Market Overview

For the want of sounding like a broken record, but trading sentiment has taken another sharp leg lower overnight, once more driven by a slide in oil. The move has come as a minor rebound on oil yesterday was completely snuffed out as the International Energy Agency warned of a supply glut arising from the return of Iranian supplies back to the international market. Across the board risk assets have tanked. After a late rally saw Wall Street broadly flat at the close, Asian equities have fallen sharply again with the Nikkei down 3.7% and European markets also trading lower. Treasury yields have again turned strongly lower with the 10 Year yield unwinding all of yesterday’s early gains and back under 2.000% again (having been as high as 2.300% as the Fed hiked rates in December).

Forex markets continue to run along a consistent theme. Risk off drives strength into the euro and the yen, whilst also driving weakness across the commodity currencies of the Aussie and Kiwi, with the Canadian Loonie also lower in front of a possible rate cut by the BoC. The outlook for the Kiwi has completely flipped again in the course of the past 24 hours (see below). Cable may look to be relatively stable today but after Mark Carney’s dovish comments suggested no set time table for a rate hike, US traders really targeted it on the short side again yesterday as another key support was taken out. There is also support for gold again today, whilst the sharp decline in the price of oil means that once more both WTI and Brent Crude are looking towards their next downside targets around $27.

Traders will be desperately hoping for some good news to change the sentiment of the market today. The UK employment data is announced at 0930GMT with 5.2% on the unemployment expected and perhaps more importantly the average weekly earnings (ex bonus expected to drop to 1.8% (from 2.0%). Then focus turns to the UK inflation data with Year on Year CPI at 1330GMT expected to pick-up to +0.8% from +0.5% last month, whilst the core data is expected at 2.1% (up from 2.0%). There are also building permits at 1330GMT (1.2m exp) and housing starts (1.2m exp). The Bank of Canada also announces monetary policy at 1500GMT today with an expectation of a 25 basis point rate cut to 0.25%.

