Market Overview

Despite a 26th record closing high in 2014 for the S&P 500 and more positive earnings data from tech giants Facebook, the Asian markets were weak overnight and Europe has started rather disappointingly with mixed early trading. This comes after a couple of positive days for equity investors, with a pause for breath possible today. Risk appetite should have been boosted by the news that the Chinese flash PMI was at an 18 month high at 52.0 which was also above the 51.0 that had been forecast. A slightly stronger yen and a surprise dip in Japanese trade data pulled the Nikkei 0.4% lower, although Chinese equities were higher.

The dollar is getting a boost once again in forex trading today with the euro remaining under downside pressure, but the big movers are coming with the selling pressure on the commodity currencies of the Kiwi and Aussie dollars. The kiwi dollar is around 1.5% lower despite a rate hike of 25 basis points. The hike had been largely anticipated by the market, but the Reserve Bank of New Zealand has also signalled that it will now be pausing its tightening cycle as it waits to see further developments in the economy. The Aussie dollar initially gained on the Chinese data but has subsequently fallen away again.

Traders will be looking out for the Eurozone flash PMIs which are announced through the early morning for European trading. The UK retail sales are announced at 09:30BST with a slight decline to 4.6% forecast (from 4.7% annualised). The US weekly jobless claims at 13:30BST are forecast to be slightly up to 310k (from last week’s 302k).

