Technical Bias: Bearish

Key Takeaways

US dollar traded lower recently against a basket of currencies, including the Euro, British pound and Canadian dollar.

US dollar index is around a major level signaling bearish continuation in the short term.

US durable goods orders report is a critical release lined up later today having a potential to ignite swing moves in the US dollar.

Recent failure to break the 88.40-50 area in the US dollar index ignited downside reaction which might continue if the US dollar sellers remain active.

Technical Analysis

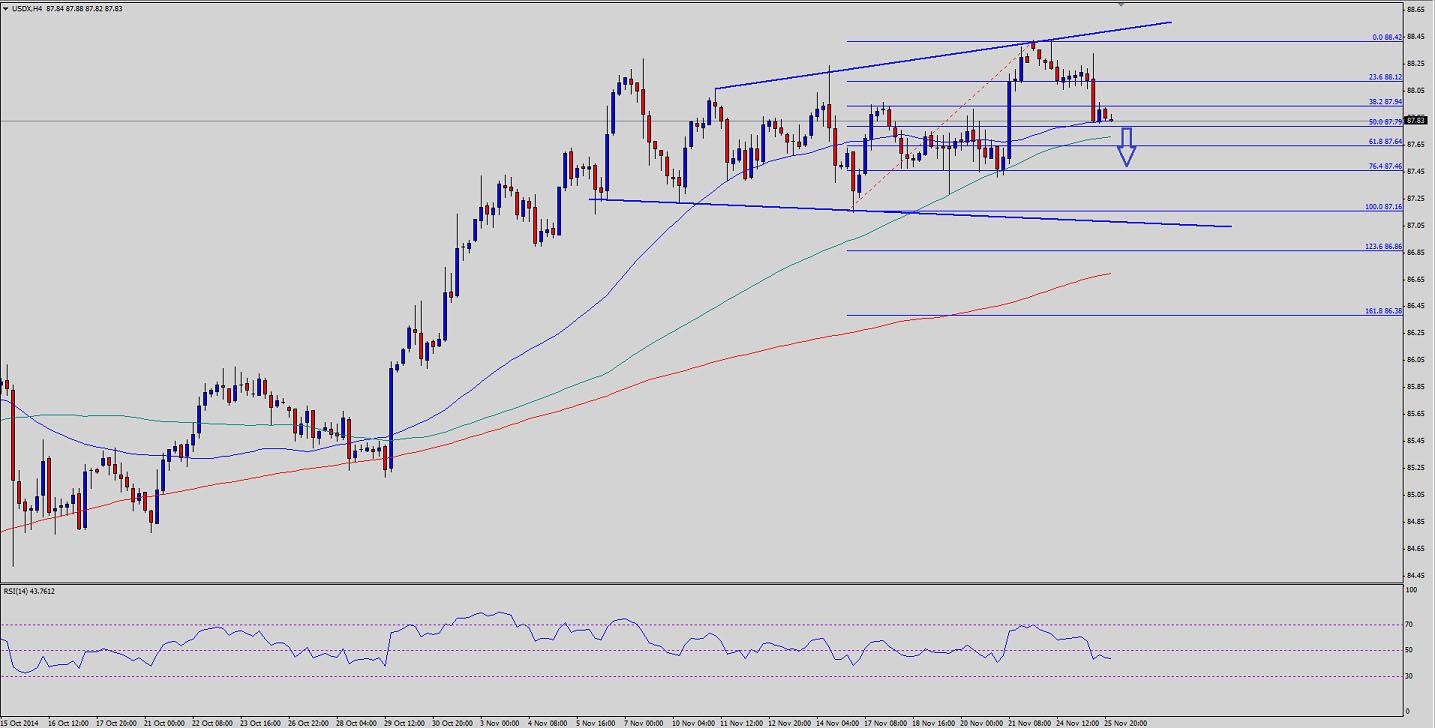

There is a monster triangle formed on the 4 hour chart of the US dollar index, which recently acted as a resistance at 88.50. After a failure to break above the triangle resistance the US dollar index moved mover and yesterday challenged the 50% Fibonacci retracement level of the last leg from the 87.16 low to 88.42 high. One key point to note here is that the mentioned fib level was sitting around the 50 simple moving average (SMA) – 4H, which also acted as a support in the near term. However, the most important support is seen around the 61.8% fib level, which is around the 100 SMA (4H). A break below the same might take the US dollar index towards the triangle support trend line where the US dollar buyers could be tested.

On the upside, a critical resistance is around the 88.10 level. Any further strength might take the US dollar index towards the triangle resistance area where it might struggle again. We need to see how it behaves during the coming sessions.

US Durable Goods Orders Data

Later during the New York session, the US durable goods orders report will be released by the US Census Bureau. The forecast is of a minor decline in October 2014, compared with the preceding month. If the outcome misses the forecast and registers more than the expected decline, then the US dollar might come under pressure in the near term.

Recommended Content

Editors’ Picks

The Fed leaves rates unchanged, as expected. Focus now shifts to Powell’s press conference – LIVE

As largely anticipated by market participants, and in an unanimous vote, the US Federal Reserve maintained its policy rates unchanged at its event on Wednesday. The Fed announced a reduction in the balance sheet runoff pace and highlighted lack of progress in inflation.

EUR/USD climbs to daily highs on steady FOMC

The selling bias in the Greenback remained unchanged after the Federal Reserve left its interest rates unchanged on Wednesday, sending EUR/USD to daily highs near the 1.0700 barrier.

GBP/USD regains its smile after the Fed leaves rates unchanged

The resumption of the upward pressure lifts GBP/USD back above 1.2500 the figure, partially trimming Tuesday’s strong retracement and bouncing off earlier lows near 1.2470.

Gold accelerates its gains on unchanged rates by the Fed

The precious metal maintains its constructive stance near the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.