Market Overview

Market volatility has just begun to calm down a little after last week’s hectic trading. The markets on Wall Street closed a positive week with slight gains on Friday and with the oil price once again holding on to support that has been built up the sentiment is positive moving into the final few days before Christmas. Asian indices have also been positive once again, although the Nikkei 225 has been broadly flat as the yen has consolidated. European markets are mixed to slightly positive in early trading today.

In forex trading, the dollar has been under a slight amount of corrective pressure during the Asian session with little fundamental news to drive direction yet. There is little economic data to drive markets into the end of the year, however the existing home sales for the US will be eyed today. The expectation is for a slight dip back to 5.21m from 5.26m.

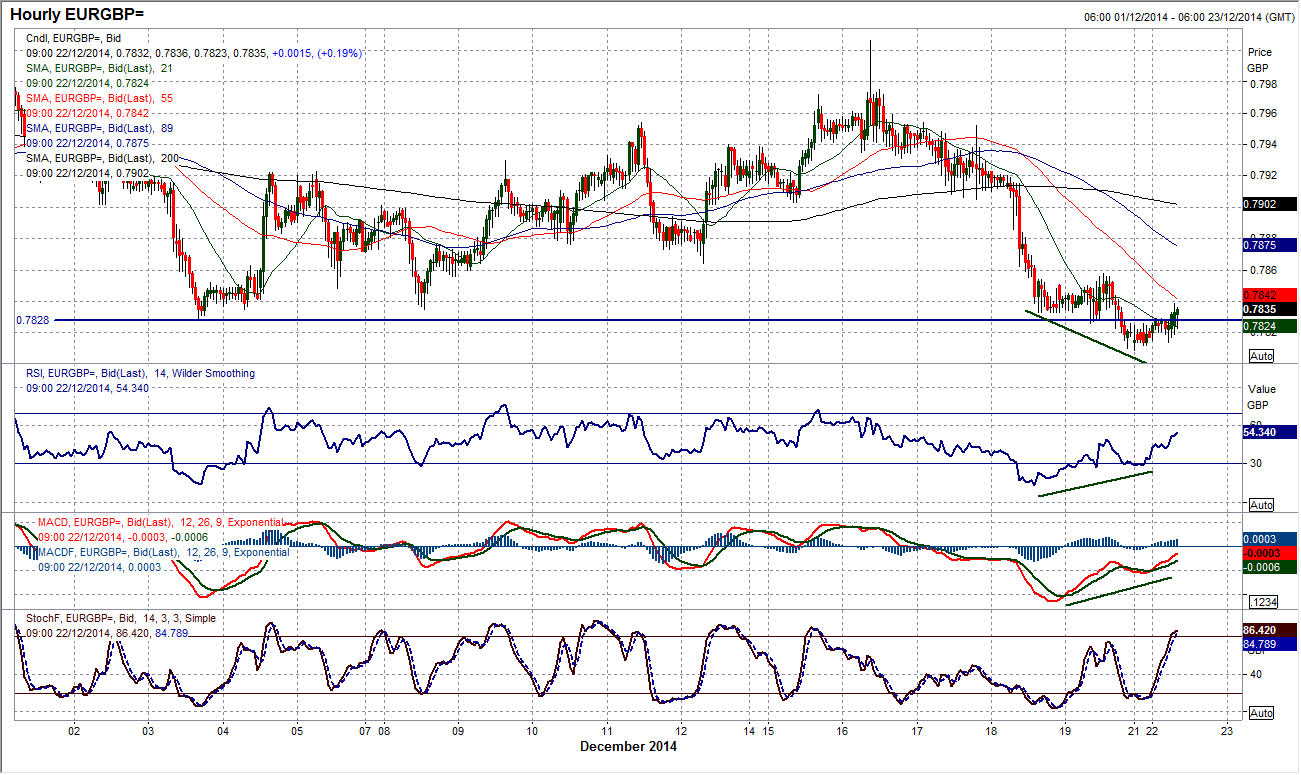

Chart of the Day – EUR/GBP

Euro/Sterling continues to trade in a broad sideways range £0.7758/£0.8065. After a few days of sharp retreat though the euro is looking once more to bounce back. There is little to suggest yet that the range is ready to break lower and once more the support around £0.7800 seems to be working as the bulls have supported again today. The momentum indicators are range benign at the moment and give very little sign other than that this is a continued range play for now. On the intraday hourly chart there have been bullish divergences on the RSI and MACD lines with the low posted overnight at £0.7808 and this could now be set to throw the euro bulls back into control near term. A move above £0.7858 which was an old support turned into new resistance would re-open upside towards £0.7950/£0.7975.

