Market Overview

Three factors have combined to improve the outlook on financial markets in the past 24 hours. First of all the oil price has finally found some support. Whether it turns out to be the low remains to be seen but perhaps all markets need is a suggestion of some support. Also the announcement that the Russian government would be supporting the Ruble through forex reserves has resulted in a sharp improvement in the prospects of the embattled currency. And finally last night, the Federal Reserve was a touch more dovish than the market had expected. All of these aspects combined to improve investor sentiment.

In its statement, the Fed noted that it is going to watch inflation very closely and notes that it will be “patient” about raising interest rates. However, it also kept the term “considerable time” in the statement. This was a fairly dovish statement and in her press conference Janet Yellen provided further clarity that the FOMC was “unlikely” to raise interest rate in the next two meetings. This clarity was the positive for equities as it helped to settle the nerves. Interestingly, this has also driven a dollar rebound, with a huge rally on the Dollar Index coming as investors moved away from safer haven assets such as the yen and Treasuries.

Equity markets have soared, with huge gains seen on Wall Street as the S&P 500 jumped 2.0%. Asian markets were also strongly higher, with the Nikkei 225 bouncing by 2.3% as the yen significantly weakened again. European indices did not get a chance to really get going before the close yesterday but will get a chance to play catch up today and are trading strongly higher in early exchanges.

In forex trading, the dollar has also been very strong. There may be an element of consolidation today, but the euro and the Swissy are weaker again, whilst there are also mildly dollar positive moves on Cable and Dollar/Yen. The improvement in risk appetite has helped provide support to the Aussie and Kiwi dollars.

Traders will be looking forward to the German Ifo Business Climate at 09:00GMT with an expectation of an improvement to 105.6 (104.7 last), whilst in the US there is the announcement of Weekly Jobless Claims at 13:30GMT (297k expected).

