Technical Bias: Bullish

Key Takeaways

- Australian dollar failed once again to break the 0.9460-80 resistance area against the US dollar.

- Market sentiment remains in favor of the Australian dollar.

- AUDUSD support seen at 0.9400 and resistance ahead at 0.9460.

The US dollar managed to recover the lost ground against the Australian dollar after the US initial jobless claims data release, which posted an impressive decline of 19K.

Technical Analysis

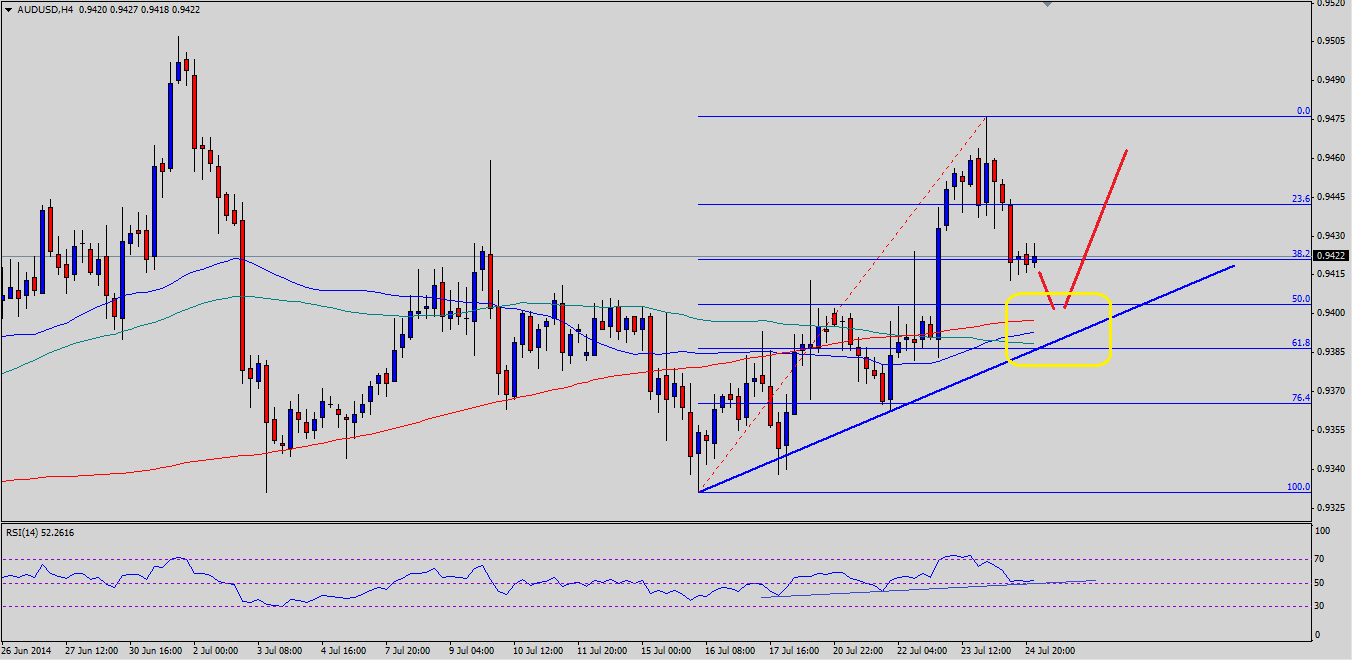

The AUDUSD pair traded as high as 0.9476 recently, but failed to gain momentum above the mentioned level. The pair is under correction at present, and it looks like that it might fall towards the 0.9400 level. There is a lot of support on the way down for the pair. First in the line is the 50% Fibonacci retracement level of the last move higher from the 0.9331 low to 0.9476 high. However, the most important support area can be seen around a critical confluence zone of all three key simple moving averages (200, 100 and 50) on the 4 hour timeframe. The mentioned confluence area is just above the 61.8% fib level. So, the 0.9400 level might act as a strong support for the AUDUSD pair moving ahead. The mentioned level has acted as a pivot zone earlier, so buyers could easily take charge around the 0.9400 support area.

If in case the AUDUSD pair breaks the bullish trend line highlighted in the chart, then the chance of a run towards the previous swing low of 0.9331 might increase. Overall, as long as the pair is trading above the 0.9400 support level, then it could retest the 0.9460 level.

US Durable Goods Orders

The US Durable Goods Orders data will be released later during the NY session by the Census Bureau. The forecast is slated for a 0.5% rise, compared to the previous 1% decline. If outcome comes in line with the expectation, then the US dollar might gain bids in the short term.

Recommended Content

Editors’ Picks

EUR/USD remains on the defensive near 1.0680 on Dollar strength

The solid performance of the Greenback keeps the price action in the risk-associated universe depressed so far on turnaround Tuesday, sending EUR/USD to multi-day lows in the 1.0680 region.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.