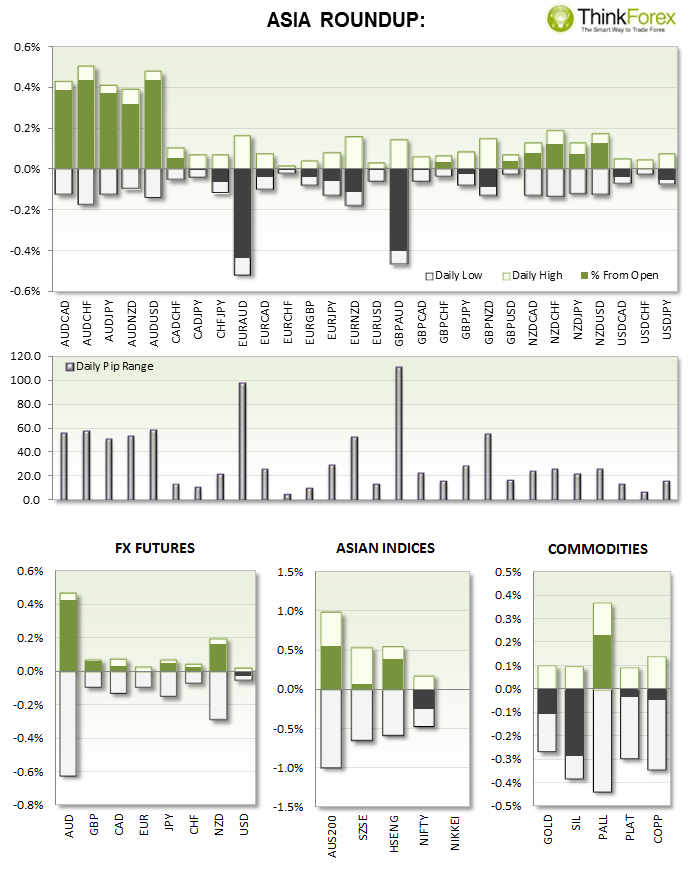

The Australian Dollar stole the show due to inflation figures hitting target, and probably eradicating any fears of a rate cut this year. Had ot not been for the Australian data then the session would have been quiet across the board for FX.

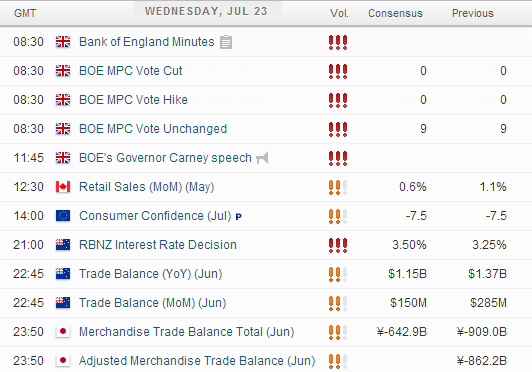

UP NEXT:

BoE MPC Votes: Traders will be looking to see if the last rate decision (to keep on hold) was unanimous, as it has been previously, or if some voting members are beginning to vote for a rate increase. If so we can expect this to be a bullish sign of cable which currently rests above key support.

CAD Retail Sales: Expected to be growing at a slightly slower rate of 0.6%. Anything at or above this level could see USDCAD retrace towards (and possibly below) 1.07 support. However any poor numbers here should be USDCAD bearish and see USDCAD trade closer to 1.080 resistance.

RBNZ Rate Decision: Please view today's post for an overview of this release

TECHNICAL ANALYSIS:

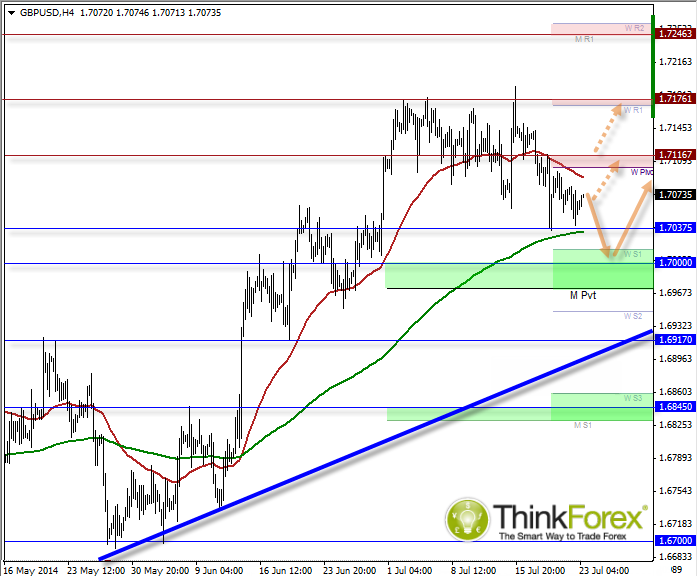

GBPUSD: The voting members should dictate Sterling moves today

The key levels have remained fairly consistent these past few weeks but the daily timeframe is making suggestions of a potential base forming (not pictured). Yesterday closed with a 2nd bullish hammer above 1.704 support to suggest a swing low is forming.

However I am also keeping in the back of my mind for a retest of 1.07 before gains continue. That said for a bullish move we would require some of the voting members to have switched from neutral to 'rate hike'. We can only assume that if they remain unanimous (neutral) then a retest of 1.07 is more likely.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.