Market Overview

There has been an incredible turnaround in market sentiment in the past 24 hours and for once it has not been driven by either the oil price or China. However the question over how fast the Federal Reserve is going to be able to hike rates in 2016 always tends to be lurking not far from the forefront and once more this proved to be the case. There have been two aspects to this that changed the game yesterday. Bill Dudley (New York Fed President but also a known voting dove on the FOMC) gave a real suggestion that the Fed may not be able to hike rates in March. Then on the back of this, the key ISM Non-Manufacturing PMI significantly disappointed and fell to an almost 2 year low. A massive dollar sell-off has ensued, something that markets are still coming to terms with today. This all sent Treasury yields sharply lower, the dollar weaker against all major currencies, and commodity prices higher. Equity markets have also bounced. The one main concern I have though is that this apparent “recovery” across markets is built on a the dodgy ground of a weakening US economy. For me this does not sound like conditions set up for a sustained recovery, just more volatility.

Equity markets bounced with gains on Wall Street and the S&P 500 up 0.5% (although a notable weakness on the NASDAQ), whilst Asian markets have been mixed overnight with the Nikkei down 0.9%. The European indices are all strong at the open, although how sustainable this move will be remains to be seen. In forex markets there is a degree of unwinding being seen across the dollar pairs today, although the commodity pairs are holding up. Gold and silver are hanging on to their gains from yesterday, whilst oil continues to rally another 2% (again how sustainable this move becomes is difficult to say in the face of such a strong build in US inventories yesterday).

Markets will be watching the Bank of England today when it gives its monetary policy update at 1200GMT. No change is expected but the interest will come in how dovish Mark Carney sets out the Quarterly Inflation Report. Expect cuts to projections on inflation and also growth. The weekly jobless claims are at 1330GMT with 280,000 expected. We also get the Factory Orders at 1500GMT with an expectation of a worrying -2.8% for the month.

