UP NEXT:

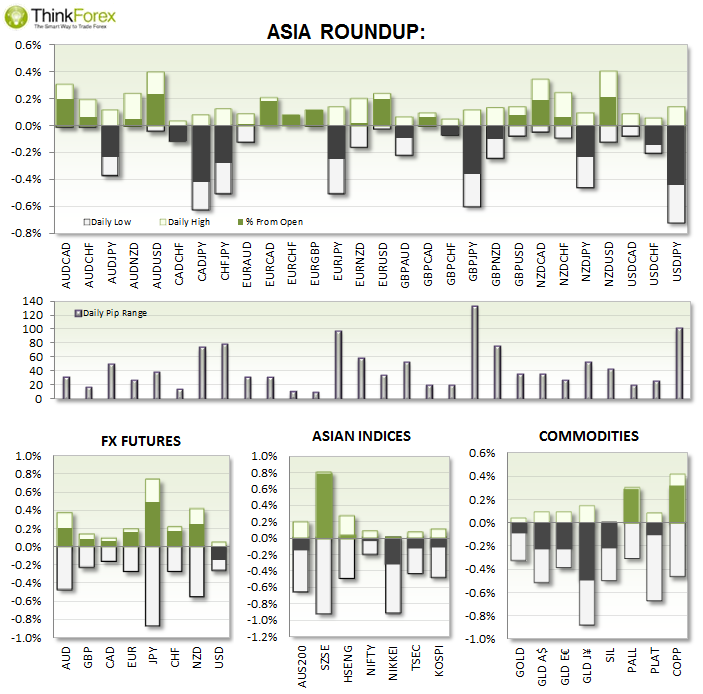

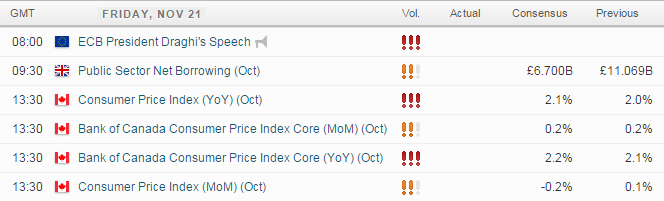

It is over to Europe and Canada tonight to provide the markets action. With Draghi speaking and and Canada providing inflation data then Euro and Canadian Crosses could be the place to look for movements.

TECHNICAL ANALYSIS:

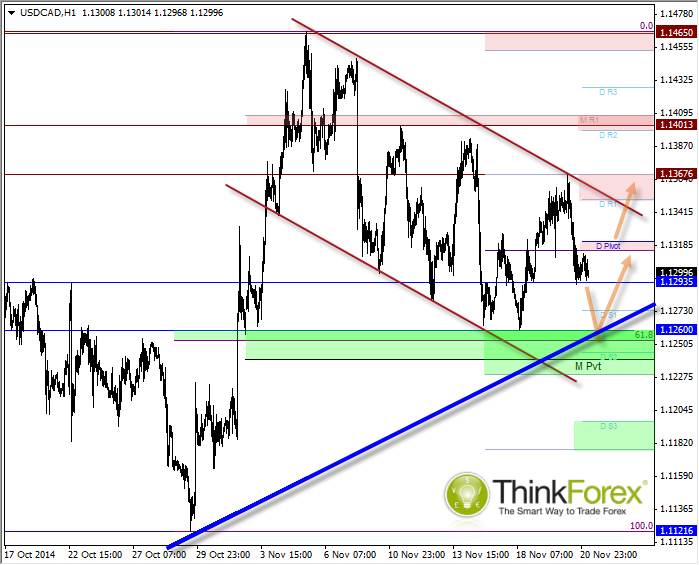

USDCAD: Should hold above 1.126

Annoyingly, after covering this pair many times of the past week or so, I suspect we will remain within range going over to the weekend. However I suspect we'll see another leg down towards the 1.260 support zone before we see the trend resume.

