Technical Analysis

EUR/USD makes a pit stop at 1.26

“Now that the fixed income market seems more content and yields are escalating, that is helping the dollar rally and is a vote of confidence in the U.S. economy.”

- BK Asset Management (based on Reuters)

Pair’s Outlook

EUR/USD has found some support at 1.26, and the pair is currently consolidating, meaning there is unlikely to be continuation of the decline today. But in the coming weeks there is expected to be a re-test of the key demand area around 1.25, a breach of which should pave the way towards the 2012 low at 1.2040. In the meantime, the supply between 1.29 and 1.2850 will act as a ceiling and prevent any rally from extending.

Traders’ Sentiment

The SWFX market remains undecided with respect to the Euro—52% of the open positions are long and 48% are short. On the other hand, the pending orders are more active—the share of the sell ones grew from 60 to 66%.

GBP/USD is about to close the week in red

“What we’re looking for is further consolidation in dollar strength.”

- Credit Agricole SA (based on Bloomberg)

Pair’s Outlook

A failure of the Cable to close above 1.62 this week resulted in the near-term technical indicators becoming even more bearish—six out of eight studies on the weekly time-frame are now pointing downwards. GBP/USD is now moving in the direction of the 1.590/1.585 area, and the nearest supports, such as the weekly PP and monthly S1 at 1.6030 and 1.5960 respectively, are not seen as a serious threat to the present bearish momentum.

Traders’ Sentiment

Most of the traders believe the Pound is undervalued and should recover some of the recent losses—64% of positions are long. Meanwhile, the gap between the buy and sell orders narrowed from 40 to 24 percentage points (in favour of the latter).

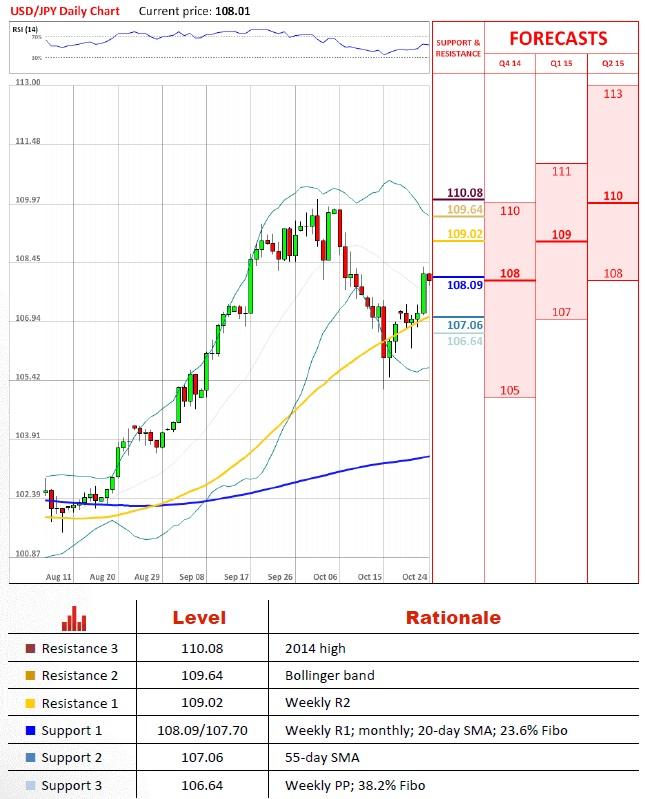

USD/JPY surprises to the upside

“Next week the market will be more event-driven, with the FOMC and the Bank of Japan, so the downside should be limited.”

- Global-info Co (based on CNBC)

Pair’s Outlook

USD/JPY overshot our expectations by a wide margin by effortlessly piercing through the resistance at 108. And while the weekly technical studies are mostly giving ‘buy’ signals, the pair must confirm the new support to confirm its longer-term bullish intentions. Alternatively, if the monthly pivot point and 23.6% Fibo are unable to stop the sell-off, the price may slide back to the 55-day SMA, which is currently residing at 107.

Traders’ Sentiment

As a result of a sudden jump in the price of the Dollar many of the market participants decided to enter short positions, the portion of which went up from 55 to 61%. But in the meantime, the percentage of the buy commands increased from 59 to 63%.

USD/CHF halted by an up-trend

“Data in the U.S. this week continues to support the view that the U.S. continues to grow at higher rates compared to other areas of the world. The overall theme of a stronger U.S. dollar, that has not really changed.”

- Mizuho Bank (based on Bloomberg)

Pair’s Outlook

The US Dollar came under the selling pressure ahead of the resistance at 0.9571, which is likely to act as a temporary ceiling. But USD/CHF should preserve the upward tendency, as eventually the pair is expected to pay 0.97 a visit and then update this year’s peak. But it is worth noticing that the monthly indicators are mostly bearish, suggesting it may take some time before the rate overcomes the resistances.

Traders’ Sentiment

The traders’ sentiment towards USD/CHF is moderately bullish, being that 58% of open positions are long. As for the orders, most of them placed 100 pips from the spot are to purchase the Dollar against the Franc.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.