ASIA ROUNDUP:

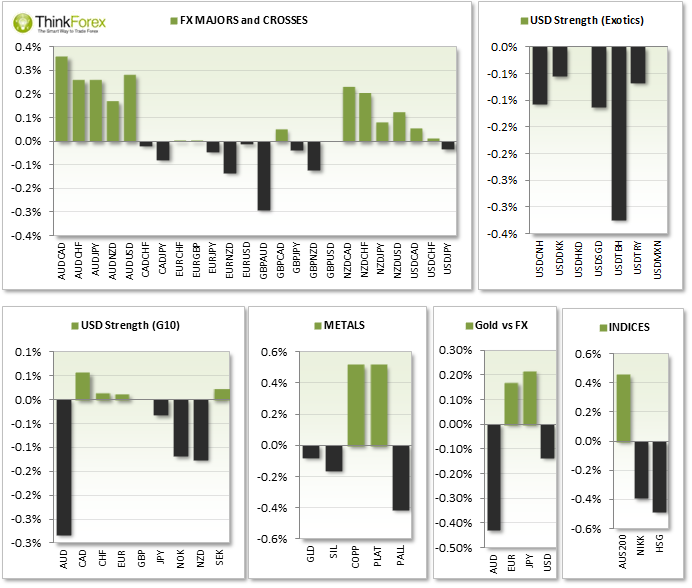

The A$ benefited the most today following today's positive 'Leading Index' release, coming in at 0.3% and the 6th consecutive positive reading.

AUDJPY saw an intraday 8-day high and broke above a descending resistance line.

AUDNZD remains near the 11-week highs and within yesterday's daily range

AUS200 Cash is set to close higher for the 4th consecutive session

Nikkei 225 breaks below yesterday's Shooting Star Reversal candle, which respected the 61.8% retracement.

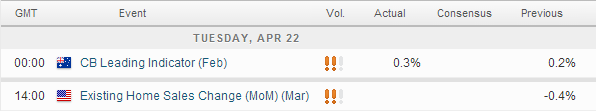

UP NEXT:

The markets are very quiet today on the news front, as Trader’s return from their 4-day weekend.

US Existing home sales has been declining for 6 months, each below expectations with a further decline expecting in today's release. Whilst it is considered a leading indicator of the economy it doesn't take into consideration sectors such as the construction industry, which would be included in the 'new homes sales'. However with not much news to go on it should at least breathe some life into some of the Majors.

TECHNICAL ANALYSIS:

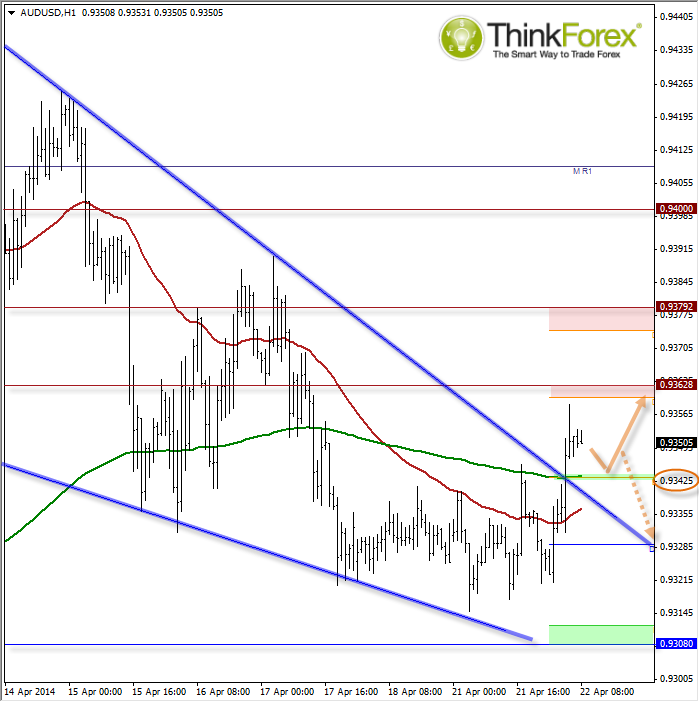

AUDUSD: Breaks out of bullish wedge

Today's bullish sentiment was driven by the positive Leading Index to indicate improving economic conditions for Australia. The intraday chart above shows how 0.9430 was a pivotal area of resistance which may now act as support to provide buying opportunities to trade in line with the bullish wedge pattern.

Scalpers may want to consider short positions as it retraces towards the potential 'buy zone' with a break below 0.9340 opening up the broken trendline as a target.

If bullish opportunities present themselves above 0.9343 then next targets are 0.936 and 0.937.

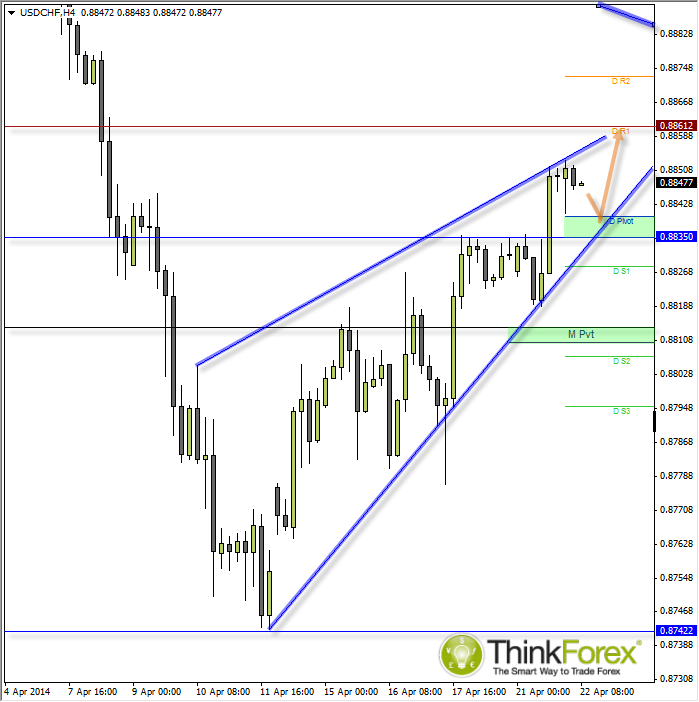

USDCHF: TPotential bearish wedge

It is labelled 'potential' simply because it has not yet been confirmed. This leaves open the potential for further highs in the meantime.

The markets may be quiet in the lead-up to news from US later so scalpers may want to consider short-positions towards the daily pivot, at which point is bullish setups present themselves then long swing trades could be considered to trade up to 0.8860

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.