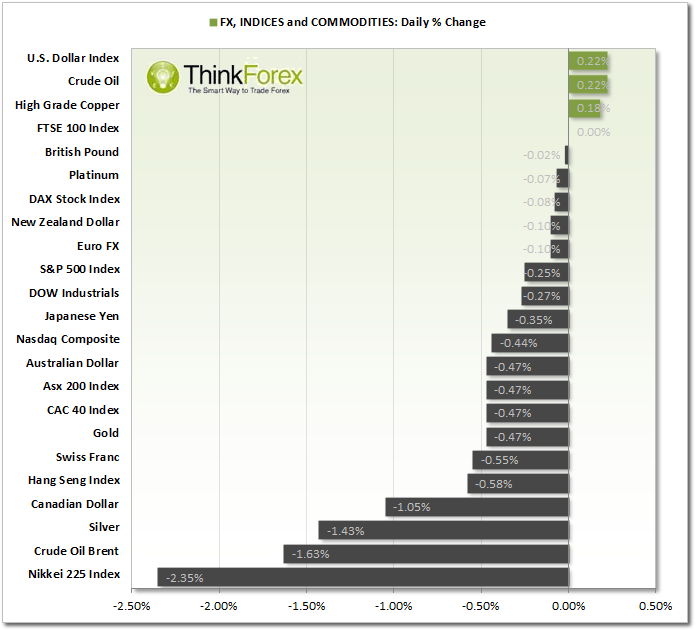

Market Snapshot:

US economic growth was given an extra boost as the trade deficit gave its lowest reading in 4 years, driven by America's domestic energy revolution. As a result Morgan Stanley has raised its Q4 growth to 3.3% and JPM claim this is more in line with 3% as opposed to 2.5% as previously thought.

USDCAD broke out to a record high today. NZD is by far the strongest single currency this week and currently trading at record highs against CHF, CAD and JPY.

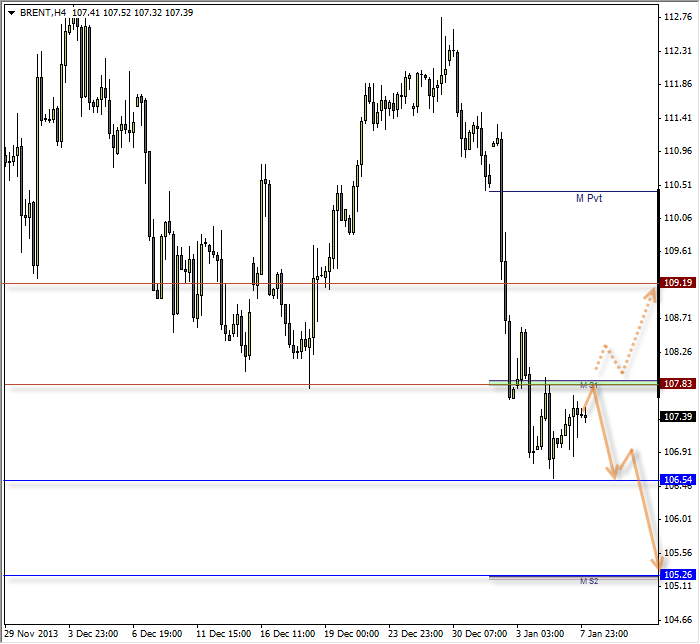

BRENT: Within bearish correction with potential down to 105.20

This trade may take a little while to play out but the bearish bias is assumed due to the speed and trajectory of the direct losses from 111.50 swing high.

We have also broken beneath the Monthly S1 pivot which has also acted as resistance along with the pivotal S/R level of 107.80. As long as 107.80 holds as resistance then next target is the lower area of 106.50 with a suspected breakout down to 105.30.

In the event we break above 107.80 then the preference is to wait for a pullback to this area and seek bullish positions with a possible target around 109.00.

As Brent is traded in USD should the bearish bias play out then this would cause inflow to USD and help it appreciate in strength. Therefor it is always adviseable to keep an eye on the commodity markets even if you trade Forex exculsively.

GOLD: Potential 5-wave count projects target at 1220

Yesterday's analysis played out much better this time around. The broken trendline held and we formed a Hanging Man Reversal (bearish candle with high wick) beneath the resistance level, before reversing and hitting the initial 1228 target.

I am not one to usually use Elliot Waves as part of my day to day analysis but this potential 5-wave move down did jump out at me. Additionally the Fibonacci extension of the 3rd wave does project a potential 5th wave ending around a support level, so I decided to include it in today's analysis.

What I am not as clear on is if we have seen the end of wave 'iv'. If we have then we should see direct losses down to the 1220 area. However we may have to also consider we are still within wave 'iv' and for either a 'flat' (dotted line) or expanded flat to occur before resumption of losses.

Due to the pivotal S/R at 1233 I have excluded the possibility of the expanded flat (as this would break above this level) so my bias is for direct losses down to 1220, with the potential for a rally to 1233 before a resumption of losses.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.