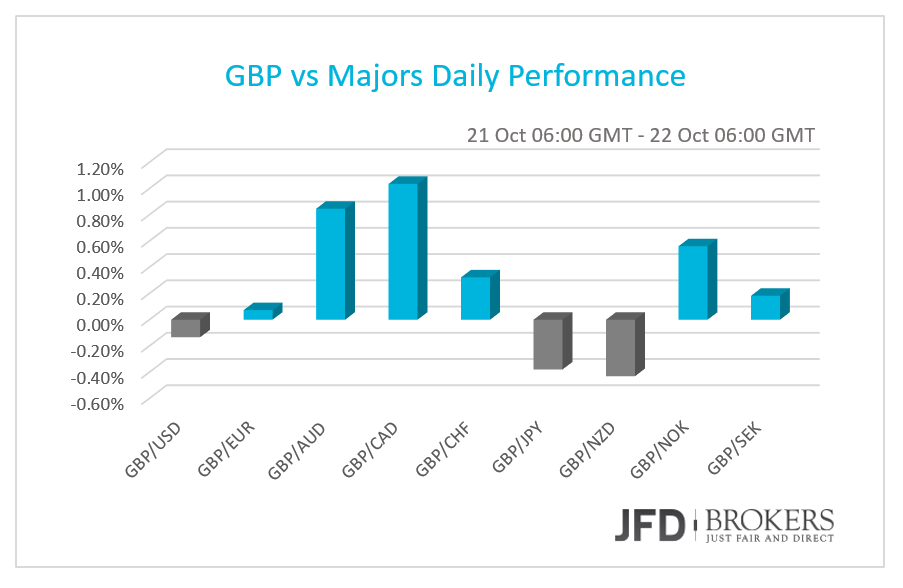

GBP mixed following BoE Carney speech

The sterling posted significant gains against the Australian and the Canadian dollars while it was slightly and mixed traded against the other major currencies on Wednesday and early Thursday. The public sector net borrowing in UK decreased to £8.628B in September below than expectations to have fallen at £9.400B. UK Chancellor George Osborne is looking forward to slashing the budget deficit to 3.7% of GDP, where he will announce the latest forecasts on 25th of November. The Bank of England governor at his speech on Wednesday, stated that the UK entrance to the European Union opened up the UK economy and made it more powerful, however, it is more vulnerable to financial shocks. The governor debated on UK Brexit in EU but left its merit undefined.

The GBP/USD pair remained trapped around the 1.5430 level, which currently finds support from the 200-SMA on the 1-hour chart, around the 1.5410 area. The same with the EUR/GBP pair where it also trapped in a tight range around the 0.7350 area. Overall, I keep a neutral stance in GBP crosses, for this week.

USD/CAD after the BoC Policy Meeting

The Canadian dollar plunged on Wednesday and Thursday morning after the Bank of Canada left its overnight interest rate unchanged at 0.50% as expected. The BoC released also its quarterly monetary policy report alongside its monthly rate decision yesterday. The central bank cut its growth forecasts for next year to 2.0% and for 2017 to 2.5%, compared to previous estimates of 2.3% and 2.6%. The reason behind that was mainly from the sharp fall in oil prices.

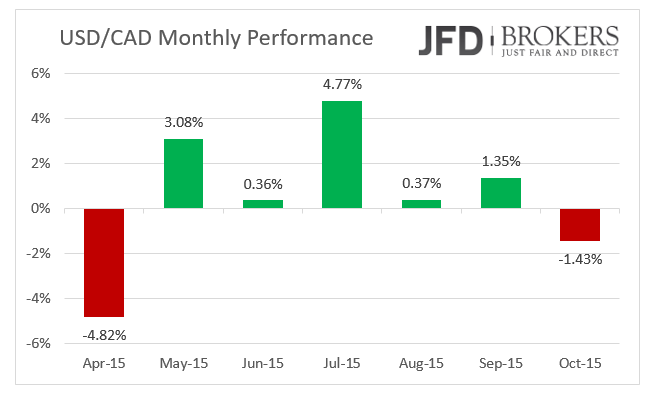

The Canadian dollar plunged against the US dollar following the decision of the BoC to keep its benchmark interest rate right where it currently sits, at 0.5%. The central bank has cut its interest rate twice this year in a bid to stimulate Canada's economy. Following the aggressive sell-off after the USD/CAD pair peak at 1.3460, the pair fell more than 2.5%, however, following yesterday’s meeting the CAD gave more than 1% of its monthly gains. At the moment, the USD/CAD is at -1.43% so far this month. Note that the USD/CAD had 5 consecutive positive months.