As there are so many levels of support around here (including a bullish trendline) I suspect it will hold. If however it does break to the downside then we could see a rapid move down to the 1.118 area and perhaps even 1.45. But due to the weekend looming I would prefer to stick to the bullish setups above 1.126 and recalibrate on Monday.

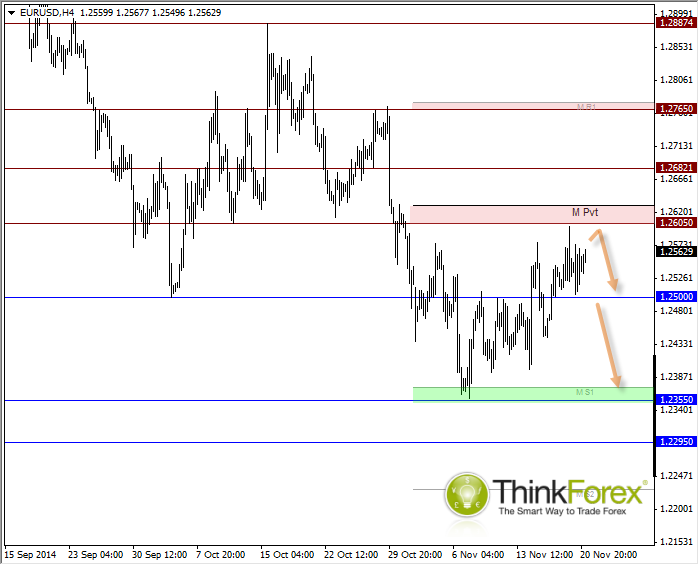

EURUSD: STILL near that resistance level...

No need to elaborate here as I have covered this previously. I just need Draghi to talk it down and all is well (if you are short).

So if you are short already just let the market do its thing. If you have not yet jumped in then you can either set a sell-limit to catch any upwards spikes (which we can expect spikes when Draghi is concerned) and hope for an eventual down leg.

Alternatively enter short at market if a bearish move unfolds or set a sell-stop.

Only above 1.60 would gin my interest in bullish setups.

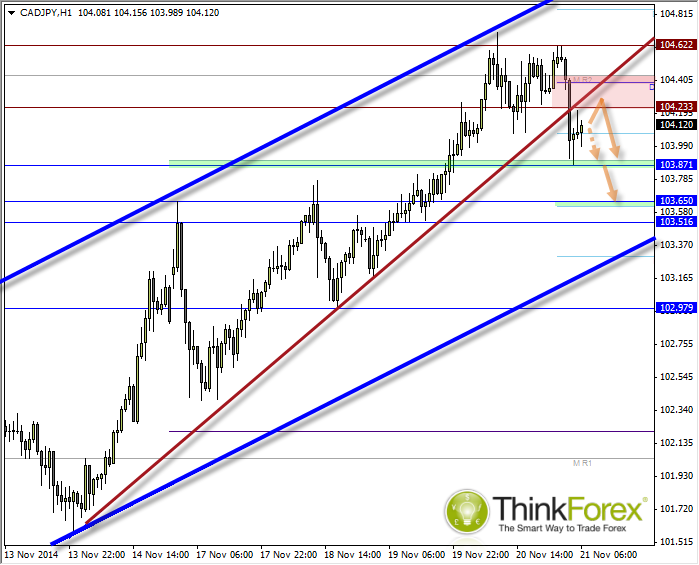

CADJPY: Crazy - but it may just work...

Yes that's right - I am considering bucking the trend near the highs against the Yen. However taking into account we had a slight verbal intervention from Japan's Ministry of Finance before which was followed by a knee-jerk reaction (and Europe and US are yet to react) there is an argument for another leg lower.

Combine this with the potential for strong inflation from Canada then all of a sudden it is a feasible plan to sell into resistance levels.

We remain within a bullish channel (blue) but broken a trendline which can now be used as resistance if we see any retracements towards it.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.