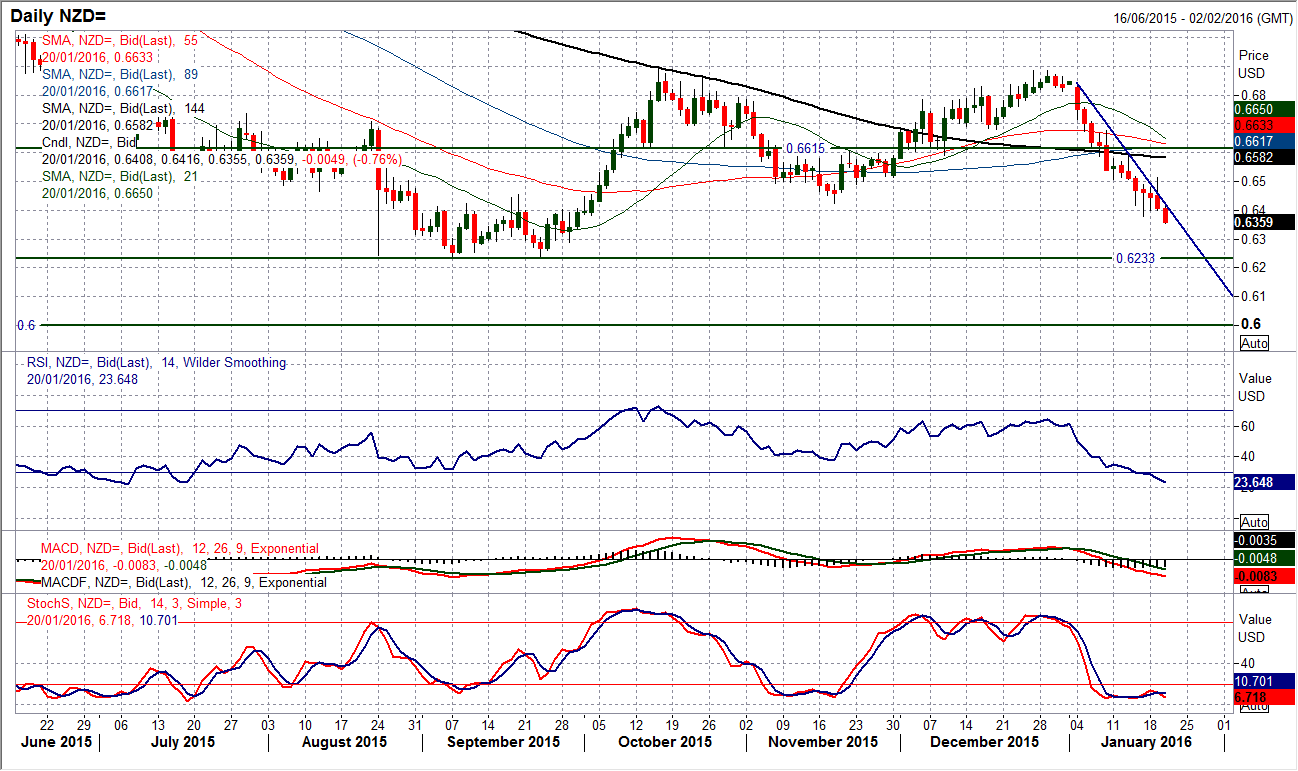

Chart of the Day – NZD/USD

I was hoping that I would be talking about the prospect of a decent recovery play this morning, however there has been a sharp turnaround overnight and the green shoots of a recovery have been completely destroyed by the bears again. So instead of talking about a recovery around the support of the old November low at $0.6425, the main analysis is based around the continuation of the downtrend. The concern is that momentum indicators continue to fall away and look increasingly negative, meaning that the trend is strengthening. A feature of the downtrend (as it has been with other key sell-offs on Cable and Dollar/Yen) has been that old support has consistently been used as a new resistance. This has left a key pivot in place at $1.6500, but also now this means that there is overhead supply in the $0.6380/$0.6415 range. There is now a likelihood of a full retracement back to the September lows around $0.6230.