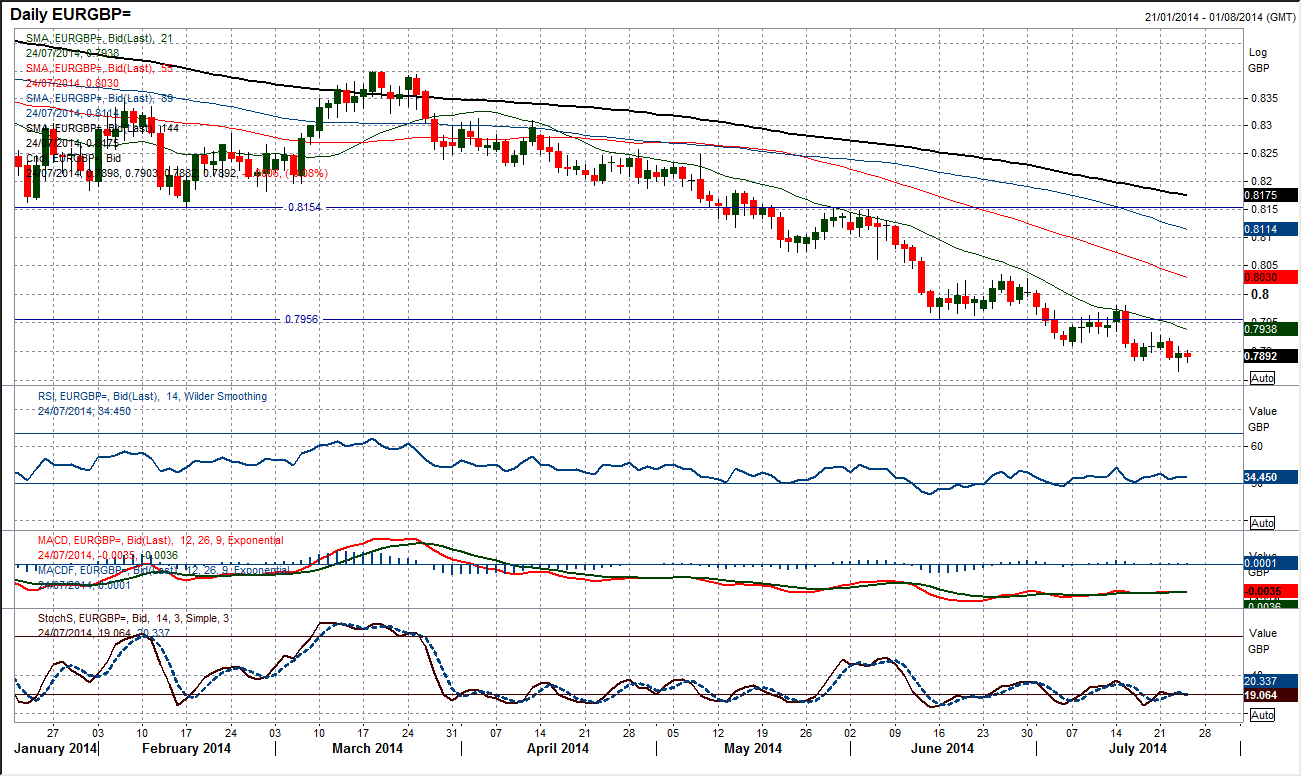

Chart of the Day – EUR/GBP

With the world and his wife all seemingly bearish on the euro, at some stage there is likely to be a short squeeze that will clean out a lot of these positions. However the big question is when. There is nothing really suggestive of a recovery on the chart of EUR/GBP. There is a stepped decline in the price which is now at its lowest level since September 2012. The momentum indicators are all deeply bearish, with recoveries on the RSI (currently at 34) struggling repeatedly to get above 40 and has now not been above 50 since April. The falling 21 day moving average (currently 0.7939) continues to be used as an excellent basis of resistance and there is little reason to suspect anything other than the price falling over once again. There is a band of resistance between £0.7910/£0.7930. There is little meaningful support until the July 2012 low around £0.7750. It would need a breach of the reaction high at £0.7980 for the recovery bulls to be interested.

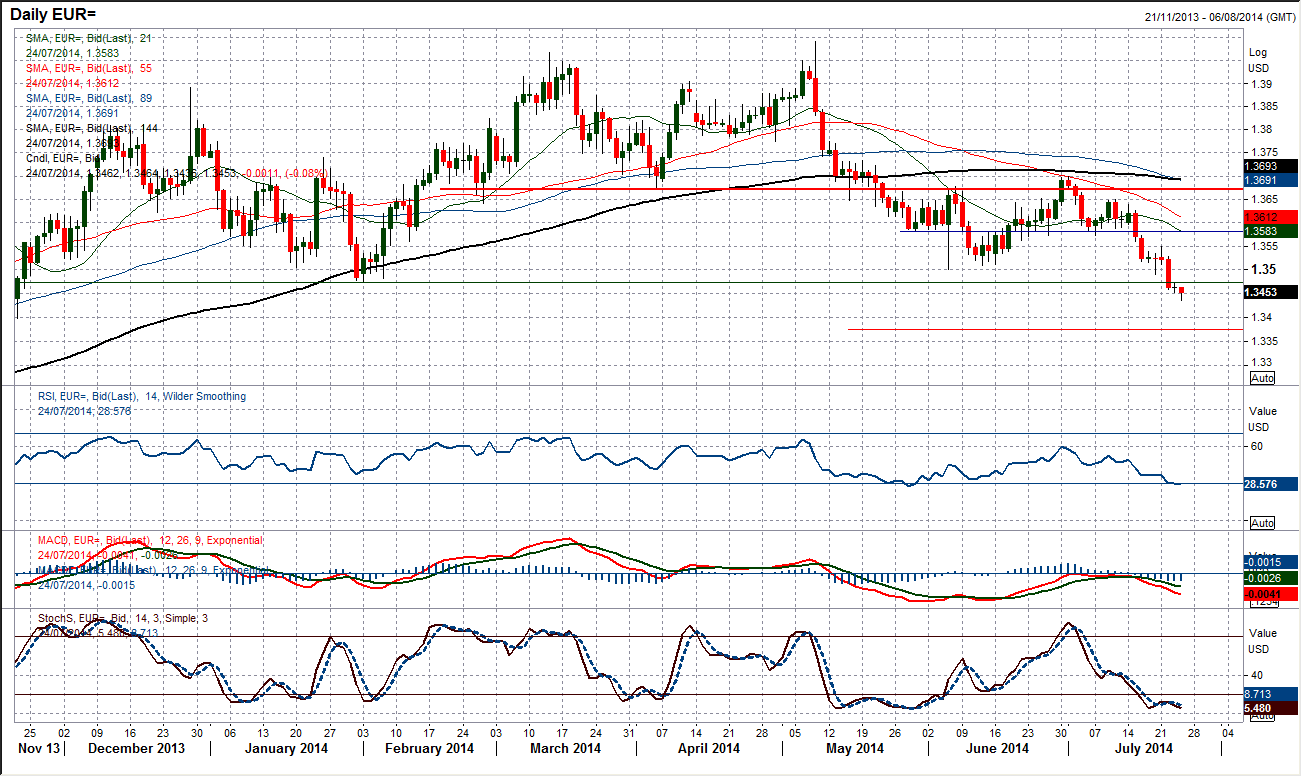

EUR/USD

As I was looking for yesterday, the euro has now had the breakdown of the big head and shoulders top pattern confirmed with a second daily close below the key support at $1.3475. The implied target for the medium to longer term is now $1.3000. All technical indicators now look very bearish and the outlook suggests only downwards from here. The only caveat to the bear picture is that the RSI is now around 29 and is beginning to look stretched. Whilst the RSI can sustain below 30 for a period of time the chances of a technical rally are growing. That makes the immediate strategy a bit tricky as to whether you should chase the euro lower or wait for a bounce to sell into. The riskiest strategy of all would be to buy the euro, but this is not recommended. There is a band of resistance now that starts at $1.3475 and then at $1.3500 and $1.3550. I would be looking for a bounce to sell into. The next downside target is at $1.3375 which is the downside target from the original double top.

