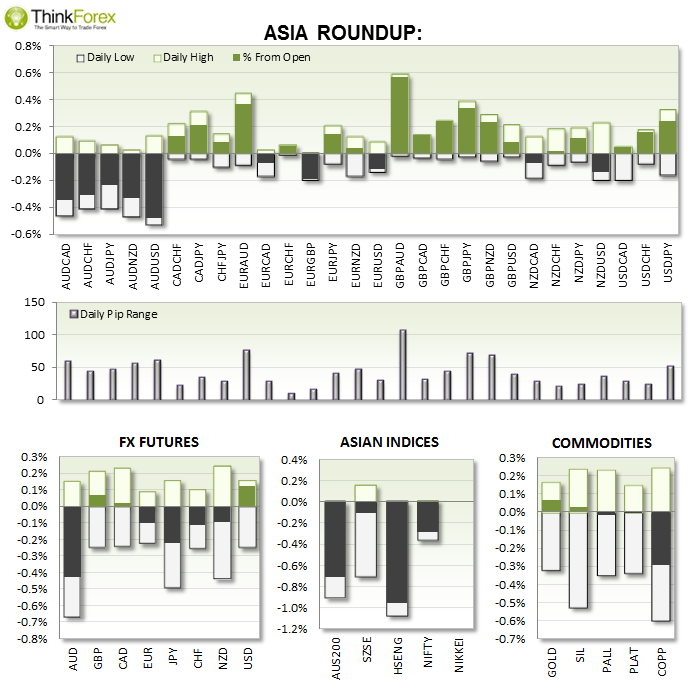

Australian Dollar and Asian Equities took the biggest hit. With Equities down in Asia and followed the theme from US yesterday there is enhance we'll see a continuation of this at European open. If stocks are dropping this tends out outline a risk-off environment, so could favour USD, CHF, JPY. Gold is also looking a little overstretched, but keep in mind that USD strength is keeping it from rising from current lows.

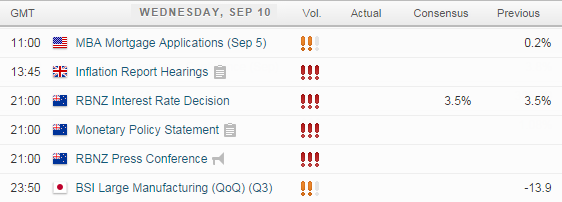

UP NEXT:

USD: Fairly light on news today from US but 'nice to know' info such as JOLTS job openings and Mortgage Approvals will be monitored by the FED. Any high numbers here may also help with FOMC staff projections which will be the headline figures next week.

GBP: Inflation report hearings are likely to be muted affair due to the uncertainty of Scottish referendum. If Scotland votes 'yes' next week then BoE are very likely to be forced to keep interest rates on hold for longer which would continue to weigh down on GBP crosses. Therefor regardless of how strong inflation data may be tonight it may not have the usual bullish effect on GBP crosses. However if this falls inflation looks pressured then this could bring further downside on GBP crosses.

NZD: Early Asia tomorrow will be kicked off with RBNZ rate decision. View today's post for further info.

TECHNICAL ANALYSIS:

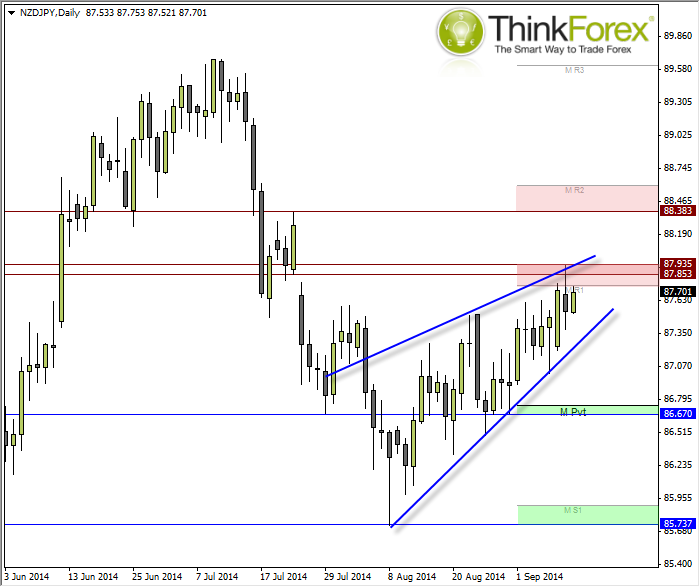

NZDJPY: One for Early Asia

BIAS: A Dovish Wheeler tomorrow should help yesterday's high cap as resistance and confirm the bearish wedge.

COUNTER-BIAS: A break above yesterday's high invalidates the bearish wedge and would suggest a bullish channel to target 88.40

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD: Further losses retarget the 200-day SMA

Further gains in the greenback and a bearish performance of the commodity complex bolstered the continuation of the selling pressure in AUD/USD, which this time revisited three-day lows near 0.6560.

EUR/USD: Further weakness remains on the cards

EUR/USD added to Tuesday’s pullback and retested the 1.0730 region on the back of the persistent recovery in the Greenback, always against the backdrop of the resurgence of the Fed-ECB monetary policy divergence.

Gold flirts with $2,320 as USD demand losses steam

Gold struggles to make a decisive move in either direction and moves sideways in a narrow channel above $2,300. The benchmark 10-year US Treasury bond yield clings to modest gains near 4.5% and limits XAU/USD's upside.

Bitcoin price dips to $61K range, encourages buying spree among BTC fish, dolphins and sharks

Bitcoin (BTC) price is chopping downwards on the one-day time frame, while the outlook seen in the one-week period is a horizontal trade. In this shakeout moment, data shows that large holders are using the correction to buy up BTC.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.