Technically, following the strong rebound from the 1.2840, the bulls seems to take control again following the break above the psychological level of 1.3000. In yesterday’s report (USD/CAD ahead of BoC Meeting), we expected the pair to move upwards and to reach 1.3015. The pair has broken above 1.3015, as well as above 1.3045 and the 1.3080, which suggest that the correction which started few day ago will continue. Bear in mind, that the 200-SMA on the 4-hour chart will provide some significant resistance to the price action, for now, but I would expect this to be temporary. With that in mind, the key levels should be the 1.3160 barrier and then the psychological level of 1.3200.

Alternatively, given how aggressive the rally has been over the last few months and the last few weeks, we could see a brief period of consolidation around the 1.3100, before a continuation of the move towards the aforementioned levels.

Gold rallied 8% since mid-July

The yellow metal was trading near its lowest in over a week on early Thursday, mostly hurt by a stronger dollar. Note that the precious metal has rallied almost 8% since mid-July and is up 4.50% so far this month. Gold was steady in early Thursday, following the aggressive sell-off during Wednesday’s session, where it forced the metal to record a negative session of -0.96%, following a positive Wednesday where it closed the day with 0.70% gains. At the moment, gold finds support around the $1,165 level, which it coincides with the 200-SMA on the daily chart. On the other hand, the bull struggles to break above the $1,185, where the 50-SMa on the weekly chart prevents any moves to the upside. Therefore, medium term traders should watch that closely. Going forwards, intraday traders should expect the metal to come under pressure and to test the $1,160 barrier. A further pressure should open the way towards the September’s high at $1,157.

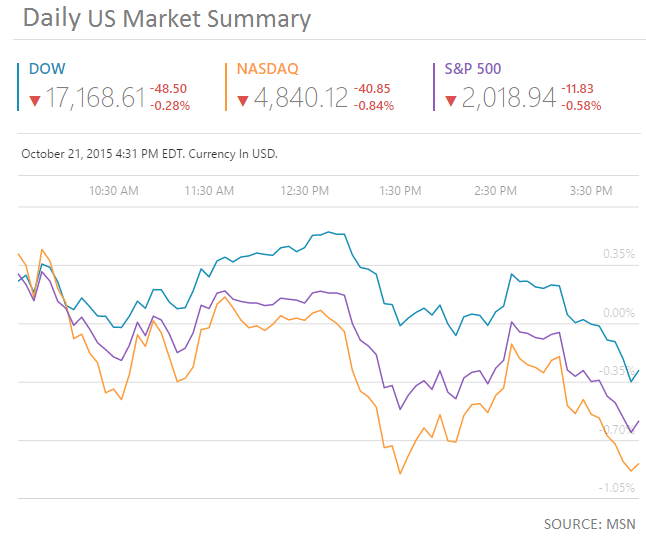

U.S. Indices record a second day of losses

Wednesday is the second day in a row the U.S. indices closed below their opening level, dragged down from the downbeat earnings report in the Energy and Health Care sectors. The two days performance increase the odds for a negative week following three green weekly closes. The Dow Jones industrial average closed -0.28% down, -48.50 points with Goldman Sachs Group Inc. (NYSE: GS) the worst performed stock of the index with losses more than 3%. The tech-heavy index slipped -0.84%, -40.85 points down while the S&P500 fell -0.58% of its opening level.

Ferrari (ticker: RACE), which is listed in the NYSE, opened at $60 per share at its trading debut on Wednesday, 20% above its initial-public-offering price of $48 - $52. The stock closed up about 5.8%, giving the company a market cap of about $10.4 billion, while the company raised $890 million at its IPO.

Economic Indicators

Today, the UK retail sales for September are coming out and forecasted to have increased at the steepest pace than the month before. The ECB policy meeting will hog the limelight! Despite that the interest rate is not expected to change, all eyes will remain firmly focused on the policy statement and the press conference to draw whether the central bank will take actions to stimulate the economy and what are these actions. The ECB president repeated in the past that ECB is ready to adjust Quantitative Easing program if it is needed. Is the time for QE adjustments arrived?

Later in the day, the consumer confidence for October is forecasted to plunge in the negative territory more than the month before. The first estimate is expected to come out -7.5 from -7.1 before. In Canada, retail sales for August will be released. In US, the housing price index and the existing home sales change for September will come out, as well as an estimate for the CB leading indicators which is predicted to be 0.0% versus 0.1% before.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.