Following the ECB's meeting yesterday the euro gave back its initial gains, while precious metals pulled back strongly from their intraday rally. However, price action across the board still looks a bit volatile, but there is a possibility that the US dollar could see some upside in the near term.

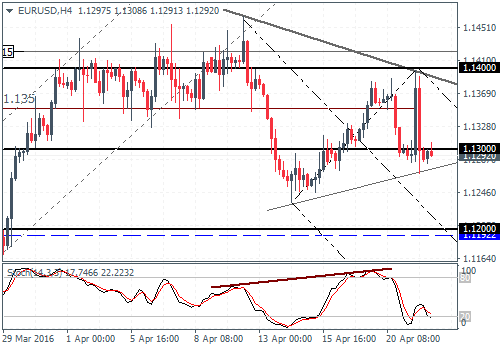

EURUSD Daily Analysis

EURUSD (1.12): EURUSD formed an outside bar doji following the bearish close the previous day. Prices remain close to the 1.130 handle so the bias remains flat as prices could still attempt to break higher. The 4-hour chart shows prices trading within a consolidating triangle which could eventually open up a strong momentum led abreakout. $1.140 is the resistance to watch on the upside while $1.120 will be the support to watch to the downside. Plotting the median line, we expect to see the downside momentum prevail but only on a close below the lows at 1.123 - 1.125.

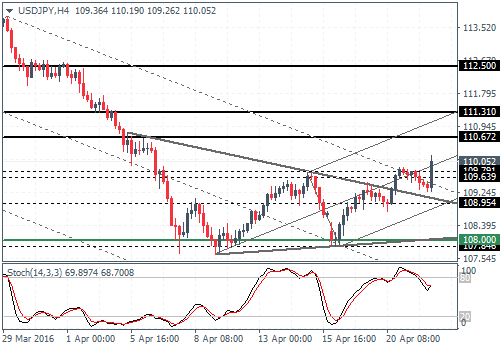

USDJPY Daily Analysis

USDJPY (109.9): USDJPY closed bearish yesterday and formed an inside bar following three days of gains and could potentially spell a pullback in the near term unless prices close strongly higher today. The breakout from the minor median line and with prices trading outside the median line indicates further upside to prevail towards 110.14 - 110.67. For further gains, USDJPY needs to close above the current support/resistance region near 109.8 - 109.64. For the moment, the 4-hour chart shows a bullish breakout from the consolidating triangle, but resistance is seen near 110.220 – 110 which could push prices lower in the near term.

GBPUSD Daily Analysis

GBPUSD (1.43): GBPUSD price action was similar to that of the EURUSD with price action forming an outside bar doji, just below the 1.4425 resistance. Price action could remain ranging unless the resistance level is broken. On the 4-hour chart, GBPUSD posted a strong decline after a test to 1.443 - 1.4425 resistance but is currently trading near the lower median line. Unless prices move higher and break above 1.4425, GBPUSD could fall back and test the support at 1.4263 - 1.4247.

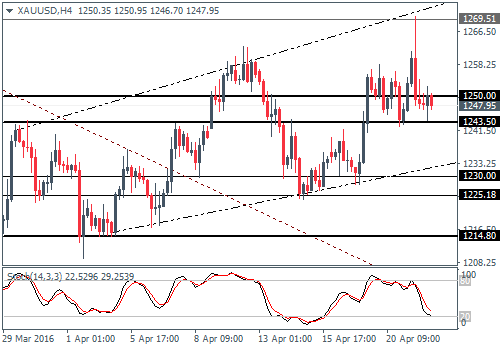

Gold Daily Analysis

XAUUSD (1248): Gold prices were volatile yesterday, but prices managed to pull back towards the end of the day. Failure to close above the most recent doji high at 1262.68 indicates a move lower. 1231.5 support will be key to watch initially; a break below could see a move to 1200. On the 4-hour chart, gold is seen trading in the 1250 - 1243 support level below which comes the previously tested support at 1230 - 1225 as gold trades within a broadening wedge pattern.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.