Technical Analysis

EUR/USD stays motionless

“We’ve kind of traded sideways a little bit. It’s largely technical, but there’s some geopolitical headlines that may be weighing on risk appetite.”

- Commonwealth Foreign Exchange (based on Bloomberg)

Pair’s Outlook

There are still no consistency among the technical indicators, as they are pointing in different directions on the weekly an monthly time-frames. Nevertheless, the currency pair is considered to be capable of rising up to 1.37 before coming under selling pressure and subsequently re-challenging a key support level at 1.35, which is reinforced by the monthly S1 and 2014 low. A breach of the latter level may potentially open a way towards 1.28—2013 lows.

Traders’ Sentiment

The bears are starting to gain an upper hand over their counterparts, as the former now constitute 56% of the market (54% yesterday). As for the orders, 63% are set to sell the Euro against the greenback.

GBP/USD rejected by 2009 high

“Market participants were left with the view that the BOE is going to raise interest rates and raise them before the Fed does, but that will be a 2015 event, not 2014 [event].”

- BNY Mellon (based on MarketWatch)

Pair’s Outlook

GBP/USD had a good chance of advancing further north, but the bullish momentum was stopped by 1.7044, the 2009 high, and by a more dovish than expected stance of the BOE. Now the Sterling is set to decline to 1.68, where it is supposed to be underpinned by the up-trend line, monthly PP and 100-day SMA. Another implication of this U-turn is emergence of a rising wedge that usually portends a reversal—in this case an eventual violation of 1.68.

Traders’ Sentiment

Though the yesterday’s events increased the volatility in GBP/USD, the SWFX traders seem to be unfazed by Carney’s comments, being that similarly to the figures 24 hours ago, 27% of open positions are long and 73% of them are short.

USD/JPY fails to gather momentum

“Talk is that stop orders are building up steadily at 101.50 yen and 102.50 yen. Market players are currently trading within this narrow band to make a little change. Overall, the yen looks better bid unless the Bank of Japan comes up with its next easing plan.”

- State Street (based on CNBC)

Pair’s Outlook

According to the technical indicators, the downward pressure should soon subside, finally giving USD/JPY freedom to pursue its bullish goals after two consecutive quarters of poor performance. For the time being the key support at 101.86/75 is holding the bears off, but once this demand area is broken, it will be immensely hard for the currency pair to return to a bullish track. Instead, the buck will be expected to target lower levels, such as 101.20.

Traders’ Sentiment

The bulls even further enhanced their advantage—their percentage in the market grew from 72% to 75%, even though the recent behaviour of USD/JPY appeared to be somewhat discouraging for the proponents of a rally.

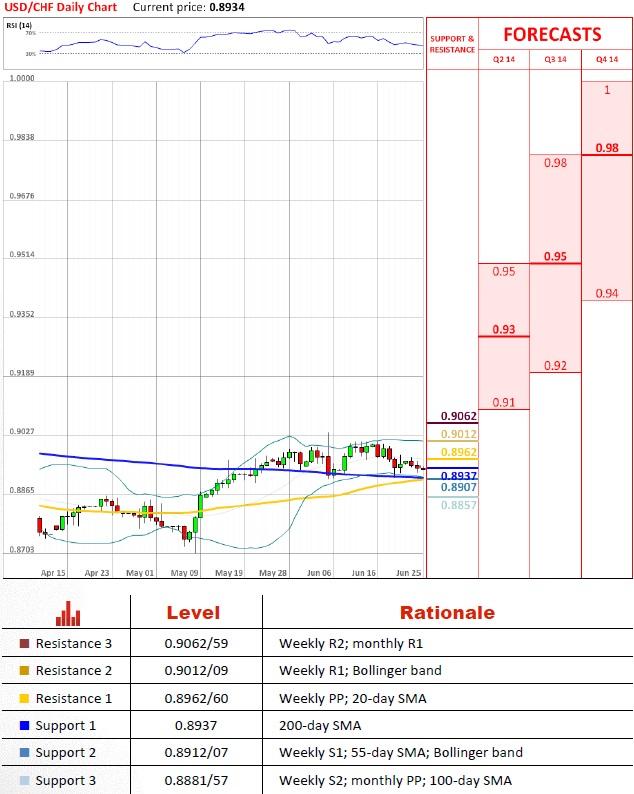

USD/CHF remains indecisive

“Traders tend to feel that a lot is out of their control with central banks being active. That’s one of the main reasons why we’ve seen these tight ranges being maintained.”

- IG (based on Bloomberg)

Pair’s Outlook

Although the 200-day has stayed intact for the past month, constantly defending the positive outlook, the pair is still unable to use it as a springboard and make a foray north, as it did in May. Apart from a prolonged absence of bullish activity, there is also a worrying sign on the monthly chart, where a half of the indicators are giving ‘sell’ signals, while none of them are defending an idea of U.S. Dollar’s appreciation relative to the Franc.

Traders’ Sentiment

The sentiment in the market is strongly bullish—as many as 67% of traders are currently holding long position on the buck, leaving the bears in a distinct minority, with only a 33% share. Meanwhile, the portion of the buy orders surged, specifically from 61% to 68%.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.