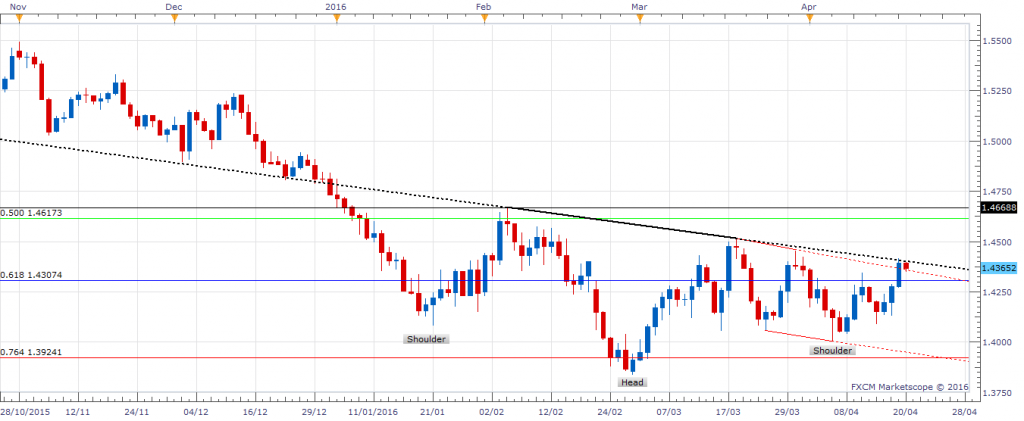

GBP/USD breached falling channel seen on the daily chart in the NY session yesterday and tested supply around the inverse head and shoulder neckline hurdle. Prices clocked a high of 1.4419 before bullish move ran out of steam. The bird is losing height in early Europe today; now trading around 1.4350 levels.

Points to be noted heading into data release

GBP bulls have been buoyed by latest Brexit polls showing ‘remain’ vote gaining an edge over ‘exit’ vote. UK TNS EU poll released today showed 38% in favor of ‘remain’, 34% in favor of ‘leave’. 28% still stand undecided.

However, oil prices are losing ground today and that is hurting risk sentiment, courtesy of which Cable dropped to 1.4350 levels.

UK data due today is likely to show –

Jobless Claims dropped for Fifth Consecutive Month in March

Average weekly earnings including bonus to rise 2.3% 3M/y/y in Feb from Mar’s 2.1%

Average weekly earnings excluding bonus to rise 2.1% 3M/y/y in Feb from Mar’s 2.2%

An uptick in the average weekly earnings including bonus may have been priced-in during Tuesday’s uptrend. Hence, it would take a better-than-expected earnings figure for markets to consider buying Sterling amid oil price drop.

Moreover, a strong wage growth and labor market figure against backdrop of Brexit polls showing “remain” vote in lead means a less reason for BOE to telegraph a delay in the rate hike. This could help Cable cut through offers around inverse head and shoulder neckline level of 1.4402.

On the other hand, a weaker-than-expected wage growth and labor market data could add credence to the technical failure at neckline level of 1.4402 seen in Asia today and may open doors for a drop to 1.43-1.4250 levels.

GBP/USD: Daily Chart

Pattern – Inverse Head and Shoulder

Resistance – 1.4368, 1.4402-1.4418, 1.4436-1.4459

Support – 1.4354, 1.43, 1.4255-1.4252

GBP’s rebound from 1.4354 (23.6% of 1.3835-1.4514) could result in another re-test of inverse head and shoulder neckline level of 1.4402.

When viewed against the backdrop of bullish break from falling channel seen yesterday coupled with bullish move in RSI, the pair appears more likely to chew through offers around 1.4402-1.4418 and make a move to 1.4459 levels, beyond which a stiff resistance is seen at 1.45-1.4514 levels.

Conversely, a dismal data may trigger a drop towards 1.43 handle, under which 1.4252 (50% of 1.4669-1.3835) stands exposed. However, bears need to observe caution as fresh demand could be anticipated on dips as long as 50-DMA at 1.4227 remains a support level.

We are not authorised by the Financial Conduct Authority of England and Wales. The information and/or data on this website is provided by us and any data providers which may be used by us for your general information and use only and is not intended for trading purposes or to address your particular financial or other requirements. In particular, the information and/or data on the website:

(1) does not constitute any form of advice (financial, investment, tax, medical, legal, spread -betting or otherwise); and (2) does not constitute any inducement, invitation or recommendation relating to any of the products listed or referred to; and (3) is not intended to be relied upon by you in making (or refraining to make) any specific investment, placing any bet or making any other decision; and (4) has not been issued or approved by Tip TV for the purposes of section 21 of the Financial Services and Markets Act 2000 (as amended from time to time).

Opinions expressed by speakers in the videos, writers of the blogs are only opinions and not expert advice. These opinions do not necessarily agree with those held by Tip TV, its directors, agents or employees who disclaim any intent to make betting, securities or securities markets recommendations. The value of investments and the income derived from them may fall as well as rise. APPROPRIATE EXPERT INDEPENDENT ADVICE SHOULD BE OBTAINED BEFORE MAKING ANY INVESTMENT, PLACING ANY BET OR MAKING ANY OTHER DECISIONS.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.