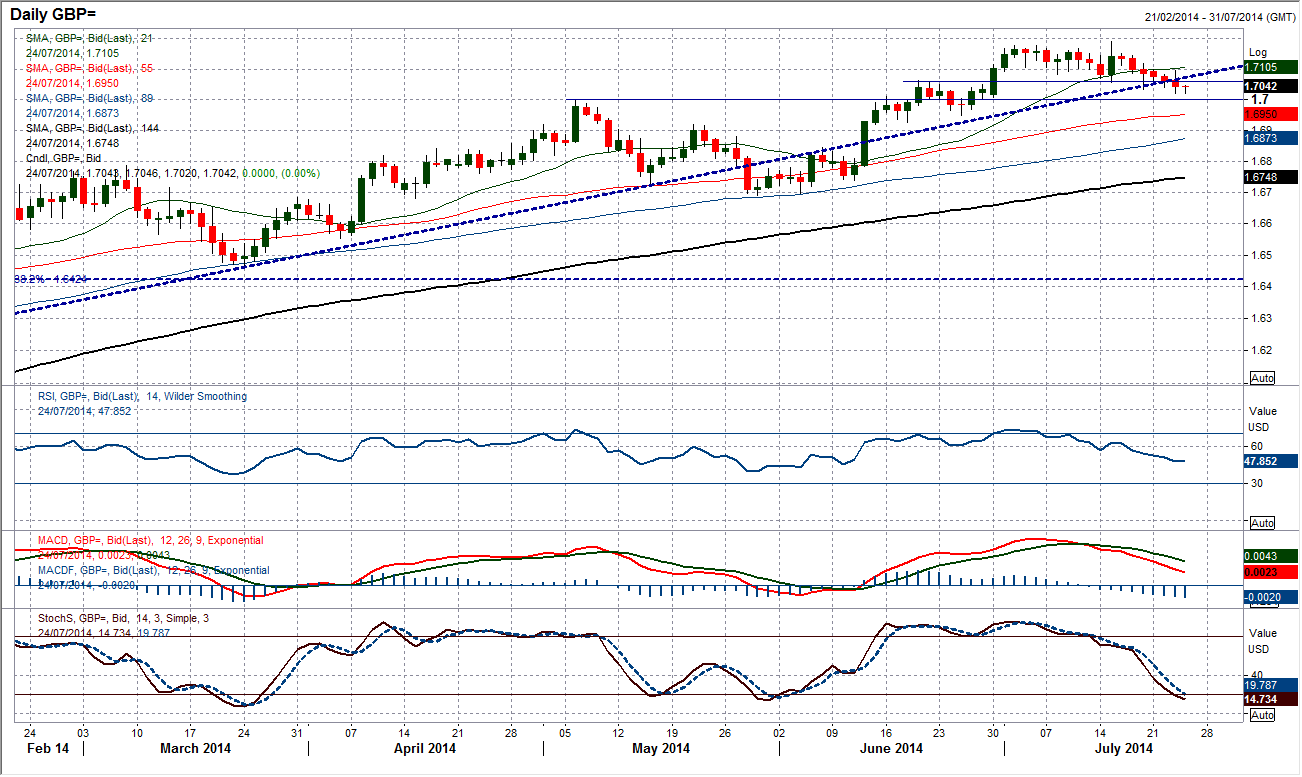

GBP/USD

Despite more of a choppy day yesterday (after the Bank of England meeting minutes especially), Cable continues to drift lower. The corrective phase has also now seen a close below $1.7060 for the first time in over 3 weeks. Whilst this is not explicitly a negative development, the rate is now firmly into a test of the 60 pip support band above $1.7000. Furthermore the correction has been almost uniformly steady over the past 7 days now. The longer term outlook remains very strong and this still looks to merely be a correction within the primary uptrend, but how far could it go. I am still expecting support to form above $1.7000 but over the course of the past few months, the last 3 big corrections have all formed support on the rising 89 day moving average (currently $16873). The likely course of events will be that a consolidation or support will take hold in the price whilst the moving average catches up and then the rally continues. However for now the drift lower is on. The next support below $1.7000 is at $1.6950. The bulls would regain the initiative above $1.7100.

