Technical Analysis

EUR/USD finds support at 1.26

“Bottom line for the euro is that Draghi needs to convince investors that ECB action will be large enough to boost inflation expectations, and that policy responses will continue to escalate if inflation expectations were to fall further.”

- BNP Paribas (based on CNBC)

Pair’s Outlook

Continuation of Tuesday’s sell-off did not take place yesterday—the support at 1.26, represented by the weekly S1 and Bollinger band, remains intact. In case of a rally from here the currency pair will encounter 1.2660—2012 Q4 low. If the bulls keep pushing the price higher—there is a cluster of resistances at 1.2750, consisting of the 2013 low, weekly PP and falling trend-line that should prevent further appreciation of the Euro.

Traders’ Sentiment

The SWFX market participants are undecided with respect to the Euro, being that the amounts of long and short positions open are equal. However, there are more sell orders (64%) than there are buy ones (36%).

GBP/USD to be capped by 1.63

“Sterling’s past moves have reduced the risk of inflation increasing sharply, despite the strong growth in employment and the overall economy.”

- Kristin Forbes, BOE policy maker (based on Bloomberg)

Pair’s Outlook

After hitting the weekly S1 during yesterday’s trading sessions, GBP/USD is currently moving counter the major trend—towards the negatively-sloped line at 1.63. Considering that this resistance is also reinforced by the monthly PP and 23.6% Fibo, the chance of the Sterling rising above this supply area is low. Instead, the pair is expected to resume the decline and re-visit this year’s lowest point at 1.6050, as suggested by the daily and weekly studies.

Traders’ Sentiment

Just like in EUR/USD, here the difference between the bulls and bears is also insignificant—it amounts only to 10 percentage points. As for the pending orders, there is a slight advantage of sell commands (57%) over the buy ones (43%).

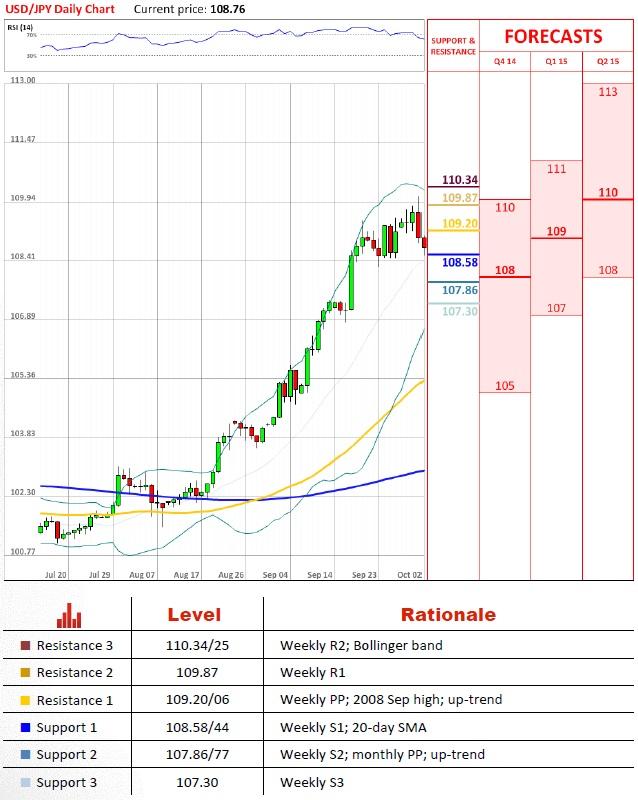

USD/JPY slipped beneath 109

“The dollar is consolidating after reaching 110 yen, and other currencies which were a bit oversold against the dollar are being bought back. Investors are adjusting their positions ahead of the ECB meeting as the dollar’s recent rise has been quite rapid.”

- FX Prime (based on Bloomberg)

Pair’s Outlook

As it turned out, USD/JPY did not have to touch the 2008 high in order to come under strong selling pressure. Right now the spot is 100 pips below the Tuesday’s close, as the weekly PP and 2008 Sep high at 109 failed to provide sufficient support. At the moment the U.S. Dollar is facing the weekly S1 at 108.50, but this downward correction has the potential to extend to 108. Here the bears should be stopped by the monthly PP and two-month up-trend.

Traders’ Sentiment

As a result of a large drop in price there are considerably less bears in the market than there were yesterday. However, the short positions still constitute a majority—60%. There are also more orders to sell the Buck—65% of the total amount.

USD/CHF intimidated by 0.9580

“A negative interest rate is in our arsenal of instruments. We don’t exclude any measure to meet our mandate of price stability.”

- Thomas Jordan, SNB President (based on Bloomberg)

Pair’s Outlook

USD/CHF keeps standing close to the resistance at 0.9586/78. If the sellers here manage to send the price down to 0.9450—the risk of a break-out to the downside will substantially increase, since the market will confirm formation of a rising wedge. Conversely, the if Greenback continues to appreciate and ignores the nearby resistances, the next target will be the 2013 Q3 high and weekly R3 at 0.9750 before the 2013 high 0.9840.

Traders’ Sentiment

While the distribution between the bulls and bears levelled off throughout other currency pairs, in USD/CHF the former improved their positions—now they take up 67% of the whole market (62% yesterday).

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.