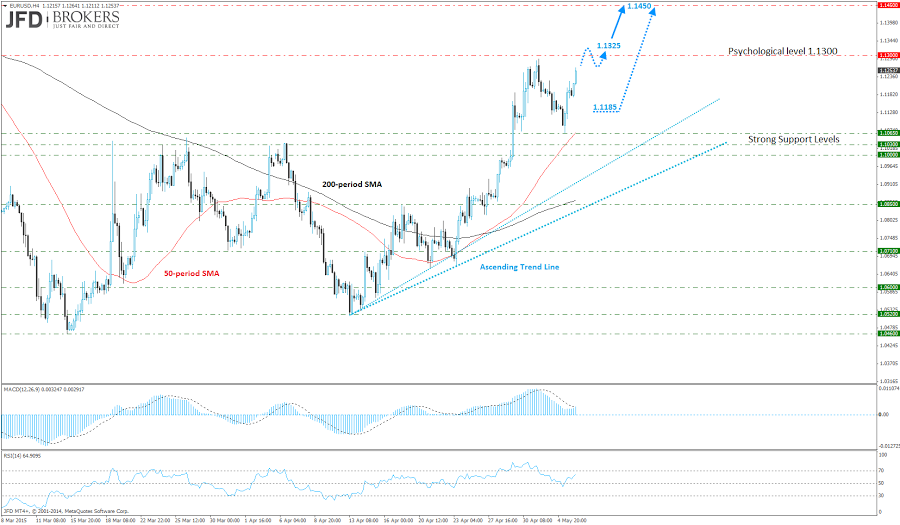

The euro rebounded from the 50-period SMA, slightly above the key support level of 1.1030 as investors looked ahead of the US ADP Employment Change report and the all-important NFP report, as well as some mixed European data, including today’s Retail Sales and tomorrow’s German Factory Orders.

The EUR/USD pair has been in an upward trend for more than weeks now, following the strong rebound around the psychological level of 1.0500. Since then, the euro is rising, taking out some important obstacles including the key level of 1.0850, the psychological level of 1.1000, as well as the 50-period and the 200-period SMA on both timeframes, the 1-hour and 4-hour charts.

The daily chart as well as the weekly chart shows that the bulls are under strong momentum driving the price back towards the psychological level of 1.1300. Technically, we have said that a close above the psychological level of 1.1300 would be a very bullish development for the euro, as we have not seen a daily close above that level since March. With the US ADP coming later in the day, we could expect any kind of reaction as the US employment change, including the NFP report on Friday, will determine the pair’s move and trend direction.

Bearing the above in mind, if we see a close above the key resistance level of 1.1300, then we could see a bigger retracement, following three positive weeks for the euro, prompting a more aggressive move towards the 1.1450 level. The former level is significant as it includes the 23.6% Fibonacci retracement level. However, for confirmation of the trend reversal, we will need to see a break above the key resistance level of 1.1500.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.