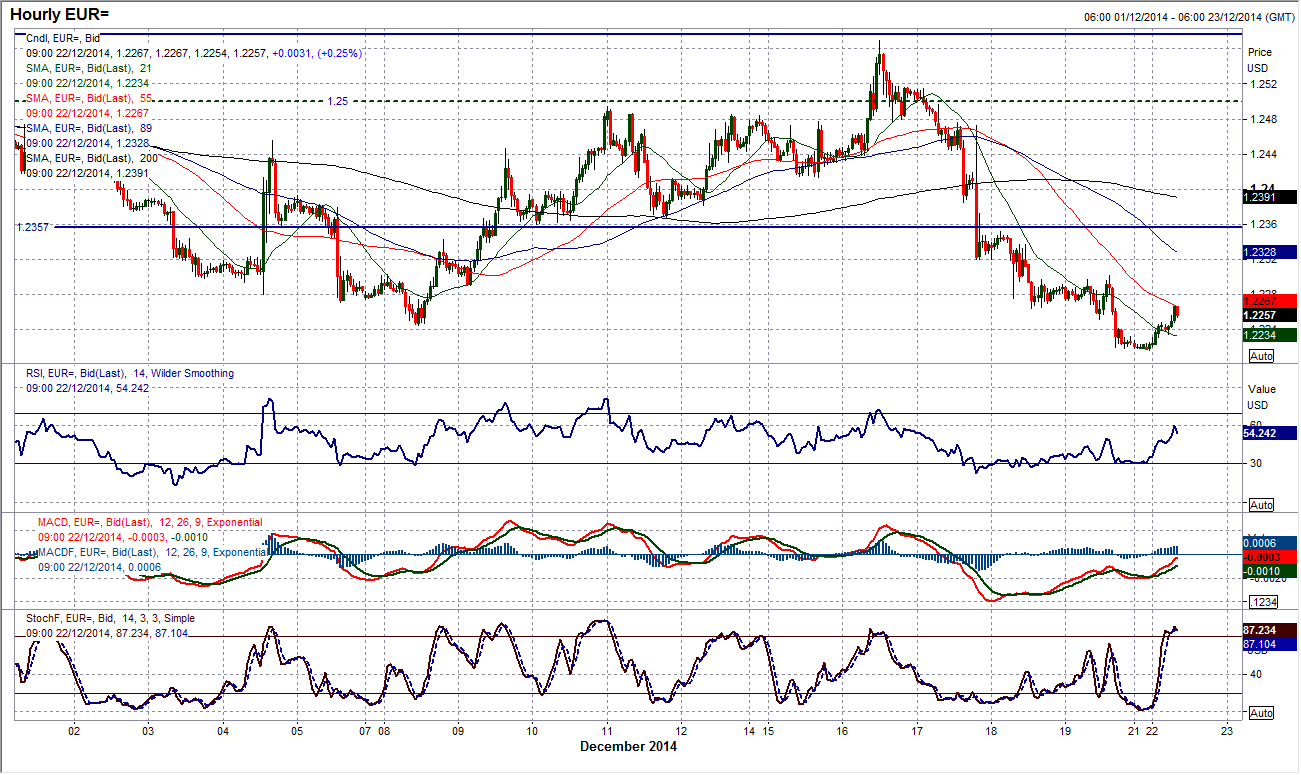

EUR/USD

In the days since the FOMC decision the euro has broken below the key support at $1.2245 to move to a new low dating back to mid-2012. The way is now open towards a test of the crucial July 2012 low at $1.2040 again. The momentum indicators are weak and the outlook suggests that rallies should be seen as a chance to sell. However these markets do not tend to move in a straight line and there are likely to be minor retracements along the way. The initial resistance is around $1.2300 and then at $1.2350. The intraday hourly chart shows negative configuration on MACD whilst the RSI is also unwinding from a stretched position. Late December can mean that markets become quite thin and movement more volatile, but I still expect the euro to continue lower in due course.

GBP/USD

The outlook for Cable remains negative although there has been no breakdown yet in the same way that the euro has done. There is still a feeling that rallies are seen as a chance to sell but as yet there are no decisive signs of imminent weakness. The argument that Cable is actually trading in a sideways range still holds true with a low around $1.5540 towards a reaction high at $1.5825. However there is a slight downside bias within the range which would suggest a preference for selling into strength. Friday’s reaction high at $1.5680 is the initial resistance and then $1.5735 before the lower reaction high at $1.5785 which could be used as a key benchmark.

