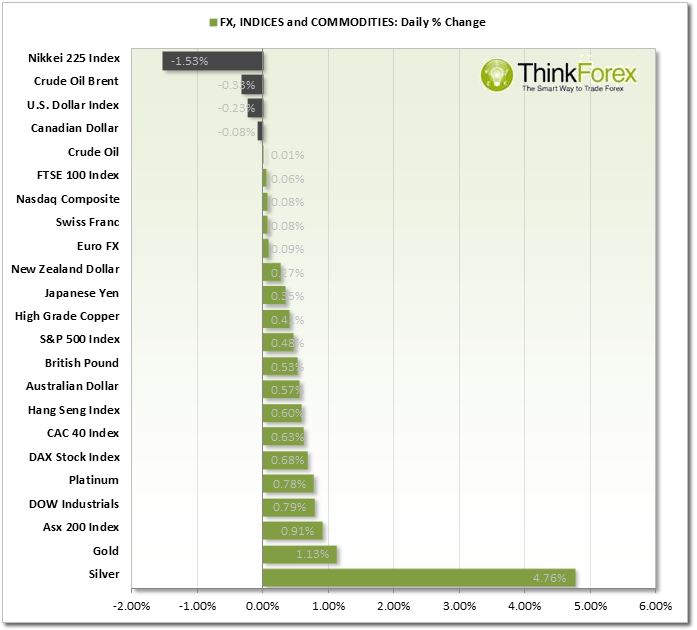

MARKET SNAPSHOT:

AUD: Today New car sales were down -3.5% versus 1.4% expected, the lowest in 6 months, to denote a lack in consumer confidence.

CAD: Manufacturing sales were down 0.9% versus 0.2% expected, is lowest level since June 2013. It is a relatively quiet week for the Canadian Dollar until Friday's Core CPI and Retail Sales.

EUR: German ZEW Economic Sentiment is due out today with a consensus of 61.3. A reading above 0 suggests increased confidence, which has been rising since Dec 2012.

JPY: GDP came in at 0.3%, much lower than the 0.7% expected.

NZD: Both Retail and Core Retail sales came in less than expected today but the market quickly shrugged these off as the Kiwi continues to appreciate against the major currencies.

USD: Bank holiday in US to celebrate Presidents' Day which may result in lower trading volume for the NYLON session and late US session.

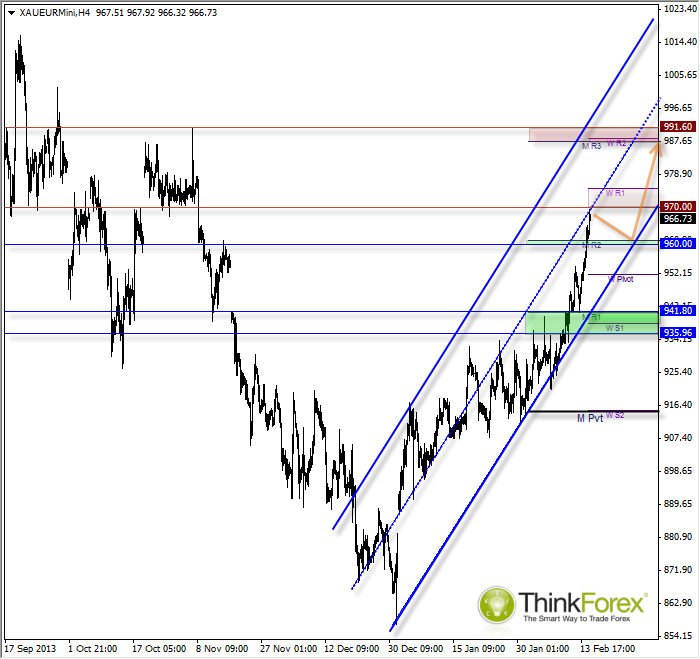

CHARTS OF THE DAY:

GOLDEUR: Above 1260 targets 988

In light of recent Gold strength and to make you aware of our new Mini-Metal contracts I thought it would be appropriate to cover the Gold/Euro chart today.

After breaking up through 942 resistance a bullish channel can be seen, which we are currently trading just beneath the midway point near 1970 resistance. Due to this my bias is for a modest pullback prior to a resumption of to the clearly bullish uptrend.

960 is a likely support area as this comprises of Monthly R2 resistance and a pivotal S/R level.

Due to the increasingly bullish momentum and weaker USD across the board my next target beyond 1270 is 988.00

Only a break back below the 1235-42 support zone puts us back into bearish territory on the daily timeframe.

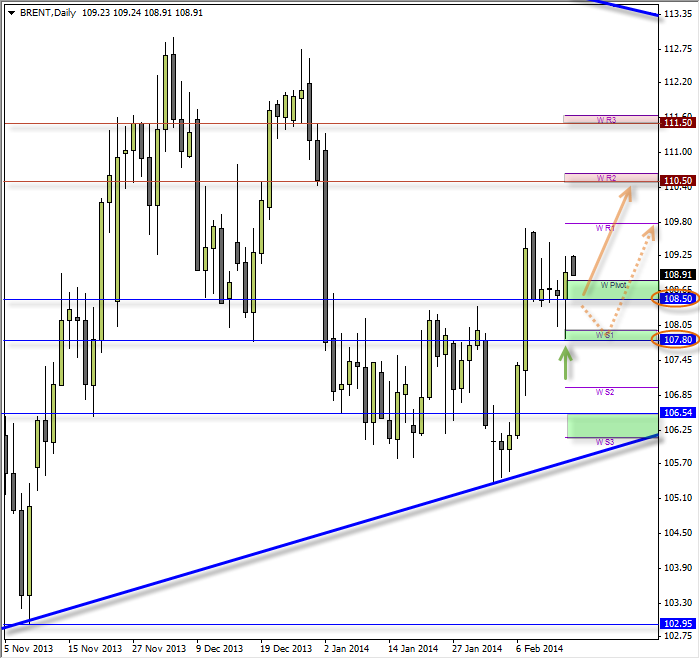

BRENT: Bullish Pinbar suggests bullish flag breakout

Friday tested but failed to break 107.80 support and closed the day with a bullish pinbar. Seeing as the original bias was for a bullish flag to be forming this provides further clues towards a pending bullish breakout and for a run up to 110.50 / 111.50.

In the event we break beneath Friday's low of 107.80 then next likely support is around 106.50. However keep in mind this is the lower trendline of a larger triangle which may provide good support. However should this break to the downside then we can expect a more significant move to 103 and 100. However due to the USD weakness across the board this is a less likely scenario, so favour the run up to 110.50.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.