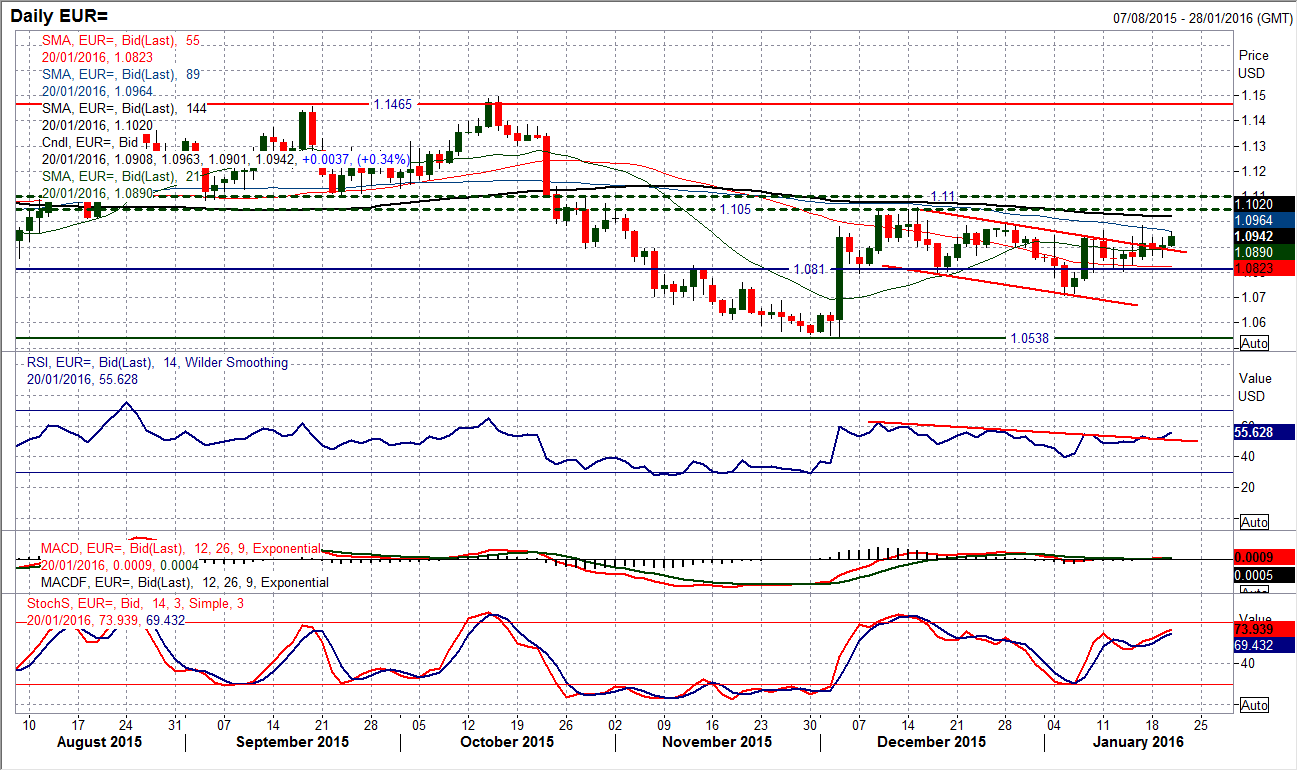

EUR/USD

With risk appetite again taking a turn for the worse overnight, as a safe haven play, the euro has picked up again. The downtrend channel which has loosely continued is now being decisively broken. Intraday moves into the resistance band have tended to fail in recent days and it will be interesting to see how the latest move fares because the momentum is now turning positive. The RSI is moving higher along with the Stochastics and it would appear that the bulls are set up for a test of the $1.0990 resistance. An upside break would then open $1.1050 again. With the intraday corrections being bought into at higher levels, having left the support around $1.0810, subsequent higher lows have been formed at $1.0833 and now at yesterday’s low of $1.0860. Watch for the hourly momentum signalling an upside break. If the hourly RSI can sustain a move above 70 then this would be a bullish signal.

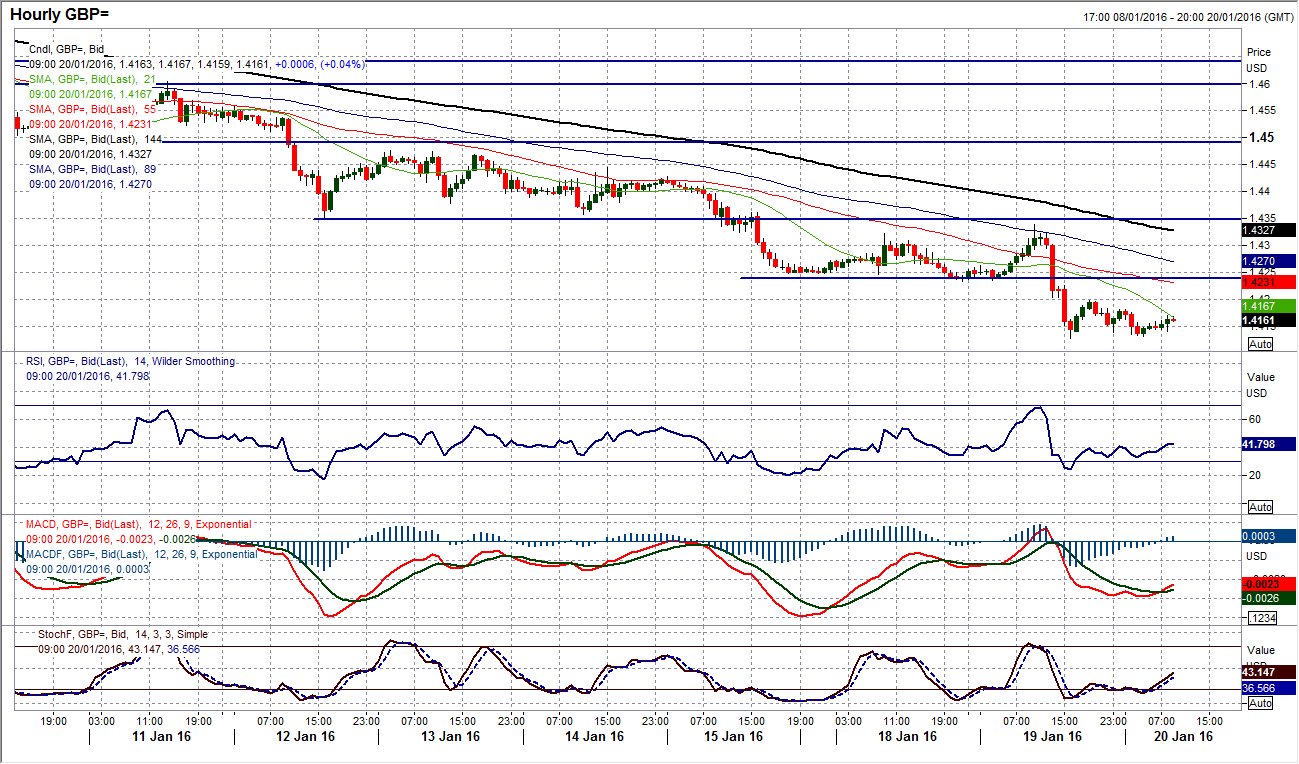

GBP/USD

The sterling bulls took a real hammer blow yesterday as a sharp sell-off turned what looked to be a positive session into a big bearish outside day that just continues the decline ever lower. The initial support was coming in at the key May 2010 low at $1.4230 but the sellers then just burst straight through this old floor to close at the lowest level since March 2009. The next level to the downside would be the psychological $1.4000 level, but in truth there is little real support until the $1.3650 low and possibly even the massive low at $1.3500. Incredible. What is also incredible is the fact that the RSI is now at 15 and the last time it was this low was in the run up to the Scottish Referendum vote in September 2014. The consistency of the selling pressure is remarkable, with old support as new resistance. This leaves resistance at $1.4230 initially, with $1.4350 now key.