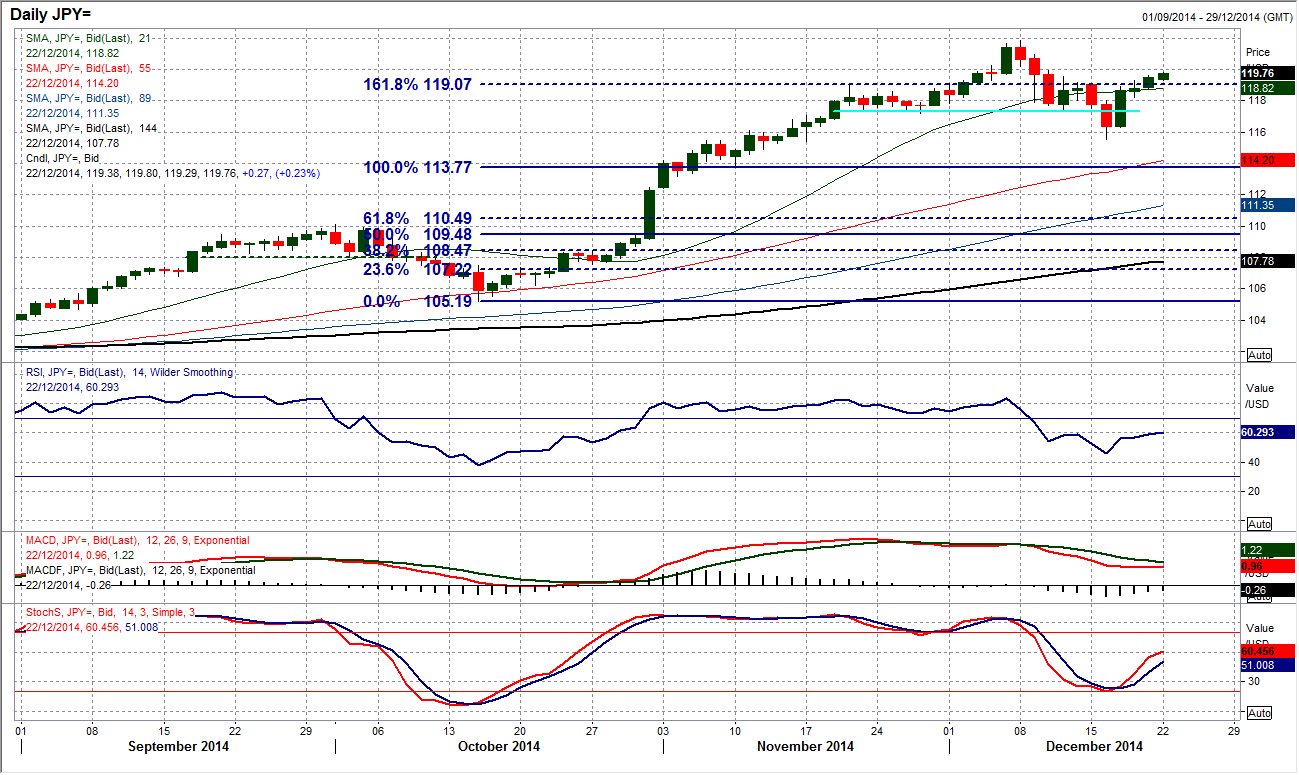

USD/JPY

On Friday we saw the completed turnaround of the outlook. Having been in correction mode for a week and a half the bulls returned with a bang in the wake of the FOMC and the prospect of a top pattern dragging Dollar/Yen lower has been removed. Friday’s move above 119.55 which was the right hand shoulder has now aborted the top and should now see the bulls regain control for a test of the highs. The lack of a close above 119.55 is a slight concern but the daily momentum indicators have now bottomed and looking on the intraday hourly chart the sequence of higher lows suggests renewed appetite for the bulls. Initial support comes in at 118.82 and then at 118.23. If the rate can now look to settle it would suggest a new acceptance at these levels and the bulls can begin to look back towards the next overhead resistance at 120 and 121.

