Main movement.

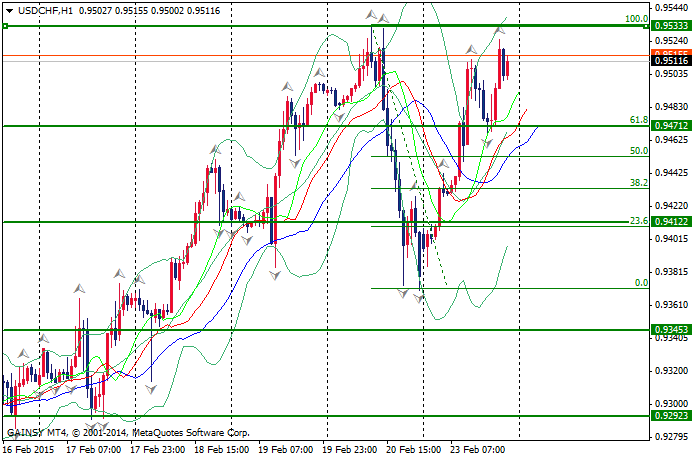

The currency pair didn't succeeded to break through the level of resistance of the previous fractal 0.9505 that is a signal for taking sell positions above the level of resistance 0.9533. Ultimate goal if 0.9620 and higher.

Alternative movement

Possibility of the long correctional movement in case the price is able to break through and get fixed below the level of resistance 0.9470 isn't excluded. Sell positions should be taken to level 0.9420.

Level of resistance: 0.9505, 0.9533, 0.9620.

Level of support: 0.9420, 0.9470.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.