Technical Analysis

EUR/USD loses steam, drops below 1.13

“The Fed will desperately try to raise rates in 2015, but they’d certainly like to see stability in equity markets before they do.”

- Rochford Capital (based on Bloomberg)

Pair’s Outlook

Support at 1.1295/62 failed to produce any bullish momentum for long traders on Thursday. As a result, the pair slumped below both of these technical levels to trade around 1.1240 by Friday morning, after testing the Jul high at 1.1216 earlier yesterday. Last month's high also guards the next support zone represented by 20-day SMA and monthly R1 at 1.12. A decline below them should trigger losses down to the main demand at 1.1130/12 (weekly S1; 100 and 200-day SMAs). From another side, any rally will meet a substantial resistance at 1.1409/66 (May/Jun highs).

Traders’ Sentiment

The share of bulls rebounded from 42% to 44% yesterday. In the meantime, pending orders in 100-pip range from the spot price slid from 55% to 45%.

GBP/USD on the edge of reaching two-month low

“Directly below lies the 1.5332 July low. A close below here is looking increasingly likely and will trigger losses to the 1.5172 June low and 1.5088 the 61.8% retracement.”

- Commerzbank (based on FXStreet)

Pair’s Outlook

The Cable dropped to the lowest in the last six weeks yesterday, with the immediate support cluster barely holding the losses. The Greenback weighed on the Sterling, amid much better-than-expected GDP data, with a similar situation due today. Strong UK GDP data is likely to boost the Pound and help it rebound, regaining some of the lost value over the past few days, with the weekly S2 limiting the gains. However, a poor reading can throw the GBP/USD deeper down towards the 200-day SMA around 1.5321.

Traders’ Sentiment

Bullish traders’ sentiment remains unchanged at 51%, whereas the number of purchase orders lost 12 percentage points. The commands now account for only 52% of the market.

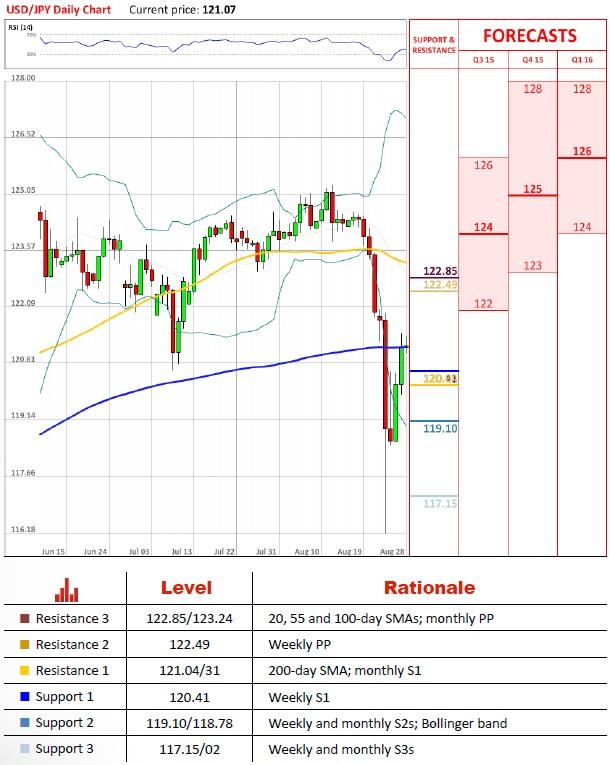

USD/JPY keeps trying to rise above 121.00

“For the dollar, one could argue, that there may still be some scope for further weakness as the market moves fully away from a September rate increase.”

- Bank of Tokyo-Mitsubishi (based on WBP Online)

Pair’s Outlook

The USD/JPY currency pair behaved in accordance with the forecast, as it surged and stabilised at the 200-day SMA at 121.03. However, the tide might turn today, with the resistance cluster around 121.15 being too strong of an obstacle, unless good fundamental figures trigger a rally. A failure to pierce the resistance is likely to cause the Greenback to retreat to the 120.00 psychological level and perhaps even towards the tough cluster around 119.00, namely the Bollinger band, weekly and monthly S2s. Meanwhile, technical indicators retain bearish signals, suggesting the given pair is to plunge today.

Traders’ Sentiment

Now 59% of traders hold long positions, up from 55%. At the same time, the portion of buy orders inched up from 63 to 65%.

XAU/USD stuck in the vicinity of 1,125

“For all the talk of market turmoil, it is important to note that the Fed does not typically look at overseas developments to make its rate decision and we don't think this time will be any different.”

- INTL FCStone (based on CNBC)

Pair’s Outlook

Gold failed to consolidate below the 1,125 support mark reinforced by the weekly S1 on Aug 27. Therefore, bulls may count on a recovery in the near-term; however, a successful testing of resistance cluster at 1,128/31 is required, in order to sustain any potential rally. Therefore, unless this area is penetrated our outlook remains strongly bearish with respect to the precious metal, while the shorts are still targeting 1,113 (Aug 15-16 lows, monthly PP). Nonetheless, bullish views are in turn strengthened by overwhelmingly positive daily technical indicators.

Traders’ Sentiment

SWFX sentiment with respect to gold fell just one percentage point yesterday, as bulls and bears are currently holding 55% and 45% of all open positions, respectively.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.