Technical Bias: Bullish

Key Takeaways

Euro surged higher against the Australian dollar and broke an important resistance area.

Any correction from the current levels might be considered as a buying opportunity.

EURAUD support seen at 1.4100 and resistance ahead at 1.4300.

The Euro managed to gain traction against the Australian dollar, as the latter one got weakened against almost all major currencies. Moving ahead, more gains are likely in EURAUD.

Technical Analysis

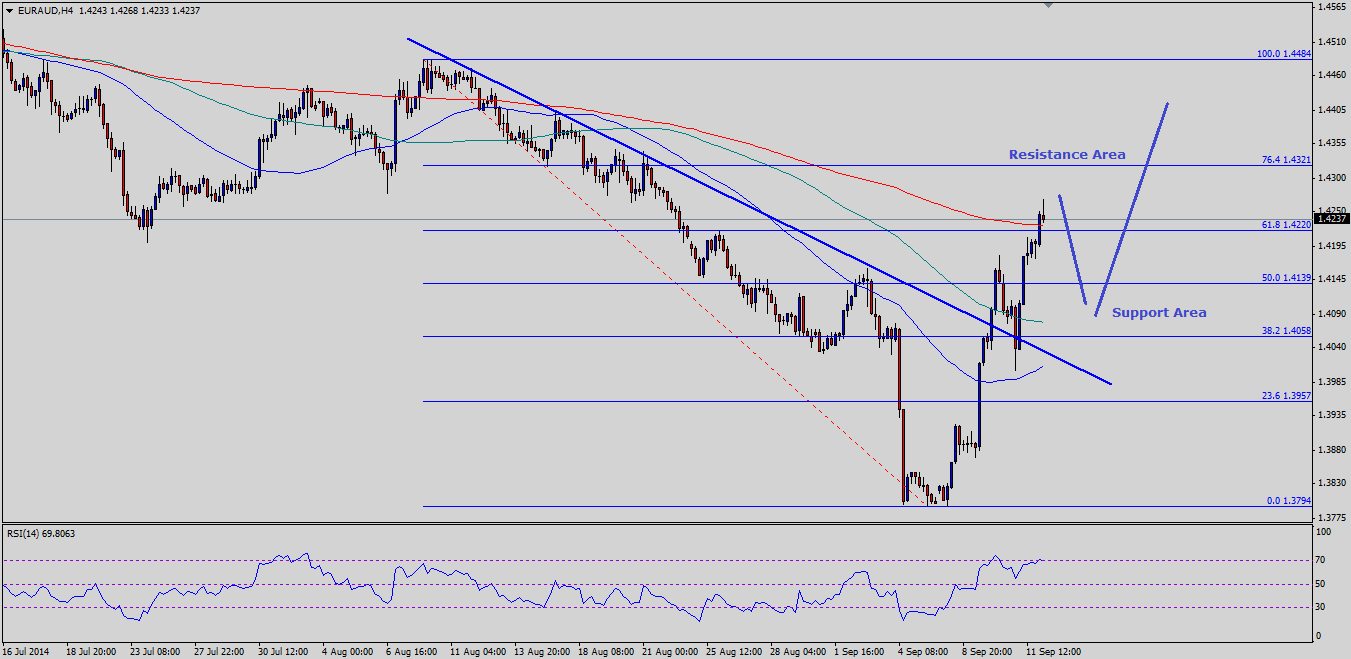

There was a major trend line on the 4 hour timeframe for the EURAUD pair, which was broken earlier during this week. This particular break can be considered as significant, as it opened the doors for further upside acceleration towards the last swing high. Currently, the pair is trading above the 61.8% Fibonacci retracement level of the last drop from the 1.4484 high to 1.3794 low. However, the pair is struggling to close above the 200 simple moving average (SMA) – 4H. So, there is a chance that the pair might move a bit lower from the current levels. On the downside, the broken trend line area might provide support in the near term. The most important point to note here is that the 100 SMA (4H) also sits around the same area. So, there is a major support around the 1.4100-1.4080 area. Any further downside should be limited unless the Euro starts moving lower.

The 4H RSI is around the extreme levels, which means a correction might be on the cards. On the upside, the 76.4% fib level might act as a resistance around the 1.4300-1.4320 levels.

Euro Zone Industrial Production

Later during the London session, the Euro zone industrial production data will be released by the Eurostat. If the outcome surpasses the expectation of a 0.5% gain, then the Euro might climb further in the near term.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.