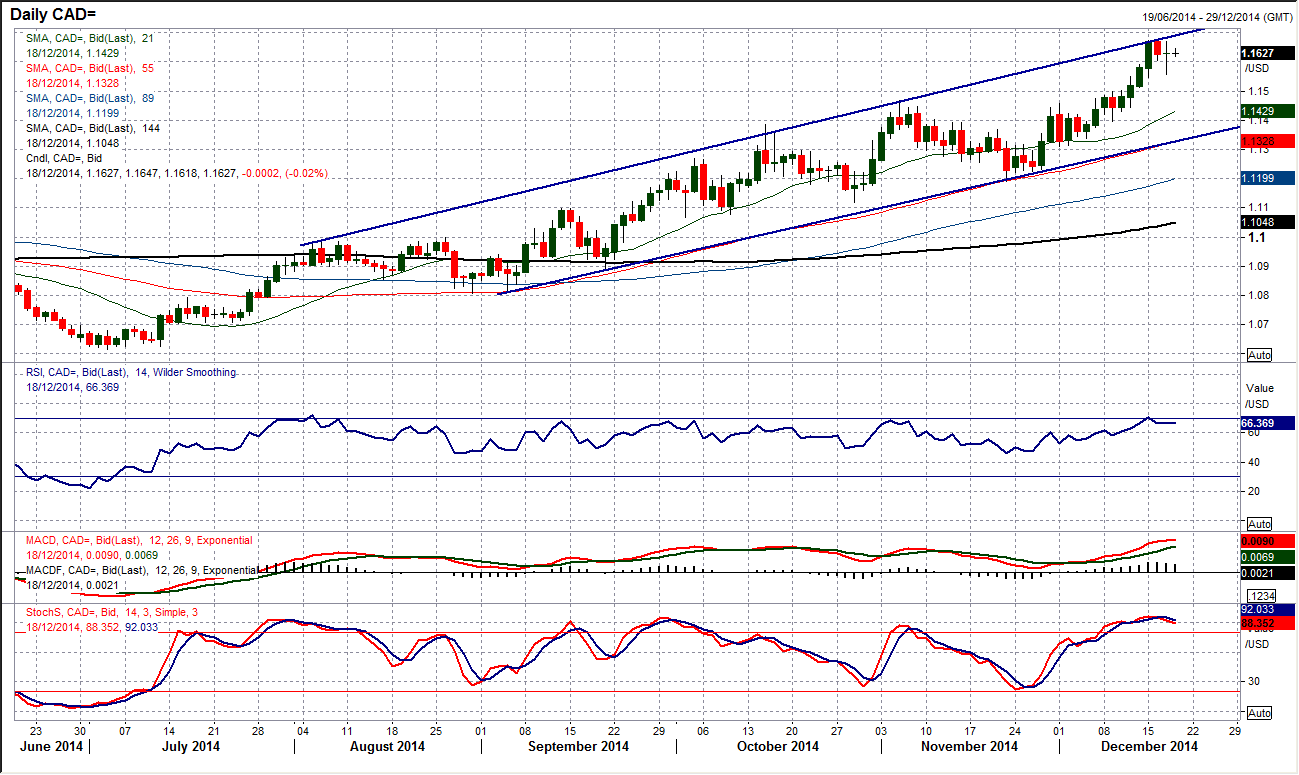

Chart of the Day – USD/CAD

It is interesting that with the recent run higher towards the top of the uptrend channel there have subsequently been a few signals that would suggest perhaps caution with running long positions now. The “dark cloud cover” bearish candlestick on Tuesday has been followed by a “long legged doji” which signifies uncertainty with the prevailing trend. Both of these candles have come at the top of the uptrend channel. Shorting into an uptrend is always a risky game but the appearance of these candles certainly suggest that the bulls should tread cautiously. Furthermore, the RSI on the daily chart is classically hitting 70 (as it has done on 4 separate occasions since August) and failing to push above it. Also the Stochastics are rolling over too. Perhaps it is time to take a breather on the long USD/CAD positions. As an aside also, if the oil price starts to rise again the Canadian dollar is likely to also find some support.