USD/JPY

The dollar bulls cannot seem to gather any momentum with the sellers consistently now returning at lower levels. The latest recovery has now had a four day run which, over the past couple of months, seems to be the usual length before it begins to head back lower again. The intraday chart shows the band of resistance around 101.60 is growing, whilst the 101.80 is also strong. Even if the 21 day moving average (at 101.56) does not prove to be a near term turning point then it is acting as a very good basis of resistance. The momentum indicators remain in bearish configuration and suggest that rallies are a chance to sell. Anything into the 101.60/101.80 band looks like a good chance to sell for a retreat back towards 101 and a likely test of the key February low at 100.74. There is further resistance at the 102.00 pivot level and also around 102.30.

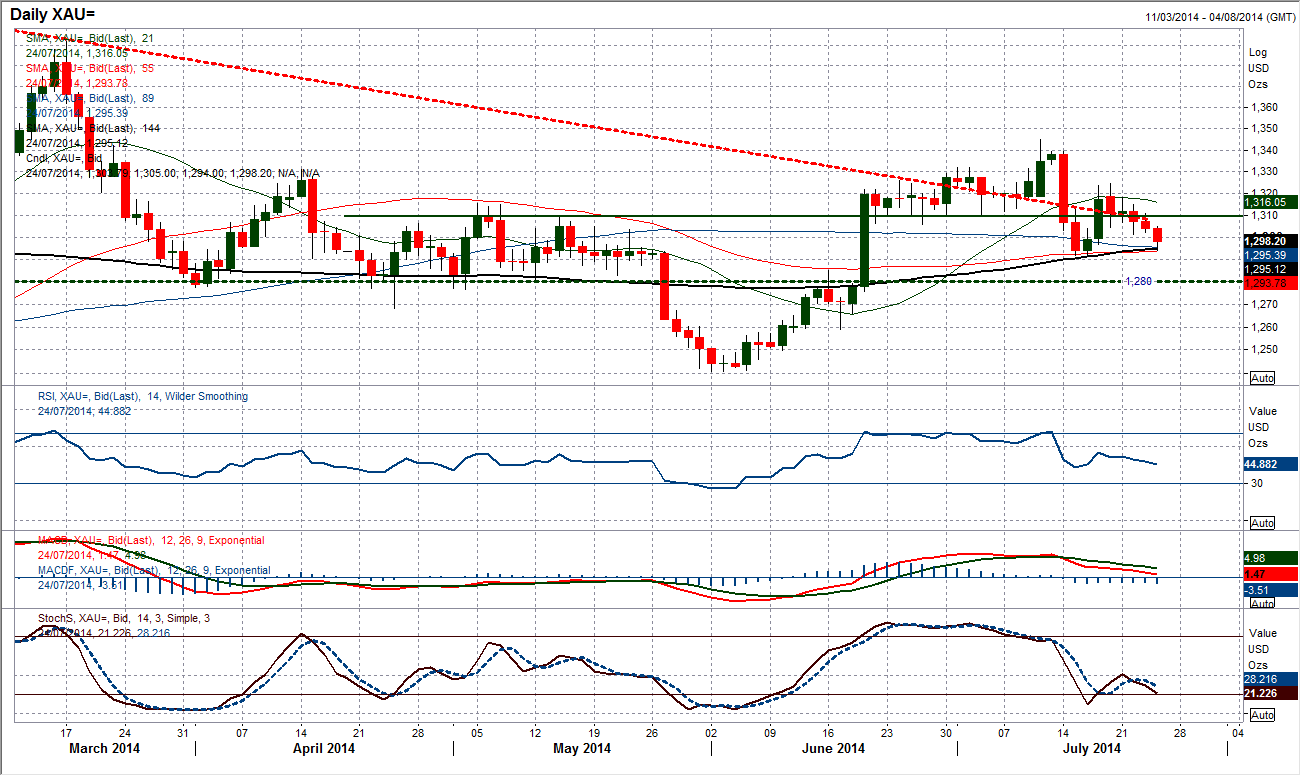

Gold

With geopolitical driving events calming down in Ukraine the “war premium” is being edged out of gold once more. This is resulting in a slide in the price. A near term floor that had formed around $1305 was breached yesterday and the price is back below $1300. This now means that the key test of the 144 day moving average is underway now around $1295, (interestingly there is a convergence here with the 55 and 89 day moving averages too which should add to support). The 144 day moving average which has been an excellent gauge for gold has already been tested in the early hours this morning, but remains under threat. The key near term support is at $1291.70 (15th July low) and the bulls will be looking for this to hold. A breach would not be disastrous as there is still the pivot support at $1280, but a breach of that would begin to question the improving medium term outlook.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.