Forex News and Events

Russia: Rates Decision

“Today the Bank of Russia is releasing its key rate which is currently at 11.50%. Earlier this week, the central bank has announced that it stopped purchasing U.S. dollars for the account of its foreign exchanges reserves as the ruble hit at a five-month low on Tuesday. In addition a weak ruble puts upward inflation pressure and the Russian economy is struggling with lingering oil prices. This is likely to prevent the central bank to cut too largely its key rate.

Furthermore, the main issue for Russia is to find the good balance between cutting rates and maintaining inflation under control. We then anticipate the Bank of Russia to cut its rate today by a 50 basis points. The central bank does not have a lot of flexibility and is therefore forced to adjust its monetary policy very smoothly or it may create disruptive effect that would lead to an inflation boom which is already at a 15.3%y/y.

USDRUB has broken this week the psychological level of 60 RUB for 1 dollar, the first time since March. We remain bearish on the RUB. Growth rate for the first quarter was -2.2%y/y and the outlook seems very negative due to the impact of Western sanctions. We target the 61.8% Fibonacci retracement at 62.76.” Yann Quelenn - Market Analyst

Effect of commodity weakness

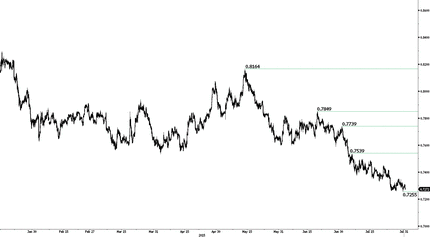

The sudden collapse of the China equity market has highlighted the risks of such a massive economic engine—when China sneezes, the whole region of Asia catches a cold. While the initial catalysts for selling stocks were structural in nature, the focus quickly became the weakness of China's growth. Worries over the Chinese economy resumed due to the surprising drop in the July “flash” PMI to a 15-month low and corresponding soft price sub-indices. Incoming data suggests that without significant policy intervention, China will be unable to reach the official 7.0% 2015 GDP target. The spillover effect is that with a humming speculative market and/or stable growth expectations, we should also see the real-estate sector continue to contract. So here comes the cold. China's massive housing construction is extremely commodity demanding. The two largest inputs copper and iron ore are also Australia's largest commodity exports. The fall in global commodity prices has all but ended CAPEX investment in Australia, making any outlook of an economic upturn unlikely. Due to strong housing prices so far, the RBA has held off signaling additional rate cuts despite economic headwinds. Annualized growth in national house prices accelerated again in June and the RBA has stated that monetary policy must take into account overall financial stability. As commodities have slumped, the RBNZ and BoC have eased their monetary policy with a direct aim of weakening their currency to revive export growth. The RBA has a bit more room since the economic erosion has not been as unforgiving. Markets are now pricing in less than a 50% chance of a rate cut over the next three meetings, however, additional China below trend growth could easily push Australia’s economic outlook into the RBAs rate cut red zone. We are bearish AUDUSD and target a challenge to 0.7190 uptrend channel support before a deeper extension of downtrend.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.