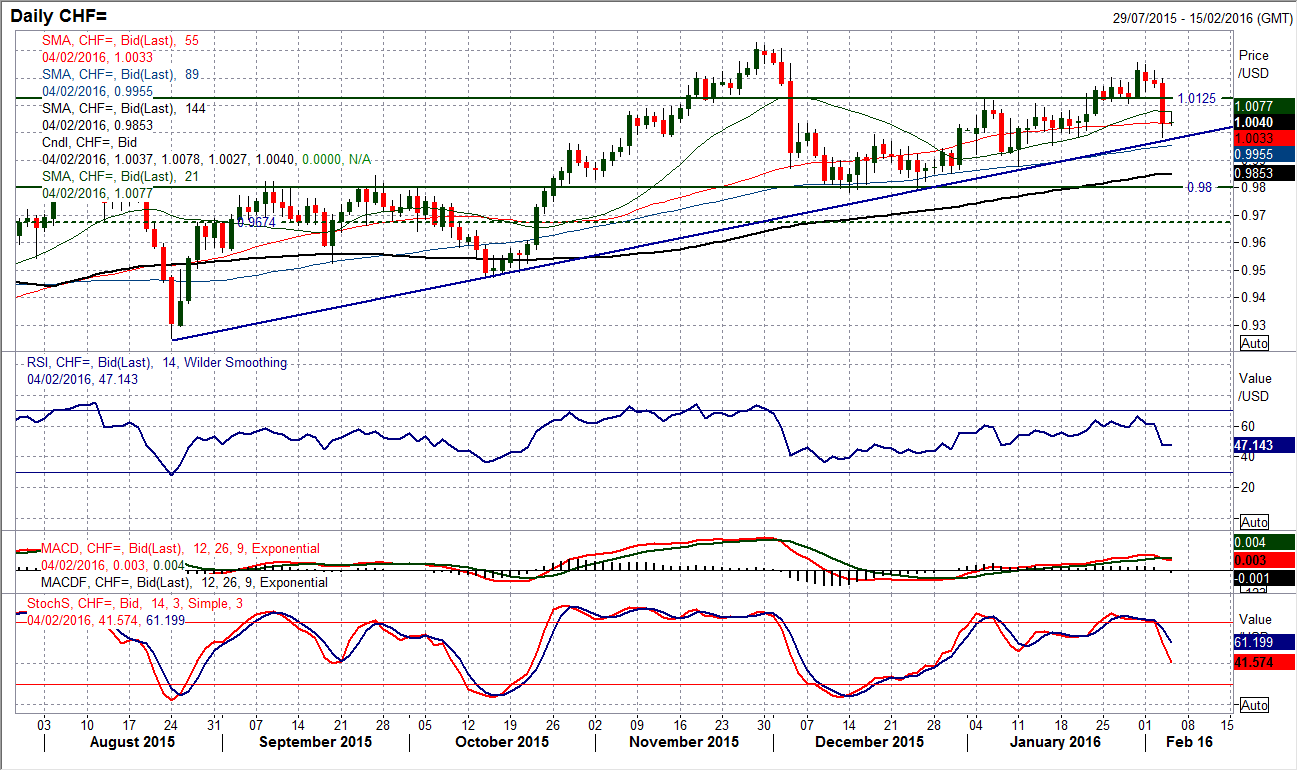

Chart of the Day –USD/CHF

The trend is your friend, but it is certainly now creaking as yesterday’s sharp dollar weakness has taken Dollar/Swissy chart back to a key medium term crossroads. There has been a strong uptrend in place since August which is now under pressure, with the trendline today coming in at 0.9980. The concern for the bulls is that momentum indicators have turned lower, giving some corrective signals now with the Stochastics giving a confirmed sell signal and the RSI in sharp reverse. The key pivot at parity is also set to come under tested and a close below crank up the pressure. A breach would then suggest that rallies would become a chance to sell. The intraday hourly chart shows a near term oversold position which is unwinding some of te weakness, but watch for the hourly RSI failing around 50 again. Also with the old support at 1.0115 now a basis of resistance, a failure to breach this level could induce the selling pressure again.

