Today's Highlights

- NZD GDP rises 1.5%

- Interest rates set to rise later this year

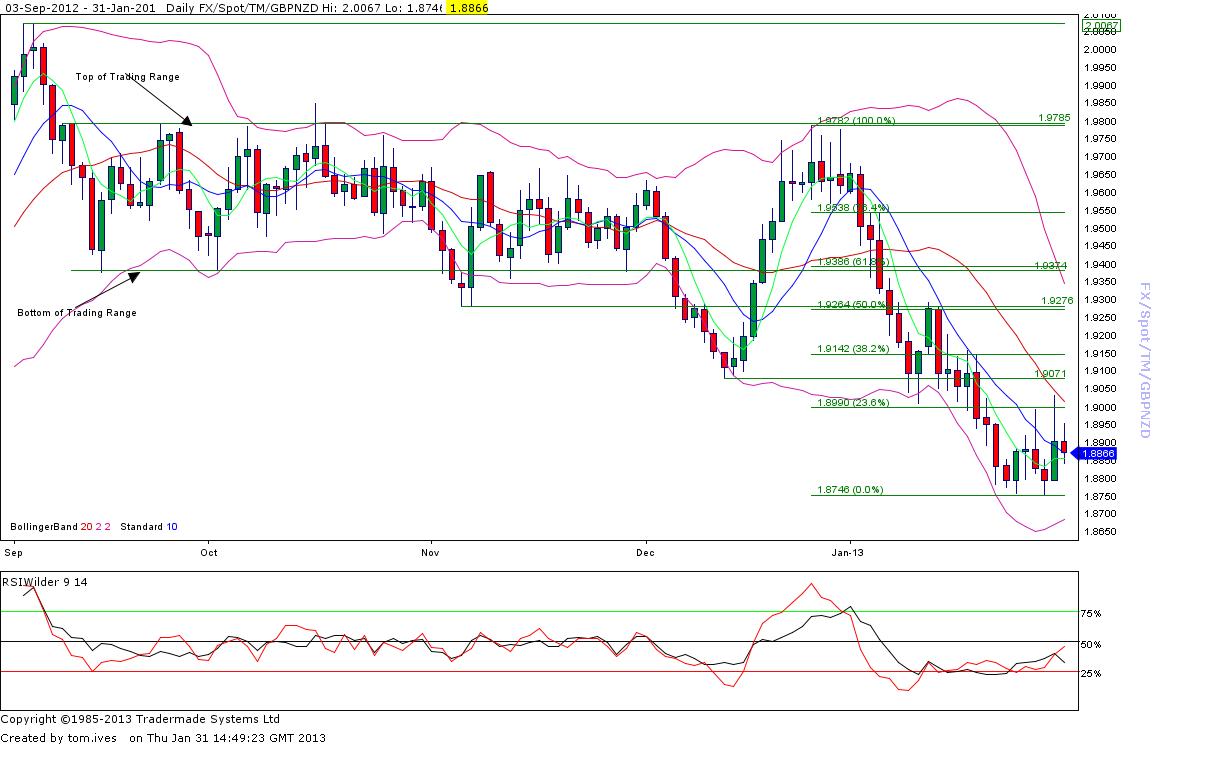

Sterling New Zealand Dollar (GBPNZD) FX Technical Analysis

Having fallen from 1.9782 at the turn of the year to 1.7965 last month, GBP/NZD has had a relatively quiet March despite everything going on in the world. During the last month or so, we have seen the debt crisis in Europe rear its ugly head once more due to the Italian election results and the situation in Cyprus. What really has been a concern for our Kiwi buyers is the lack of impact these events have had on GBP/NZD.

As a rule of thumb, whenever risk sentiment takes a knock as is undoubtedly the case at present then NZ dollar is sold and GBP/NZD heads higher. On this occasion however, GBP/NZD has barely moved as the situation in Europe has deteriorated. There could be several reasons behind this lack of impact; personally I tend to think it is due to two factors. Firstly, US stock markets have continued to trade at or close to record highs suggesting risk appetites in the world’s premier economy remain resilient and secondly we have seen some stellar numbers from New Zealand.

NZ GDP for the fourth quarter posted a 1.5% rise, which was double expectations and well above the RBNZ’s forecast. In addition to this stronger than expected 4th quarter growth figures, we have seen the NZ trade balance post a surprise trade surplus of NZ$441 million for the month of February. This increase in trade balance, was largely due to an increase in exports to China which has increased from NZ$527 million in Feb 2012 to NZ$787 million this Feb (approximately a 50% increase in the course of year). This is despite the headwind of a strong kiwi dollar.

With the data suggesting that the NZ economy is well on its way to recovery the market has begun to speculate interest rates will go up later this year and the Kiwi will remain well supported despite Wheeler claiming the Dollar is not a one way bet.

With yield hungry investors being starved of places to earn a return on their capital, New Zealand’s headline interest rate of 2.5% and it’s well capitalised and therefore secure banks looks like a very attractive place to park your money at present.

Technically, having fallen so aggressively in the early part of the year we would usually expect to see a correction. As a rule, markets tend to correct between 23.6% & 38.2% in a strongly trending market but can correct as much as 61.8%. Having traded to a low of 1.7965 in Feb, the market ran into resistance at the 23.6% Fibonacci level (1.8394) over the course of the last month and has been unable to break through and close above it which is a major concern for our kiwi buyers. With momentum break below the 50 level (bottom panel of chart) and moving average cross over generating a sell signal, it looks as though the downtrend is about to be resumed. This will be confirmed when the prices break below the previous low of 1.7965.

For NZD Buyers

There really doesn’t appear to be much good news out there for you at the moment, so sooner rather than later seems to be the order of the day. If you’re keen to place orders, I would consider targeting rates in the 1.82-1.83 region as resistance at 1.8394 has capped the market for the last month or so. Stop loss orders need to be placed below the recent lows of 1.7965 as a break of here opens the door for further falls.For NZD Sellers

Realistically, the trend is in your favour at present so let it be your friend as the old marketing saying goes. I would consider the placement of a stop loss order above 1.8394 as this has capped the market and a break of this level should see a move towards 1.8659 follow but as long as we’re below this level, I would be tempted to see how far you can push it.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.