Technical Bias: Bearish (Short-term)

Key Takeaways

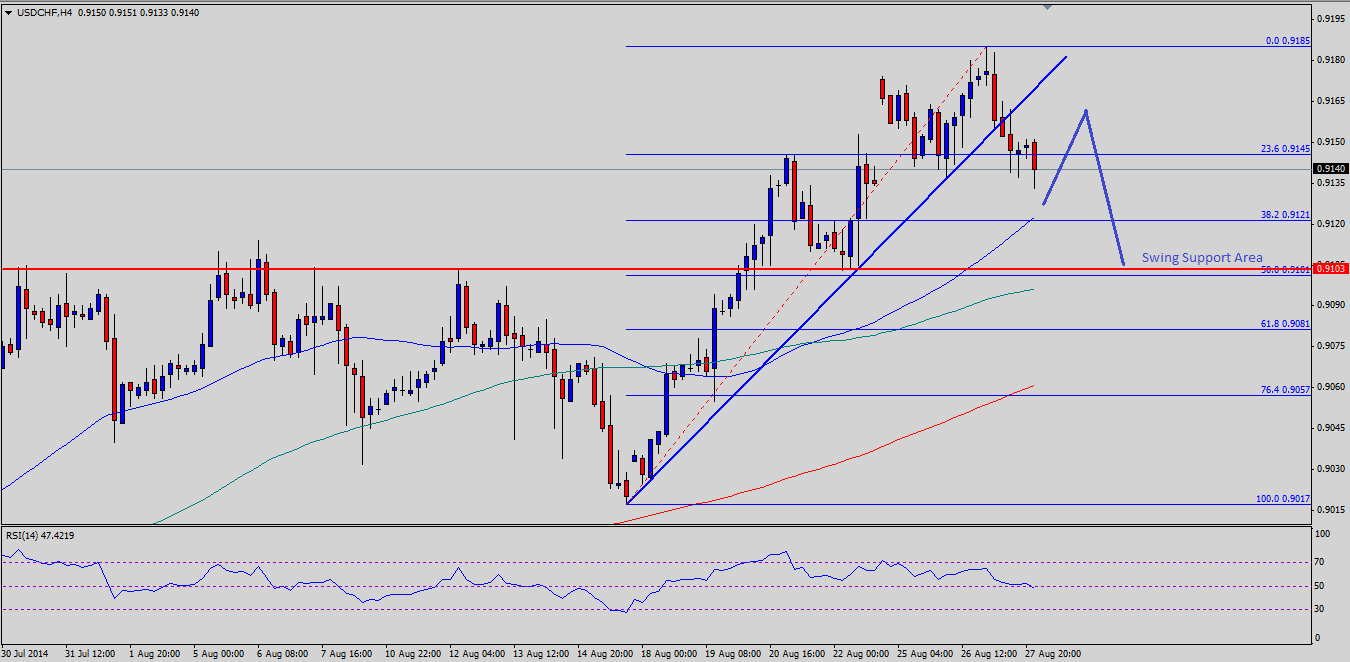

- US dollar traded lower against the Swiss franc yesterday and broke an important support area.

- If buyers step aside, then a short-term correction is possible.

- USDCHF support seen at 0.9105 and resistance ahead at 0.9170.

The US dollar resiliency against the Swiss franc was jolted yesterday, when there were signs of sellers emerged during the New York session.

Technical Analysis

There was a major bullish trend line on the 4 hour timeframe for the USDCHF pair, which was broken during the NY session yesterday. This break might provide a reason to the US dollar sellers in the short term to ignite a larger correction. Currently, the pair has managed to close below the 23.6% Fibonacci retracement level of the last leg higher from the 0.9017 low to 0.9185 high, and heading towards the 50 simple moving average (SMA) - 4H, which also coincides with the 38.2% fib level. So, there is a chance that the pair might bounce from the current or a bit lower levels, but could find resistance around the broken trend line area. If the pair fails to break higher, then a move towards the 50% fib retracement level is possible, which is just above the 100 SMA (4H) at 0.9105. The mentioned level acted as a resistance earlier, and is likely to provide support to the pair in the short term.

On the other hand, if the USDCHF pair continues higher, then a break above the 0.9170 level might call for a retest of the recent high at 0.9185. Any further gains could push the pair towards the 0.9200 resistance zone. The 4H RSI is flirting with the 50 level, and if it breaks down, then it would open the doors for bears to control in the near term.

Moving Ahead

Overall, buying dips still remains a good option in the short term as long as the pair is trading above the 0.9100 level.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.