In the early part of the week there was a noticeable growth of USD in relation to other currencies. It was caused by an exit of final indicators on change of volume of GDP of the USA in the last quarter. Gross domestic product of America was registered by increase for 2,2% against an old index of 2,6%, having justified the predicted growth by 2,2%. The main CPI confirmed expectations, having kept balance on a mark of 1.1%.

It is probable that this week the American dollar will a little lose its positions on the eve of a release of data on employment in the USA for February, it is connected with the fact that traders are in expectation.

At the beginning of a week across New Zealand there was a number of positive news, in particular the publication of data on the import and export prices which was higher than one had expected: -1,80% against -4,5% before it, expectation of -3,1% and 0,20% against -0,10% before it, the forecast of -0,40% respectively. Despite that the exit of an index of trade conditions in New Zealand was published better than expected: -4,4% earlier, the forecast of - 3,0%, nevertheless NZD went down in comparison with the American dollar.

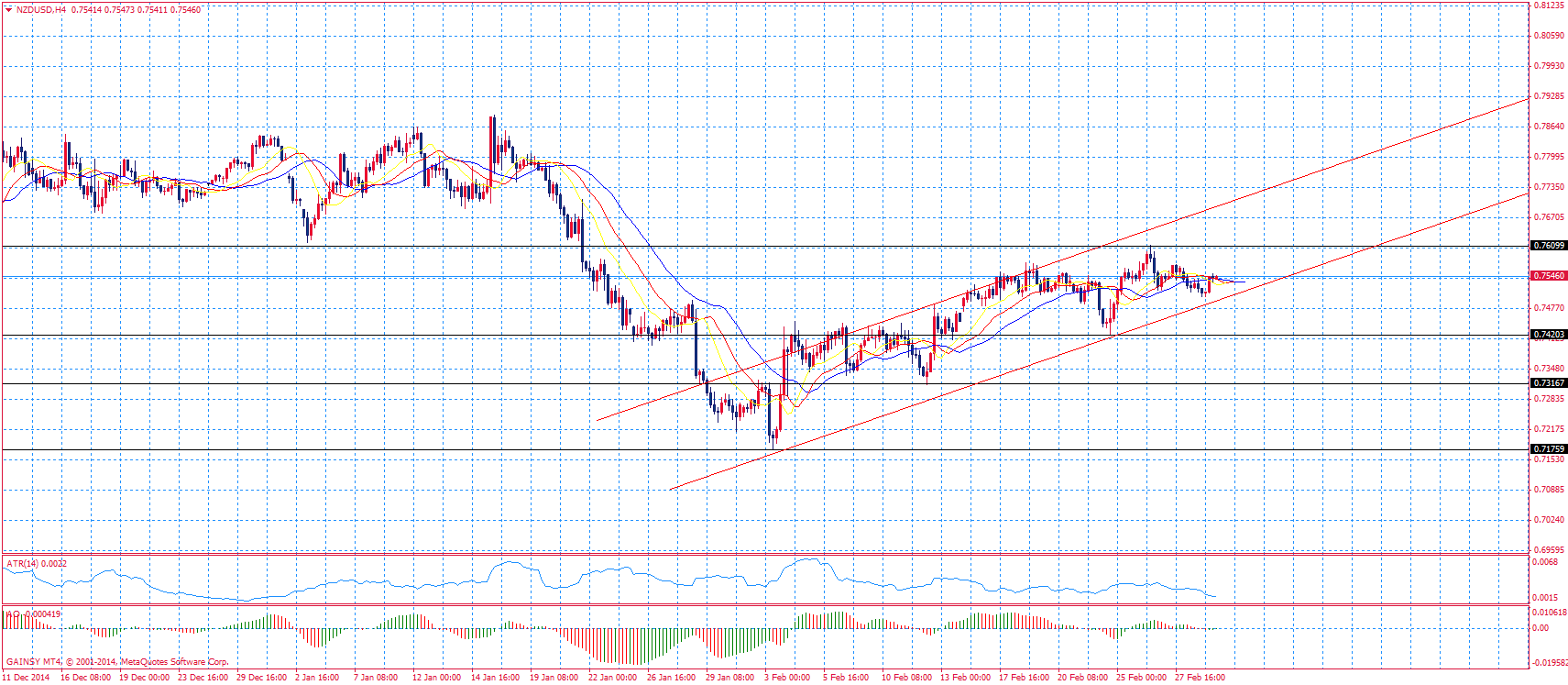

Support level for a currency pair of NZD/USD is now 0.7500. Resistance level — 0.7600. Currency pair is traded in the ascending trend 0.7500-07670.

Recommendations:

NZD/USD continues the slow descending movement towards a correctional point 0.7400 . The rebound from this level will give support to "New Zealander", and will promote a correction level raising to 0.7600. In turn fixing of a course below 0.7400 will give the chance to predict falling of the price to 0.7230.

Recommended Content

Editors’ Picks

Australian Dollar maintains ground amid subdued US Dollar, US Nonfarm Payrolls awaited

The Australian Dollar rises on hawkish sentiment surrounding the RBA prolonging higher interest rates. Australia’s central bank is expected to maintain its current rate at 4.35% until the end of September. US Nonfarm Payrolls is expected to print a reading of 243K for April, compared to 303K prior.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.