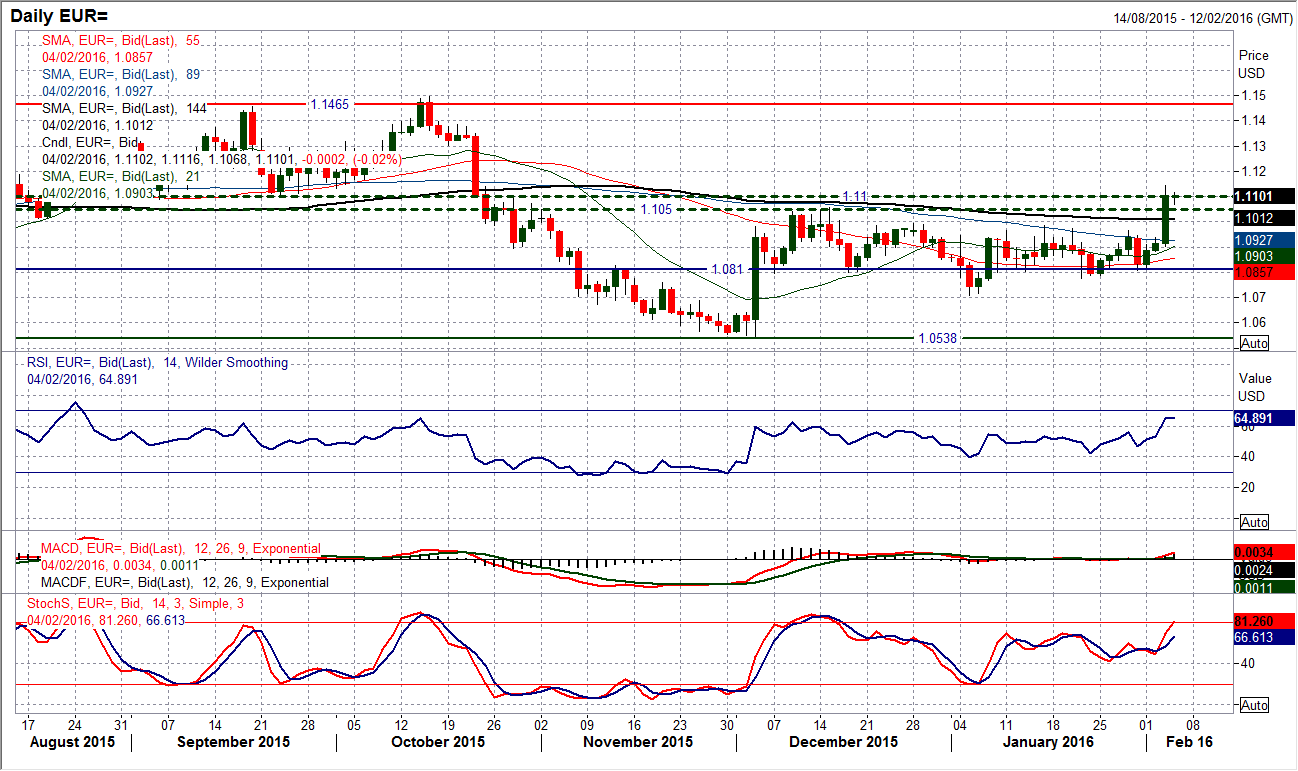

EUR/USD

The technicals certainly did not see a huge breakout and almost 200 pip gain on the day coming. The move came on the dovish comments from the FOMC’s Dudley and weak ISM Non-Manufacturing data. However there has been a significant impact on the chart as the outlook has completely changed. The consolidation phase that has lasted all of two months is now over. There was a huge run through all of the key resistance levels, but perhaps the most meaningful is the old key pivot at $1.1050 which was smashed. The intraday spike to $1.1145 and subsequent close above $1.1100 reflects a change of mind-set for traders. The initial reaction today is for a slight corrective drift but if the support forms above $1.1050 then the bulls will certainly be looking higher. The momentum is now increasingly positive with the RSI well above 60 to confirm the breakout, in addition to positive Stochastics and even the MACD showing signs of life. Hourly momentum reflects the consolidation near term which is understandable after such a strong run. Beyond $1.1050 the support is at $1.0990. Above $1.1145 there is little resistance until $1.1315.

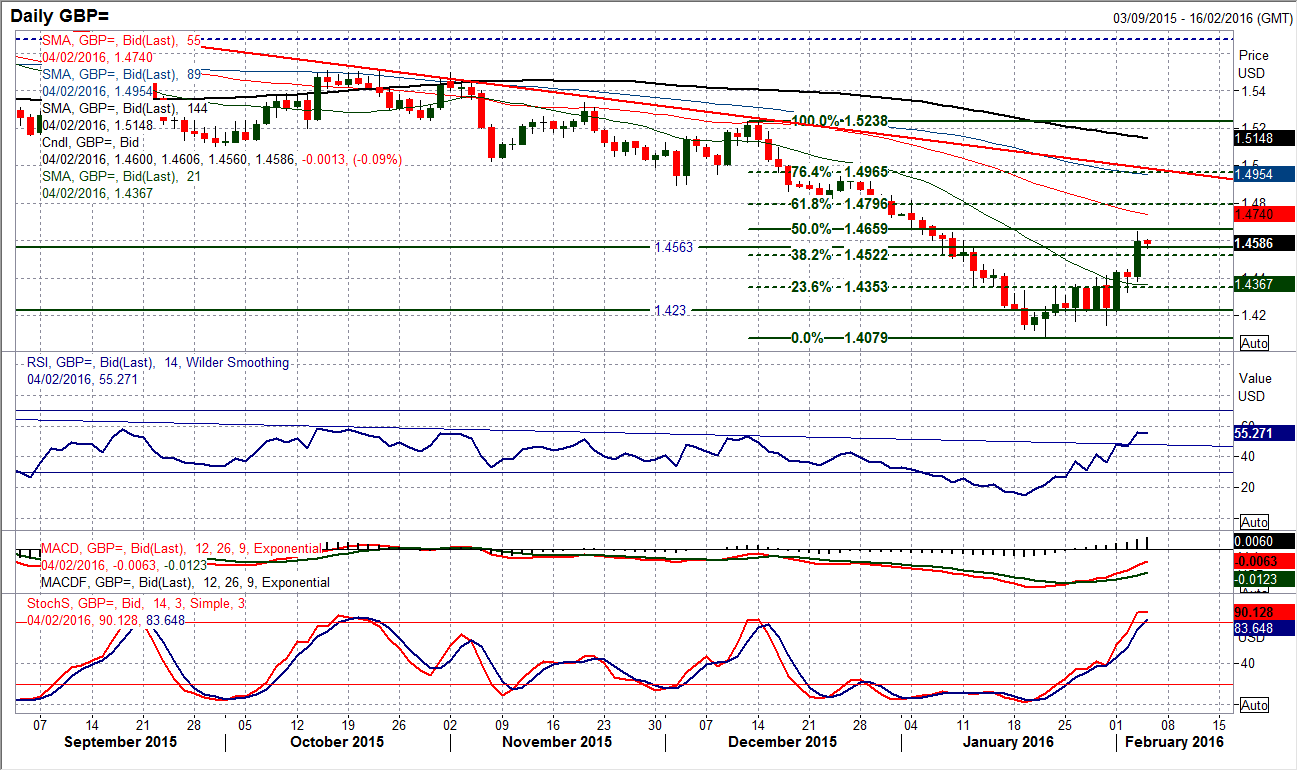

GBP/USD

The market really took off yesterday as the recovery continues. The key factor here is the strength of the momentum in this rally is now such that a long term downtrend on the RSI that dates all the way back to May 2015 has now been broken. This suggests the bulls have the upper hand now and that corrections should be seen as a chance to buy. The 50% Fibonacci retracement of the December to January $1.5238/$1.4079 sell-off in around $1.4659 has all but caught yesterday’s high, so the 38.2% Fib level at $1.4522 comes in as an area to start looking at buying opportunities. The hourly chart shows a previous pivot at $1.4490 is also a good reference. The hourly chart shows a slight unwinding of the gains early today but once this starts to form support, look for a buy signal to trigger further gains.