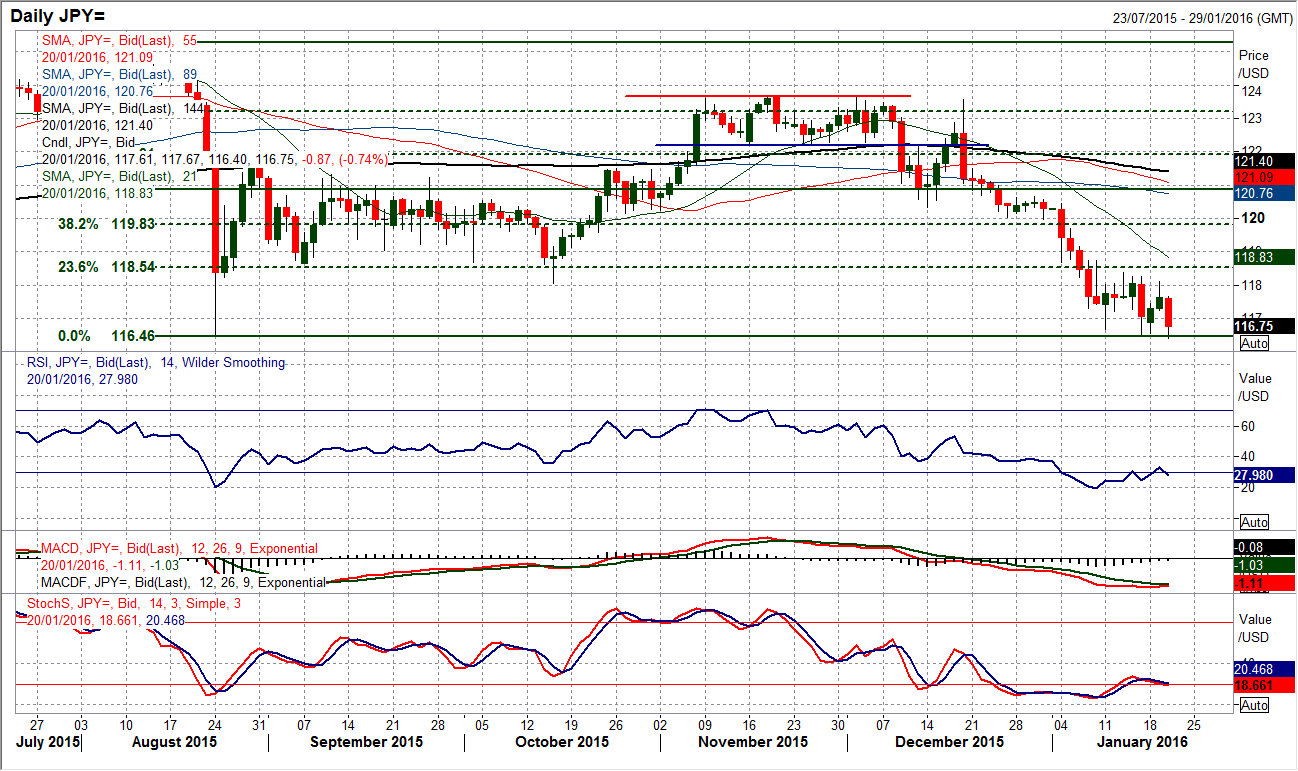

USD/JPY

Just when it looked as though the prospects of a recovery were looking much better, there has been a complete turnaround again. Subsequently, once more we are looking at a test of the key 116.46 low. This is a level that has been tested already on 3 occasions recently and each time it has successfully held. However the sharp selling pressure of the past 20 hours which has seen the pair turn sharply lower again from 118.10 means that the bear pressure is being felt again. The concern is that the more times this support is tested, the more tired the bulls will become. A breach would re-open the big December 2014 low at 115.55 and the prospect of a massive top pattern. It certainly does not look as though the bulls are ready for a recovery yet. The old near to medium term pivot is still playing a role at 117.20 and is now back as initial resistance.

