Technical Analysis

EUR/USD denied by monthly R1

“The dollar and euro had been stuck in a narrow range for a while, and positions tend to build up in such an environment. When stops are triggered under those conditions, currency movements tend to be volatile.”

- State Street (based on CNBC)

Pair’s Outlook

EUR/USD did not manage to pass through the supply zone formed by the weekly and monthly R1 levels and retreated to the weekly pivot point at 1.3833. Accordingly, the downside risks are now elevated. The currency pair may slide back to 1.38 before it follows the scenario suggested by the daily and monthly indicators, namely advance further north.

Traders’ Sentiment

The bearish with respect to the single European currency sentiment strengthened, as the percentage of open short positions increased from 66% up to 69%. Meanwhile, there was almost no change observed in the distribution between the buy (38%) and sell (62%) orders 100 pips from the spot price.

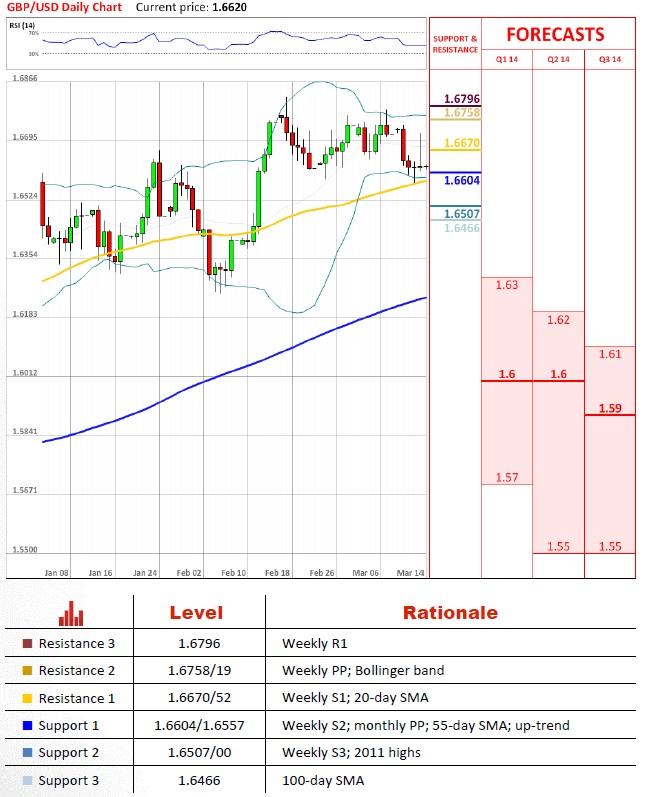

GBP/USD gravitates towards 1.66

“The pound is higher today as a result of a weak dollar across the board. The market is also thinking the U.K. will probably be the first major economy to increase rates. This drags pound-dollar higher as well.”

- Mizuho Bank (based on Bloomberg)

Pair’s Outlook

Originally, the Sterling did receive a strong upward impetus after touching upon the support at 1.66. However, the bullish momentum was exhausted, once the pair approached the weekly PP, and gave way for a sell-off. Now the Cable is again trading near the monthly PP and the up-trend, meaning there are still good reasons for the price to rise in the future.

Traders’ Sentiment

The bearish market participants are slowly but surely enhancing their advantage over the bullish traders. Currently the former take up 57% of the market, while the latter—43%. As for the orders placed 50 pips from the spot, the share of sell ones surged from 44% up to 59%.

USD/JPY plunges 100 pips

“Yen strength across the board has been exerting itself as the best way to play risk aversion. We are watching very closely the referendum over the weekend.”

- Australia & New Zealand Banking Group (based on Bloomberg)

Pair’s Outlook

Though we did expect USD/JPY to cover the distance between the monthly R1 and monthly PP with no real effort, at the same time we also considered the support at 102 to be tougher. Now an extension of the dip to the 50% Fibo seems to be as the most likely course of events. Additional demand is at 100.71/67, where the monthly S1 merges with the 200-day SMA.

Traders’ Sentiment

Traders have become somewhat less optimistic with regards to the U.S. Dollar, being that the share of long positions lost three percentage points. Still, the bulls are is a distinct majority—71%. Meanwhile, the number of buy orders (67.5%) considerably exceeds the number of sell ones (32.5%).

USD/CHF well-supported by 0.87

“With the approach of Sunday's referendum in Crimea, reports of Russian troop movements near the Ukraine border and escalating warnings of Western sanctions all contributed to renewed anxiety.”

- BNP Paribas (based on Reuters)

Pair’s Outlook

USD/CHF has finally tested the support around 0.87, which appears to be capable of stopping the decline seen since May of 2013 and capable of laying foundation for the bullish market. In order to confirm such long-term intentions, however, the currency pair will have to overcome a series of formidable resistances, with the nearest being the down-trend line at 0.8825. The next obstacle will then be the 2012 lows at 0.89.

Traders’ Sentiment

The ratio between the long (74%) and short (26%) positions is exactly the same as yesterday. In the meantime, more and more traders are planning to purchase the U.S. Dollar—the portion of buy orders reached 91% 50 pips from the spot.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.