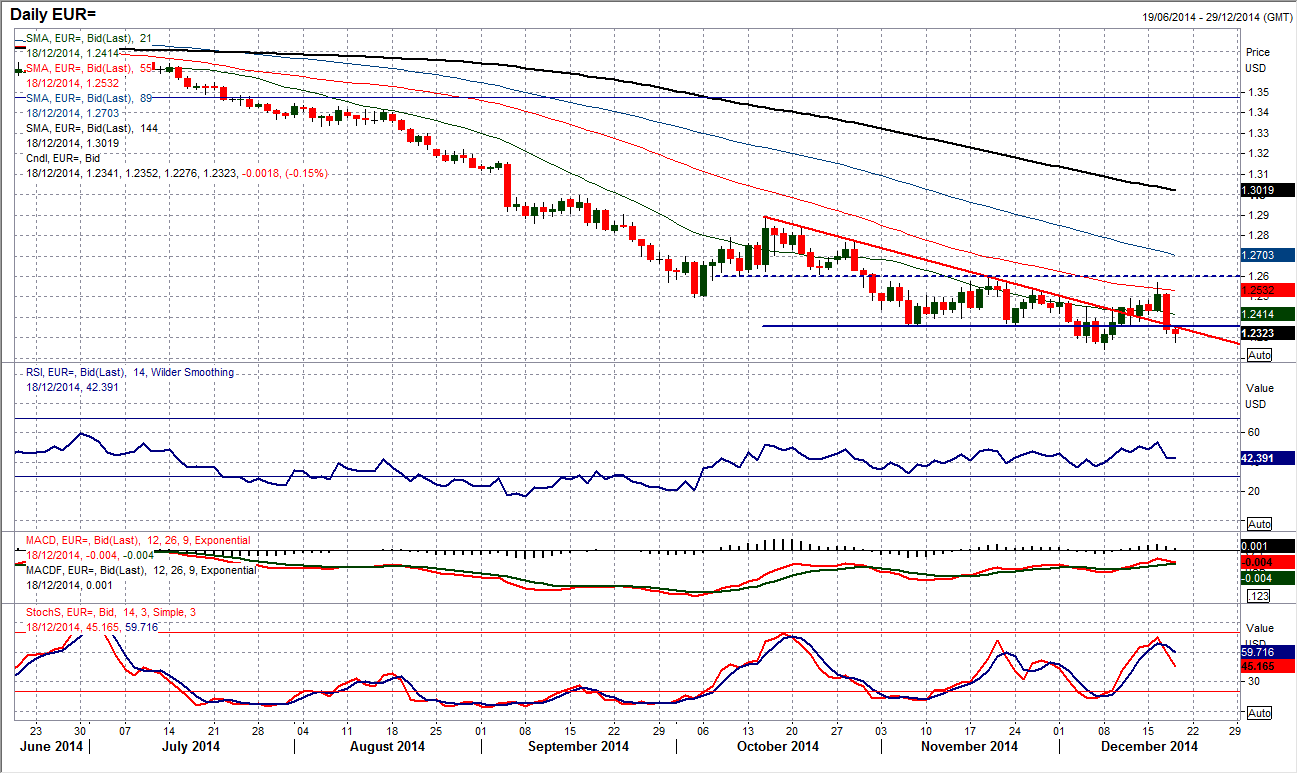

EUR/USD

The euro recovery was turned on its head yesterday as the Federal Reserve sought to calm nerves over the potential for rate hikes. Despite the FOMCC remaining relatively dovish the dollar strengthened as financial markets settled down again. This has pulled EUR/USD sharply lower again, with an almost two big figure range on the day from high to low. This has undone much of the recovery work that the euro had been putting in and we now see a change of outlook once more. This will often be the case with ranging periods and that is what the euro has been doing for the past 6 weeks. The intraday hourly chart shows a move below the support at $1.2357 which has opened the support area around $1.2300 and is likely to mean that a retest of $1.2245 is also on the cards. History tells us that over the past 6 weeks we should play the range and until it breaks down there is little use in turning all out bearish again.

