Market Sentiment – Neutral

Key Takeaways

US dollar hits weekly high vs Swiss Franc

US Existing Home sales remain flat in March

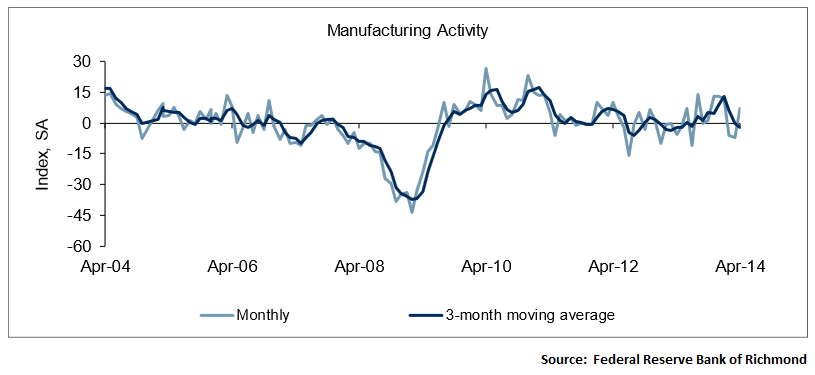

Richmond Manufacturing index climbs to 7

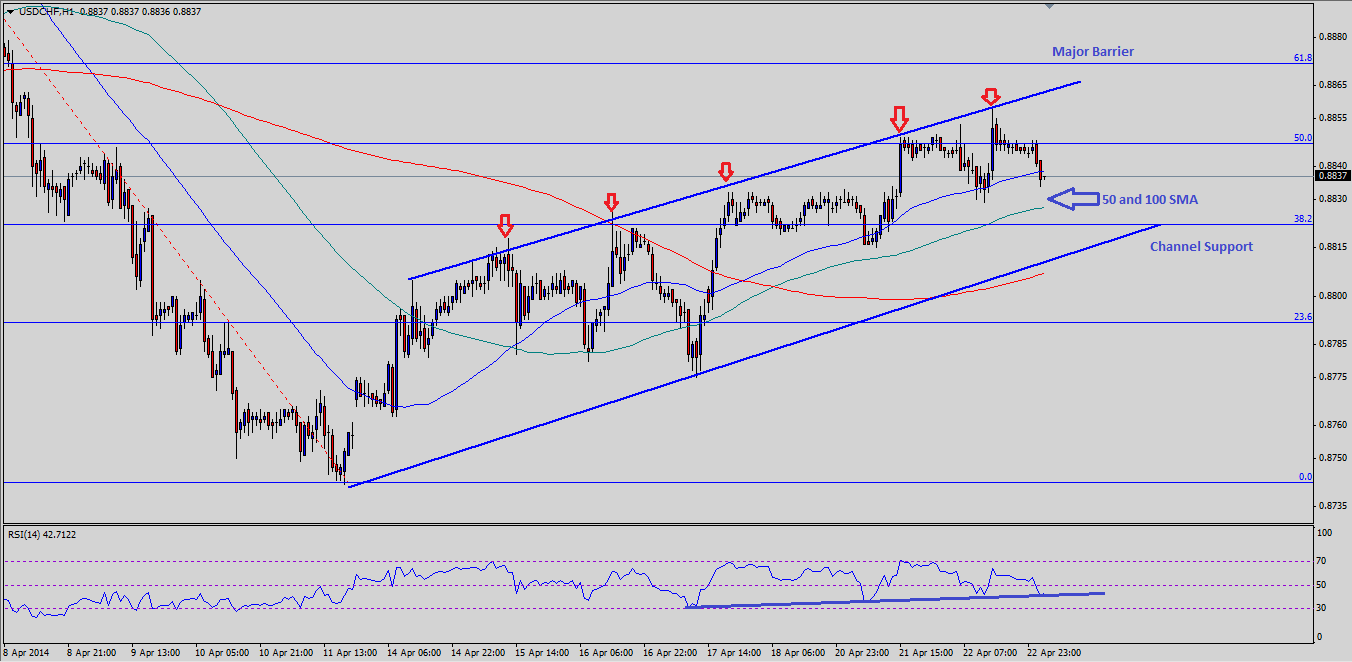

The dollar edged higher versus the Swiss Franc after the US Existing home sales and Richmond’s manufacturing index were released during yesterday’s New York session. The dollar rose to its highest level in nearly seven days against the Swiss franc, as the market sentiment got a lift post economic releases.

USDCHF upside pressures remain intact. Some traders, however, played down the possibility of USDCHF trading higher, and suggested that the rally from April 11, 2014 low was only corrective.

US Existing Home Sales and Richmond Manufacturing index

Yesterday, the US Existing Home Sales and Richmond’s manufacturing index were published by the National Association of Realtors and Federal Reserve Bank of Richmond respectively. The existing home sales remained flat in March, and slipped 0.2 percent to a seasonally adjusted annual rate of 4.59 million in March from 4.60 million in February. The highlight was the Richmond Manufacturing Index, which climbed to 7 from -7, beating the expectations of 0. Employment rose, while wages advanced at a slower rate, according to the report.

Technical Analysis

USDCHF has managed to form a solid bullish channel on the hourly timeframe. The pair failed to take out the channel resistance a number of times, but the positive is that the sellers have failed to match the number of attempts on the downside. Despite mixed economic data, USDCHF managed to trade higher and registered a new weekly high at 0.8858, and found resistance in the form of channel trendline. A break higher might take the pair towards the 61.8% Fibonacci retracement level of the last major drop.

There is a major trendline noted on the RSI, which might act as a catalyst for the pair. However, as long as the pair is tracking the channel more upside cannot be denied.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.