Technical Analysis

EUR/USD rebounds from 12-year lows

“If the euro rises further, I think there will be lots of people who will look for opportunities to sell into the rally.”

- Brown Brothers Harriman (based on Reuters)

Pair’s Outlook

EUR/USD rebounded during trading on Monday of this week, while the pair returned back above 1.12 level. All in all, daily gains reached as many as 100 pips, with no resistance levels crossed in course of this move. The closest supply zone is located at 1.1332 and is represented by the weekly pivot point, which may even stop bulls by acting alone. Therefore, short-term gains up to 1.1350 are possible, but the medium-term outlook remains negative for the Euro.

Traders’ Sentiment

Distribution between long and short opened positions on EUR/USD pair decreased slightly from yesterday to 49% and 51%, respectively. At the same time, commands to acquire the Euro lost one more percentage point during last 24 hours to stay at just 31%.

GBP/USD jumps above weekly PP

“We should see some stabilization and perhaps some scope for sterling to move higher in the near term.”

- Bank of America Merrill Lynch (based on Bloomberg)

Pair’s Outlook

Though we expected more weakness for the Sterling, the currency rebounded from 1.50 because of the new speculations regarding the rate hike in the UK. There is a good chance the currency has not yet fully realised its near-term bullish potential, and GBP/USD may reach the monthly S3 at 1.5150 in the coming days. The key resistance is at 1.53, where the multi-month down-trend joins forces with the monthly S2 level.

Traders’ Sentiment

The bulls remain in a majority, and the current percentage of long positions is at its 10-day average, namely at 57%. At the same time, there are less and less people willing to sell the Pound, the share of orders to sell the currency declined from 74 to 66%.

USD/JPY challenges 55-day SMA

“The U.S. dollar remains supported, and that will continue for the foreseeable future. That’s being driven by other central banks needing to be much more aggressive.”

- Westpac Banking Corp. (based on Bloomberg)

Pair’s Outlook

USD/JPY managed to offset all the Friday’s losses and gained a foothold above 118 once again. However, the resistance at 119 remains intact, and the currency pair must break it to confirm bullish intentions. The first target will then be the late December highs at 121, followed by the 2014 maximum just below 122. In the meantime, the support at 118 seems no longer reliable, the demand at 116 is a better candidate to be the medium-term line in the sand.

Traders’ Sentiment

There are even more people confident in appreciation of the US Dollar relative to the Yen than yesterday, as 65% of open positions are now long. The share of buy orders increased by a considerably wider margin, from 57 to 70%.

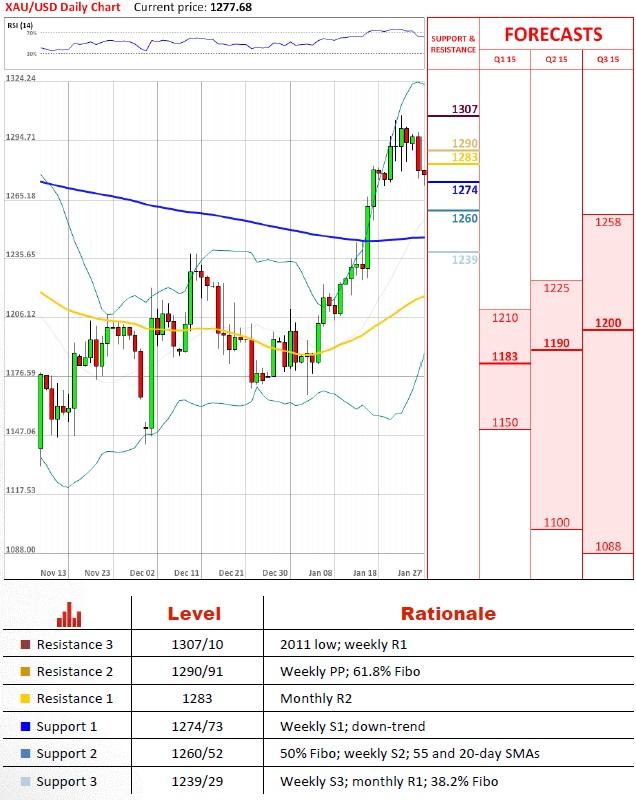

XAU/USD pierces through monthly R2

“The bullion market's focus may shift to the upcoming FOMC two-day meeting on 27-28 January.”

- HSBC (based on CNBC)

Pair’s Outlook

On the first day of this week the precious metal lost around $15 per ounce and crossed a number of major demand areas during trading. At first, a support in face of weekly PP and 61.8% Fibonacci retracement was eliminated. The same happened with the monthly R2 at $1,283; therefore, gold managed to close at $1,281 in the night between Monday and Tuesday. If the bearish pressure persists in the near term, a violation of weekly S1/down-trend around $1,273 seems more than possible. In case of success, a decline may even extend down to 38.2% retracement.

Traders’ Sentiment

Advantage of bulls over bears to buy the precious metal continues to stay close to 70% after a short-term fall in the beginning of the previous week, as the share of long positions among SWFX traders rose three percentage points from Monday to hit the 69% mark on Tuesday's morning.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.