Gold

There price has settled down in the past few days as volatility has drained out of the gold price. It seems as though the psychological level at $1200 is a level of stability currently, and the near term outlook over the past three weeks on the daily chart is becoming increasingly neutral. However, the consolidation of the past couple of days means that the downtrend that has been forming since the key high at $1238.20 is now fast catching up. On the intraday hourly chart, the downtrend resistance will now drop below $1200 by tomorrow morning so the consolidation is coming to a head. This could be a downforce on the gold price which is under downtrend pressure on not only a near to medium term horizon but also on a longer term basis. A move above resistance at $1212.80 would perk the bulls up again.

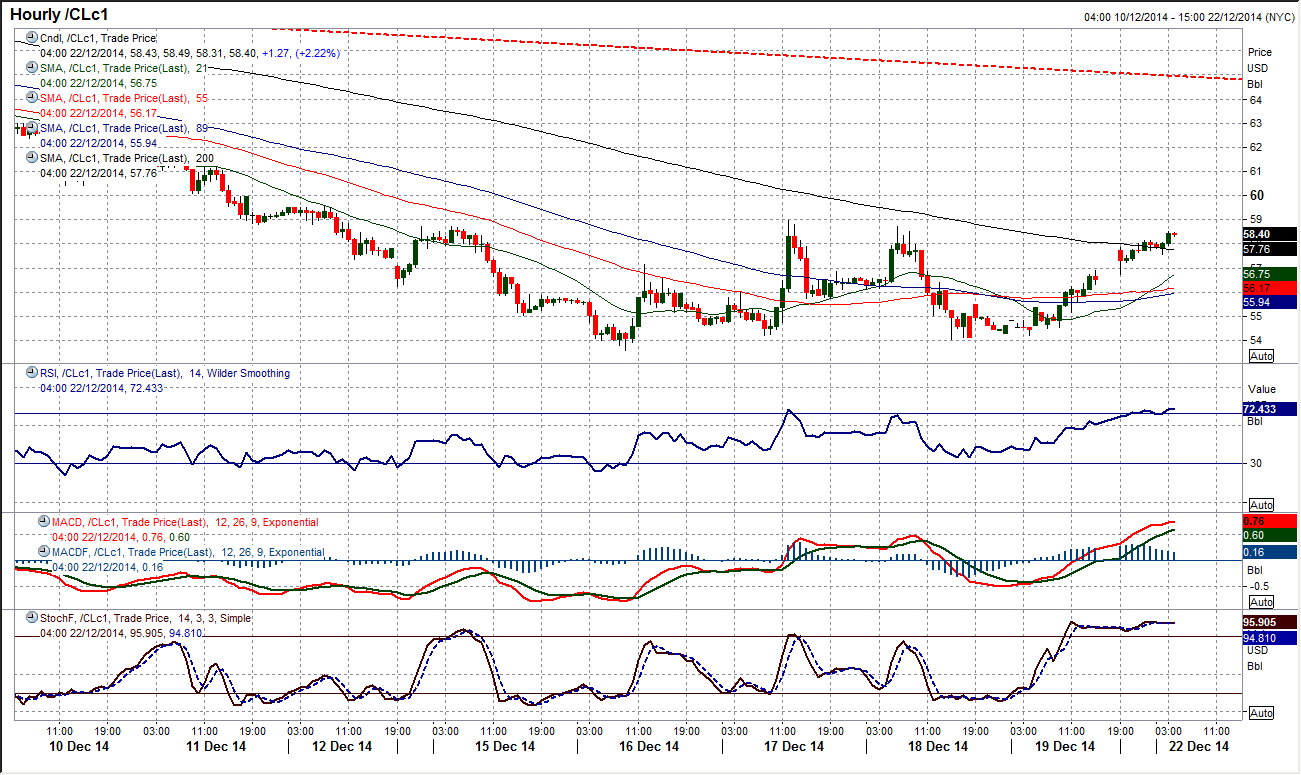

WTI Oil

The prospect of sustainable support (at least in the near term) having been laid at $53.60 is growing as the low from last Tuesday continues to remain intact. Right now the WTI price seems to be bumping along the bottom, but the volatility seen in recent weeks means that, in fact, the range that has built over the past week is from $53.60 to $59.00 and is therefore a range of exactly 10%. This is a wide range to play with if you are a short term trader. We must look at the intraday hourly chart for the signals then. There is a mid-range pivot level around $56.40 which can be used as a line in the sand, with moves above this level treated as bullish for a move back towards the range highs, whilst moves below could see the support of the lows under pressure again. Hourly moving averages are flat and reflect a range play.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.