Technical Analysis

EUR/USD starts week with bearish gap

“Draghi and the situation in Ukraine are going to keep the euro heavy.”

- RBS (based on CNBC)

Pair’s Outlook

Friday’s price action and a large downside gap confirmed an assumption that there is a formidable resistance area between 1.39 and 1.395. Accordingly, while there could be a rally today in order to cover the distance between last week’s close and this week’s open prices, it is unlikely to extend beyond 50 pips. Despite the ‘buy’ signals on the weekly and monthly time-frames the outlook on the single European currency is still considered to be bearish.

Traders’ Sentiment

There was a slight decrease in the number of short positions, from 71% down to 68%, and the sentiment with respect to EUR/USD remains strongly bearish. Meanwhile, the difference between the buy (45%) and sell (55%) orders is currently insignificant.

GBP/USD finds support at 1.67

“Sterling is going to nudge higher throughout the course of this month.”

- Argentex (based on Bloomberg)

Pair’s Outlook

Although GBP/USD received a strong bearish impetus after a test of the February’s high, today the currency pair is not keen on declining, as it seems to have found support at 1.6704 (weekly PP). Nevertheless, the downside risks are significant and there is still a high probability of the price falling down to 1.6642/35, where it will meet the monthly PP and 55-day SMA. Additional support is beneath 1.66—up-trend line and 100-day SMA.

Traders’ Sentiment

The gap between the amounts of longs and shorts narrowed, but there are still notably more bears (60%) in the market than there are bulls (40%). In the meantime, the distribution between the buy and sell orders 100 pips from the spot price is 55% and 45% respectively.

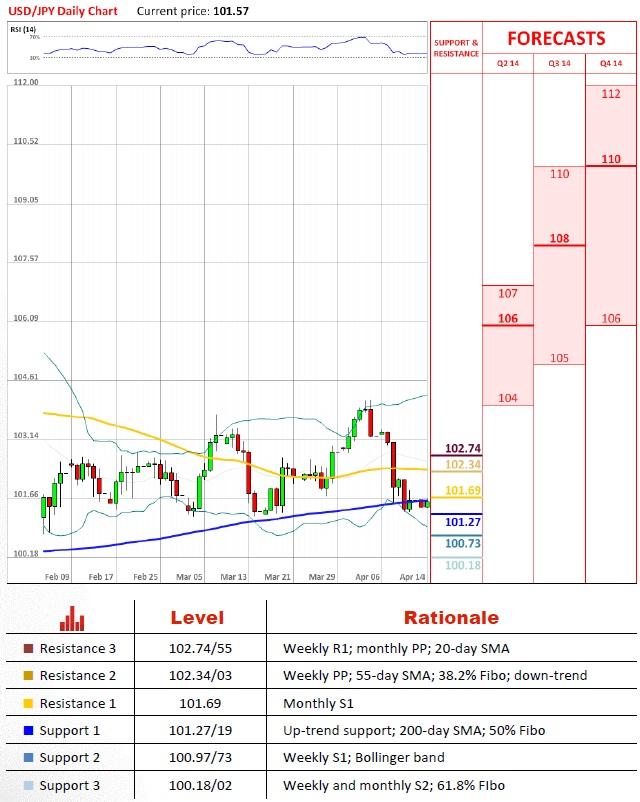

USD/JPY struggles to rally

“Given the technical damage inflicted on the dollar and the decline in U.S. interest rates, it is tempting to look for the greenback's losses to accelerate.”

- Brown Brothers Harriman (based on Reuters)

Pair’s Outlook

In order for USD/JPY to preserve a bullish bias, it is required to rebound from 101.27/19, the key support area that consists of the rising trend-line, 200-day SMA and 50% retracement of the November-December up-move. However, for now the currency pair hesitates to start a recovery, meaning that the demand here is not as strong as it initially appeared. If the sell-off drags on, the next significant line in the sand is the monthly S2 and 61.8% Fibo at 100.

Traders’ Sentiment

Just as last week an overwhelming majority of the SWFX market participants are holding bullish views towards USD/JPY, specifically 73% of them. At the same time, the distribution between the orders is heavily skewed towards the buy ones (73%).

USD/CHF targets down-trend at 0.863

“The Fed minutes suggested that the market may have been off-base in beginning to price in a rate hike sooner than previously expected.”

- Commonwealth Foreign Exchange (based on MarketWatch)

Pair’s Outlook

After an explicitly bearish week there is a fairly high chance of a correction. But even if it does take place, the rally is unlikely to drag on for long, considering there are tough resistances at 0.8813/12 (weekly and monthly PP) and 0.8842/38 (20 and 55-day SMAs). The outlook will remain bearish until USD/CHF confirms presence of a formidable support at 0.8631, where the pair should meet the 12-month trend-line and jump.

Traders’ Sentiment

More than three out of four traders (76%) expect the U.S. Dollar to increase in value relative to the Swiss Franc. The positive outlook is also provided by the orders placed 100 pips up and down from the spot—76% of them are to purchase the greenback.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.