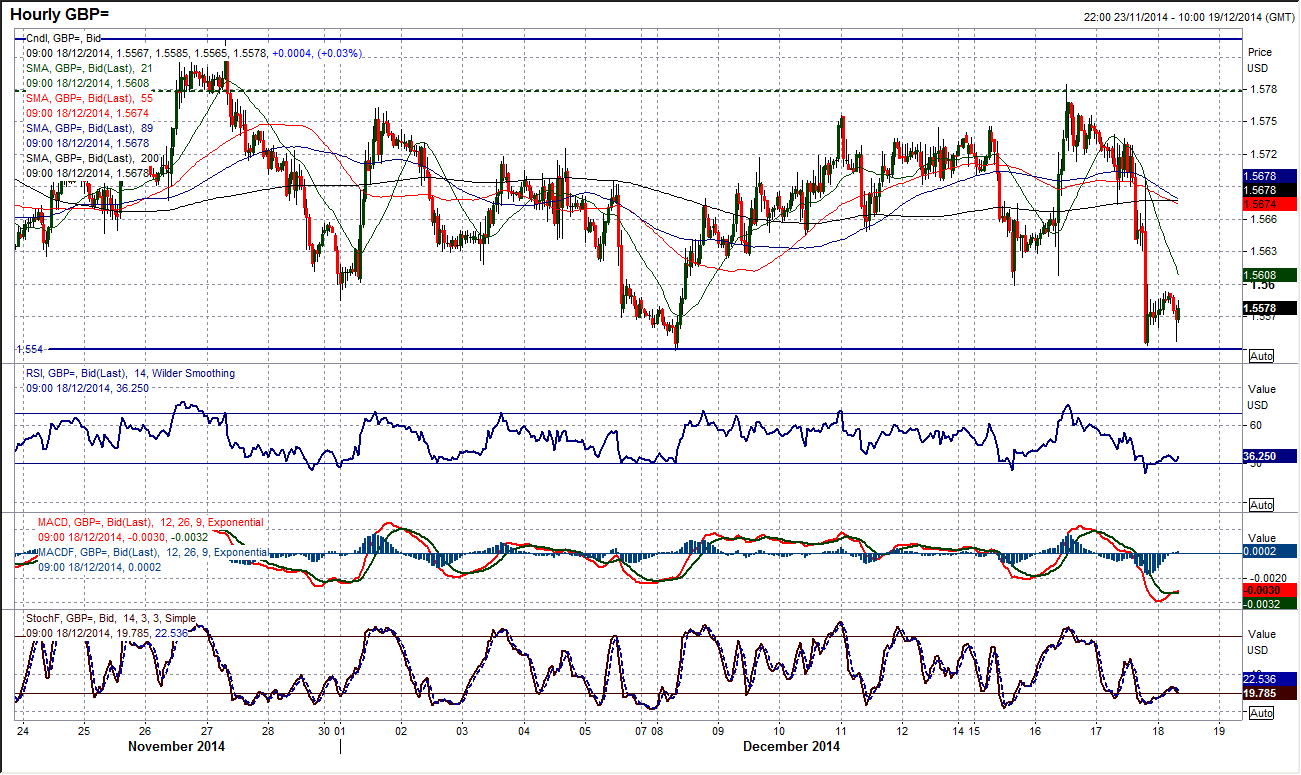

GBP/USD

Although the range of the past 5 weeks continues, one day can really change the outlook of a chart and yesterday’s sharp decline has the potential to be just that. The sharp decline means that the dollar strength has dragged Cable back to test the lows around $1.5540, but for now the range remains intact. The continued bearish configuration on the momentum indicators suggests that the dollar strength will ultimately prevail to break Cable lower, but for now we must wait. Once more the intraday hourly chart shows the RSI dipping back to 30 where the support has come in again. So now today becomes an important day for the general outlook. If Cable is unable to retrace some of yesterday’s weakness and pull back above the initial resistance at $1.5600 then the bears will begin to gain the control and serious pressure could be mounted on the los of the range. There is further resistance in the middle of the range around $1.5640.

USD/JPY

Keeping aware of the impact of fundamental events is an important part of trading and yesterday’s move on Dollar/Yen following the FOMC just goes to show that. The technical outlook on the pair is corrective, but a sharp 150 pip move higher has put a strain on the head and shoulders top pattern which has built over the past 4 weeks. However, for now, the pattern remains intact. The key resistance at 119.00 has so far held back the rally, whilst in theory the pattern will remain viable until a move above the right hand shoulder at 119.55. Of course the dollar bulls are once more feeling more confident and the rebound means that over the past two days a series of higher lows has been left with the latest one around the neckline of the top pattern at 117.15. It will now be interesting to see whether the bulls can push on now as the resistance band 119/119.55 is strong near term. If the breach is made then the outlook will once more turn positive.