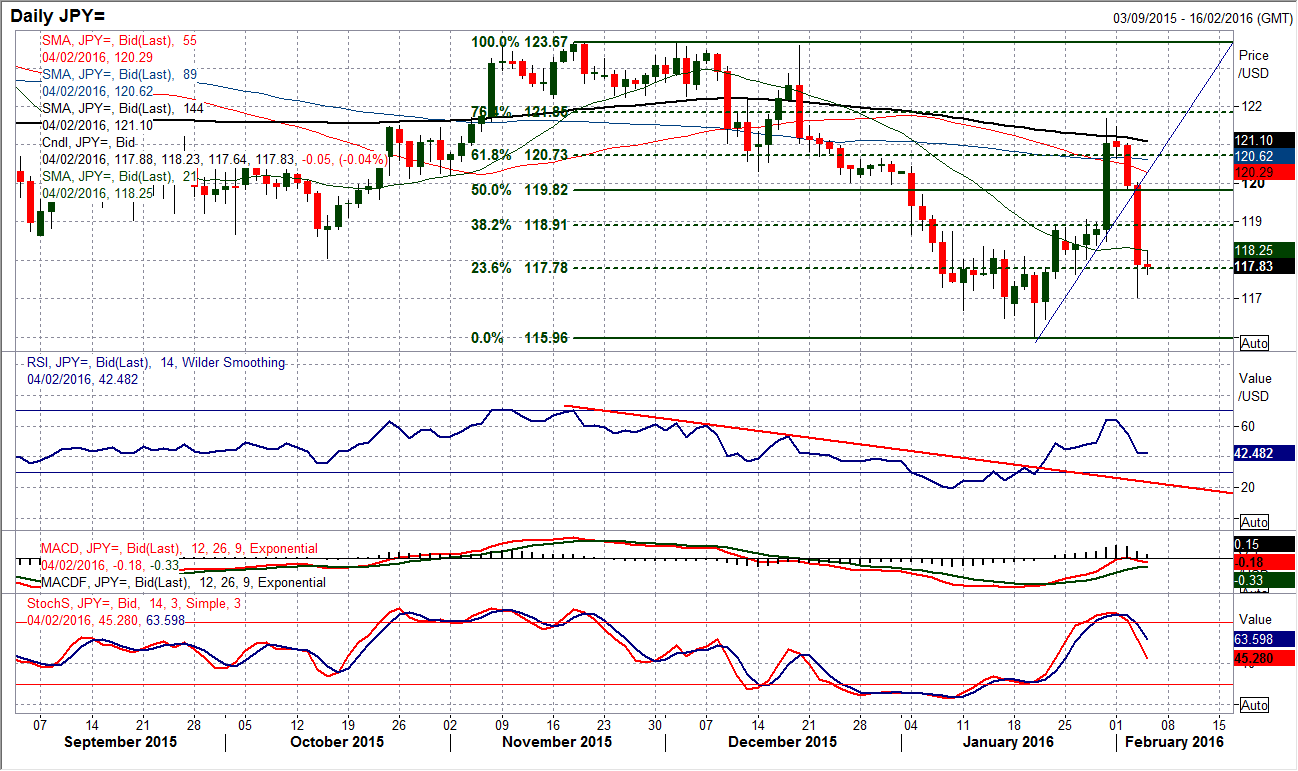

USD/JPY

An incredible unwind of the move following last week’s BoJ easing has seen the yen strengthen to pull Dollar/Yen lower by as much as 400 pips in just two sessions. The rebound off yesterday’s low at 117.03 is just helping to unwind some of the near term oversold momentum. However the legacy is that the daily indicators have given a series of bearish signals, the most worrying is the confirmed sell signal on the Stochastics. The Fibonacci retracements of the 123.67/115.96 sell-off are once more an interesting reference. The 23.6% Fibonacci retracement at 117.78 was breached yesterday and all but caught the closing price, so the 38.2% Fib at 118.90 will be watched if a rally sets in today. Already though the hourly chart suggests that the overnight rebound is just an unwinding move and is likely to just provide another chance to sell. There is further key resistance around 119.00. I will be looking for another sell signal for a retest of the lows.