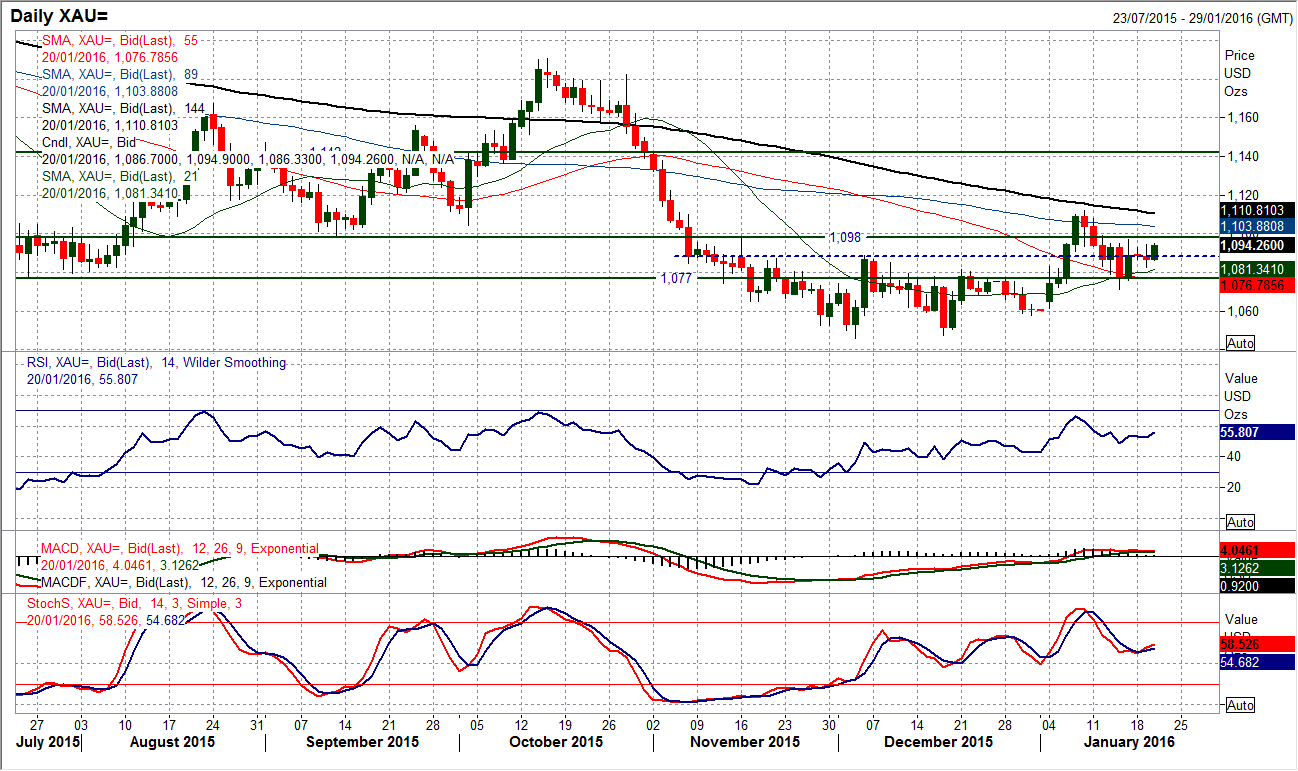

Gold

With two days of very neutral candles, the battle for control of this gold chart continues. There are arguments that can be made either way, but whilst the price trades consistently above the old pivot band at $1077 but below the old resistance at $1098, then it is difficult to really back anyone either way. We have a rather broad set of momentum indicators which although there is a very slight (and I mean slight) bullish bias, there is nothing concrete to be backing a breakout quite yet. Furthermore, the moving averages are all but flat. So we are still looking for signals of a breakout. Primarily this needs to be a close outside the $1077/$1098 for starters, so for now I await the next signal.

WTI Oil

WTI had a complete intraday turnaround yesterday. The initial push higher above $30 into the overhead supply that had built up over the end of last week seems to once more providing the sellers the opportunity to go short again. This maintains the bearish outlook which is a feature of the recent bear phase which show that rallies are a chance to sell still. The downside target of the 100% Fibonacci projection at just above $27 remains in play as a next downside target. In truth the chart is so bearish that there would need to be a substantial recovery through a key near term overhead rally high to even start to think that a recovery was sustainable. This means that beyond $30, the resistance band between $31.75/$32.10 remains key.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.