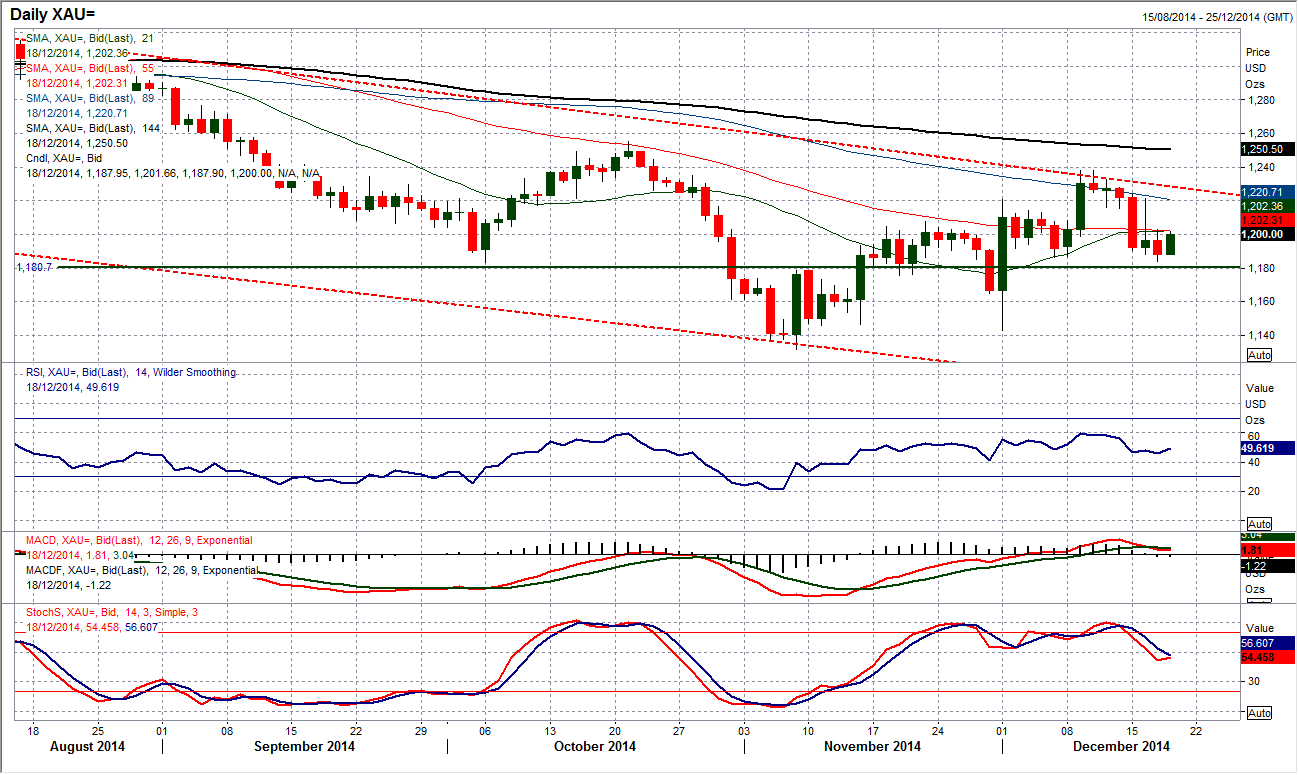

Gold

Gold has been rather volatile in the past few days as the outlook becomes increasingly difficult to ascertain. Yesterday’s dip below the higher low at $1186.10 could have then resulted in further downside, but a low has been posted at $1183.70 which is again above the key long term pivot level at $1180.70. Furthermore, there has been another rally overnight back towards $1200 which has strengthened the support. Momentum indicators are increasingly neutral now with RSI, MACD and Stochastics all now devoid of any real guidance. I am still erring on the side of the bears though with the big downtrend channel intact, and the intraday hourly chart showing a sequence of lower highs (with the latest key high at $1221.40) and now with yesterday’s breach of support post the Fed. Gold is a tough one to call at the moment but when it comes down to it I believe there is further weakness in the price allied to the likely dollar strength that should be seen.

WTI Oil

Volatility remains high but for the first time since 1st December there has been a significantly promising bullish move. The support has now been strengthened at $53.60 and the rebound in the WTI price at its peak yesterday was over 6% for the upside move on the day. Encouragingly, the move has also taken out the lower highs of the past two days, with the breach of the $58.73 high from 15th December. Despite the fact that the move has had an element of retracement, there is now a basis of support between $55.50/$56. Additionally the move has taken the price above the shorter hourly moving averages. The 55 hour moving average which has been the basis of resistance since early December, is now bottoming out at $55.60. Once more I re-iterate that more needs to be done, but the foundations of a recovery are being laid.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.