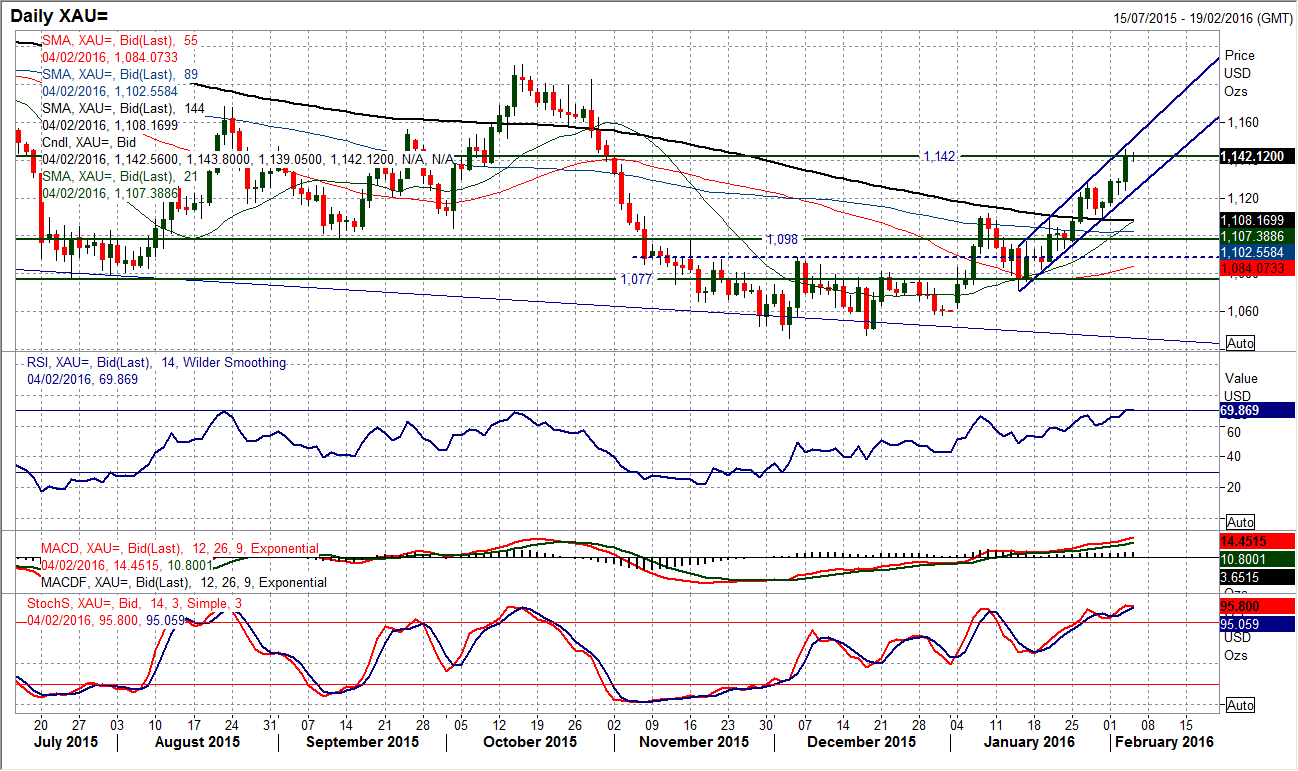

Gold

Gold is still conforming very uniformly to the uptrend channel of the past 3 weeks and for now the trend remains solidly higher. The move has now unwound the price back to the old key floor at $1142 and although momentum remains strong near term for the trend, there is the possibility now that upside potential may become limited. The upper trend line in the channel was again hit yesterday before slightly coming off so we must be prepared for a possible consolidation or even correction once more within the channel. The RSI is now up around 70 which tended to be the limit of the August and October highs. Initial support comes in at $1137, with breakout support at $1130, and the channel support in at $1125. The next resistance band comes in around $1151/$1156.

WTI Oil

The oil price saw a sharp intraday turnaround yesterday. However the move was built more on the back of sharp dollar weakness than any sustainable fundamental improvement. The EIA oil inventories report contained nothing other than concerning news over increasing stockpiles and the rally yesterday seems to be built on shaky ground. The market subsequently held on to the key near term support at $29.25 and even though yesterday’s candle was a bullish engulfing, the technical indicators suggest the bulls are still under real pressure. Furthermore, the move has simply brought the price back to the resistance of a 3 month downtrend. The deteriorating momentum indicators suggest that rallies are still a chance to sell with the RSI around 50 and the Stochastics having turned lower again. The hourly chart shows there is a pivot around $32.75 which could limit the gains today and if this coincides with a sell signal the bears could return quickly. Expect further pressure back on $30 again with a test of the key $29.25 support still likely.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.