Technical Analysis

EUR/USD stopped by 1.2740

“We continue to expect further easing measures in Q1, and would look for ECB officials to continue to stress willingness to do more if necessary.”

- BNP Paribas (based on CNBC)

Pair’s Outlook

Although EUR/USD seemed to have found strong support at 1.26 when it hit the Aug-Sep down-trend, the rally initiated there was unable to penetrate the resistance at 1.2740. Now the currency pair is unlikely to launch an attack on the 2013 low before it travels down to this year’s minimum at 1.25. But if the Euro closes beneath this level, the next support will be at 1.24—the current location of the monthly S1.

Traders’ Sentiment

Neither the bulls nor the bears have an advantage at the moment—both take up a half of the SWFX market. In the meantime, the share of orders to sell the European currency against the US Dollar grew from 49 to 59%.

GBP/USD slides to 1.59

“Sterling is likely to underperform in the near term as rate hike expectations get pushed back.”

- CIBC World Markets (based on Reuters)

- Pair’s Outlook

The Sterling took a major hit yesterday, falling nearly 200 pips in one day, as the support represented by the monthly S1 and now former 2014 low failed to nullify the downward momentum. Accordingly, GBP/USD is now set to test another demand area at 1.5862/25. If this cluster of supports is also violated, there is a high chance the price will keep falling towards the monthly S2 at 1.5711, even though the technical indicators are mostly mixed.

Traders’ Sentiment

There was a slight increase in the percentage of long positions (from 57 to 59%), but it did not affect the overall situation in the SWFX market—the sentiment is moderately bullish, just like yesterday or five days ago.

USD/JPY is poised to resume rally

“The yen rally has faltered as it approached its upper Bollinger Band. If the yen weakens below 107.50 per dollar, it could signal the yen’s rebound is over.”

- Gaitame.com (based on Bloomberg)

- Pair’s Outlook

There are signs USD/JPY has finally bottomed out at 106.60 after tumbling all the way from 110. Yesterday the pair managed to negate some of the most recent losses, thus confirming strong demand below 107 (38.2% Fibo and 55-day SMA). However, except for the weekly studies, there is no encouragement from the indicators on different time-frames, and only a close above 108 will imply the Buck is ready to challenge the 2014 high once again.

Traders’ Sentiment

We continue to observe absence of any substantial difference between the amounts of long and short positions open, meaning the market is undecided. The portion of the former is 48% and the portion of the latter is 52%.

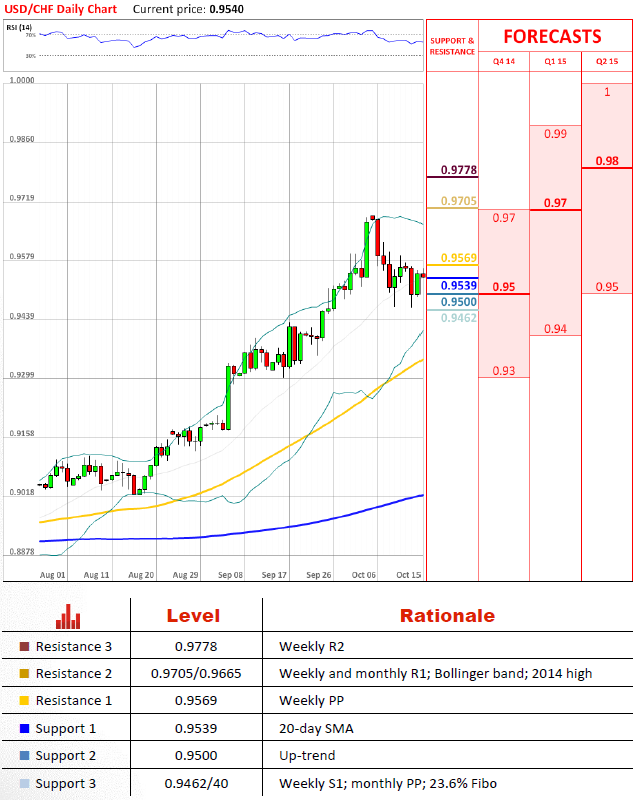

USD/CHF is short-term bullish

“With the ECB cutting interest rates and honing in on quantitative easing, the SNB will have no choice but to extend the timeframe of its currency cap against the euro.”

- Moody’s Analytics (based on Bloomberg)

- Pair’s Outlook

Despite intensive selling the last few days the rising support line (Aug 17 and Sep 4 lows) remains intact. Therefore, the outlook for USD/CHF is still positive, with the immediate obstacle standing at 0.9569 and a more serious threat to the bullish perspective at 0.97. The latter resistance is mainly formed by the monthly R1 and 2014 peak, meaning it is the key to even higher levels, such as the 2013 high at 0.9840.

Traders’ Sentiment

Apparently, yesterday’s performance of USD/CHF encouraged the Dollar-bulls, being that the share of longs went up from 57 to 60%. At the same time, the gap between the buy (48%) and sell (52%) orders placed 100 pips from the spot price came to naught.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.