The U.S. dollar traded higher against all of the major currencies today and its strength in the face of exceptionally weak retail sales numbers has many investors wondering if the currency has bottomed. The most important event risk this week was retail sales and according to the latest report, consumer spending contracted by -0.3%. Given the recent uptick in wages and improvement in the labor market, many economists (us included) anticipated an increase in spending. However to everyone's surprise consumption fell for the second time in 3 months, paving the way for a weak first quarter GDP report. In fact, we saw no increase in spending in the first 3 months of the year and it will be very difficult for the Federal Reserve to justify raising interest rates in June if we do not see retail sales rise more than 0.5% in each of the next 3 months.

When the dollar moves higher despite such an abysmal report, market participants start to wonder if the softness of the U.S. economy has been completely priced in and that the dollar's downtrend is finally over. Considering that the rest of this week's economic reports are not expected to have a dramatic impact on the dollar, we would not be surprised if the greenback continued to recover but once some shorts have been shaken out, the downtrend should resume. The improvements reported by the Fed's Beige Book is not consistent with most recent economic reports. While the market has completely ruled out tightening by the Fed this year, if each piece of incoming data continues to worsen ahead of the June monetary policy meeting, the dollar will fall as investors start thinking about rate cuts.

After consolidating above 1.13 for the past 10 trading days, euro ended the North American trading session sharply lower against the U.S. dollar and a move to 1.1260 would confirm a near term top. Weak Eurozone industrial production sparked the sell-off but it was the recovery in the dollar that drove the pair to fresh 2 week lows. If 1.1260 is cleared, the next stop for EUR/USD will be at least 1.12 and possibly even 1.1150. Eurozone consumer prices are scheduled for release tomorrow - the recent rise in German CPI points to a stronger release but the market's appetite for U.S. dollars will dictate the performance of the currency.

Meanwhile the Canadian dollar also shrugged off the Bank of Canada's optimistic monetary policy assessment. The BoC left interest rates unchanged and while they expressed some concern about the level of its currency and its impact on the non-resource sector, they also revised up their 2016 GDP forecast to 1.7% from 1.4%. This move reflects their positive outlook for the domestic economy and their belief that the output gap will close sooner than anticipated. However with oil prices pulling back, USD/CAD could not find the momentum to extend lower and now appears poised for a stronger potential recovery before another leg lower.

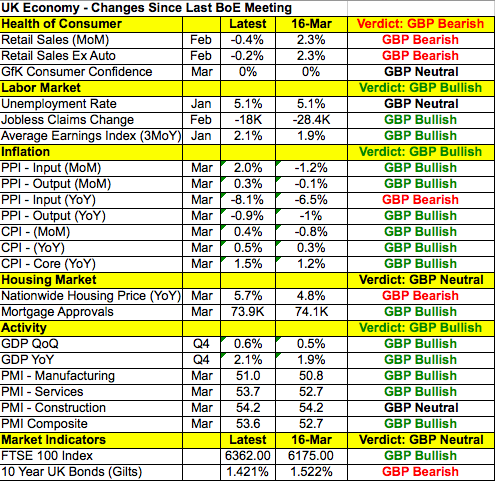

Now that the BoC rate decision is behind us, the focus will shift to sterling and the Bank of England's monetary policy announcement. Since the last BoE meeting, we've seen widespread improvements in the U.K. economy. The following table shows upticks in manufacturing and services, higher wage growth, lower jobless claims and rising consumer prices. Unfortunately spending remains weak and Brexit poses an ongoing risk to the economy. The last time we heard from the BoE, they warned about the impact of Brexit on spending but spent more of their monetary policy statement talking about looser financial conditions, strong spending and their concerns about second round CPI effect on wages. A similar tone could be seen this time around.

Finally the Australian and New Zealand dollars also moved lower against the greenback. Australian employment numbers are scheduled for release tonight and stronger numbers should propel the currency to fresh highs while weaker numbers could deepen the correction.

Past performance is not indicative of future results. Trading forex carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade any such leveraged products you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with trading on margin, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.