On Friday evening the authorities of Greece and representatives of the eurozone were agreed on extension of financial support of Greece for 4 months that had a favorable impact on European currency and from a week minimum it rebounded again to the level of resistance 1,1430 together with US dollar . However today, by the end of the working day, it is necessary to Tsipras's government to introduce the preliminary list of reforms for consideration by European Central Bank and the IMF and if this list of reforms doesn't get approval by creditors in Greece, the reached agreement will be cancelled.

Main movement of currency pair

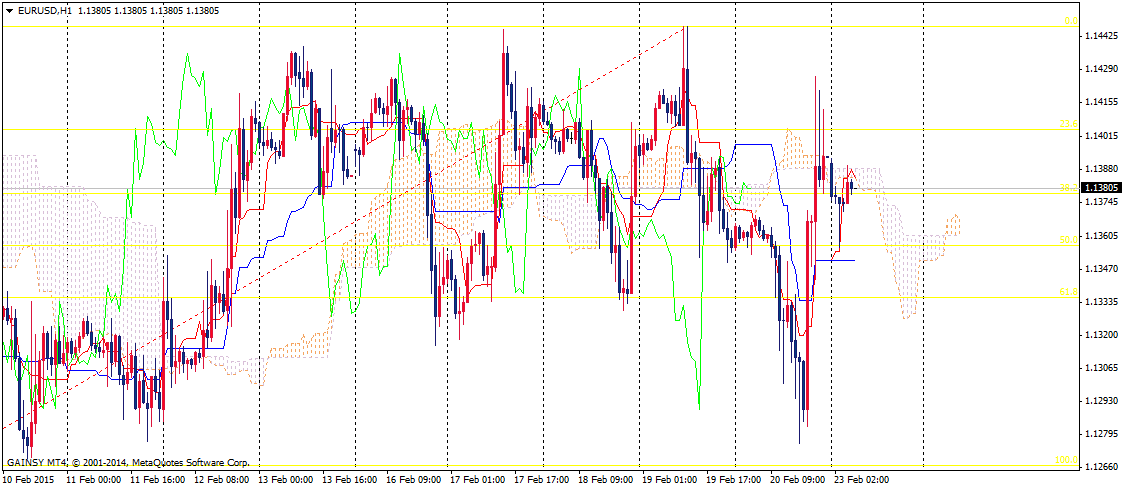

EUR/YSD pair is traded in a lateral trend, Tenkan and Kijun line are bound below the price curve, the price is kept below the descending cloud, continuation of the ascending movement is predicted. It is desirable to traders to take “buy” positions above the level of support 1,1356, to fix profit at the levels of resistance 1,1390, 1,1420, 1,1440.

Alternative movement of currency pair

If pair manages to break through and get fixed below the level of support 1,1356 , continuation of the descending movement to the following levels of support 1,1330, 1,1290 will be possible.

Level of resistance: 1,1390; 1,1420; 1,1440.

Level of support: 1,1356; 1,1330; 1,1290.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.