Technical Bias: Bearish

Key Takeaways

- Euro was following a nice bullish trend until sellers stepped in to clear an important support.

- Canadian Consumer Price Index (CPI) will be released by the Statistics Canada today, which is expected to post an increase of 1% in February 2015, compared to February 2014.

- EURCAD has a major resistance on the upside around 1.3600-20 where sellers might take control.

Canadian CPI will be released today, which might ignite a lot of moves in the Canadian dollar pairs in the short term.

Technical Analysis

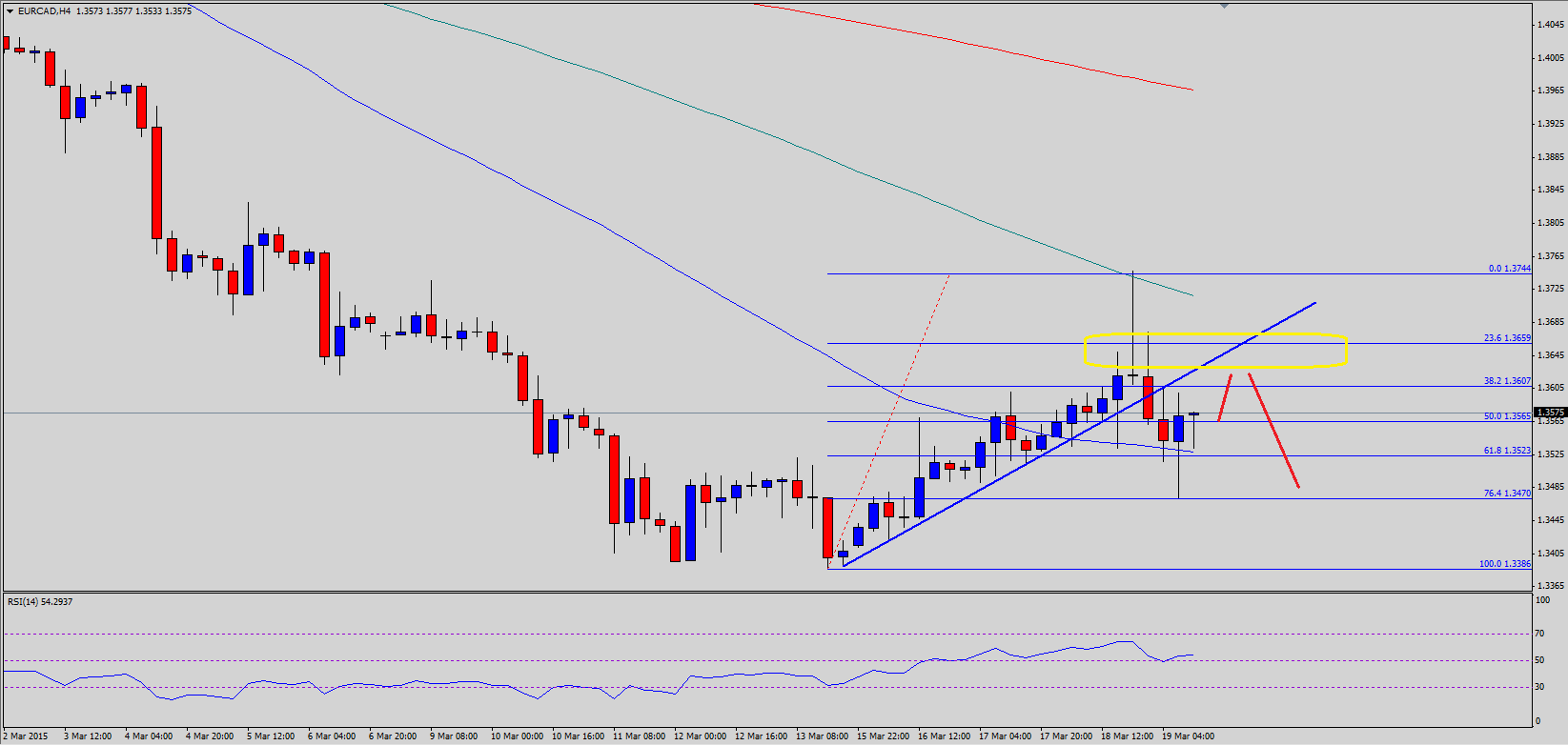

The Euro traded higher this week against the Canadian dollar until the EURCAD pair found a major resistance around the 100 simple moving average (SMA) – 4H. There was a bullish trend line formed on the 4 hour chart as well, which was breached by sellers. The downside reaction was very sharp, but the EURCAD pair managed to find support around the 76.4% fib retracement level of the last leg from the 1.3386 low to 1.3744 high. The pair is currently moving back higher, but there is a major hurdle formed around the 1.3600-20 area, which can be considered as a pivot area for the pair. The most crucial resistance is around 100 SMA (4H) where the Euro buyers might struggle one more time.

If the EURCAD fails to move higher, then it might head back towards the recent low of 1.3470. Any further losses might take the pair towards 1.3400.

We need to monitor movements in the 4H RSI, as a break below 50 could ignite bearish pressure.

Canadian CPI

Later during the NY session, Consumer Price Index (CPI) will be released by the Statistics Canada. The forecast is slated for an increase of 1% in February 2015, compared to February 2014.

Trade Idea

One might consider selling rallies in the EURCAD pair around 1.3620 as long as the pair stays below the 100 SMA (4H).

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.