Good morning from beautiful Hamburg and welcome to our Daily FX Report. Turkey announced that they will allow Iraqi Kurdish fighters to reinforce fellow Kurds in the Syrian town of Kobani on Turkey’s border. In addition the United States air-dropped arms to help the Kurds there resist an Islamic State assault. In the meantime an emergency military deployment with stealth ships and helicopters were hunting for a foreign submarine in the Stockholm archipelago and caused Sweden’s largest military mobilization since the Cold War. Concerns were rising about Russian Intentions in the Baltic Sea region.

Anyway, we wish you a great trading day.

Market Review – Fundamental Perspective

Last Friday the Dow Jones Index of shares climbed 0.1 percent and the Standard & Poor’s Index rose 0.9 percent. Investors pushed out expectations for the Federal Reserve to raise interest rates amid signs of slowing global growth. Dallas Fed President Ricahrdc Fisher said he continued to be hawkish on rates but wanted to be sensible. The USD dropped against higher- yielding counterparts and was little changed at 106.95 JPY. The EUR/USD climbed 0.3 percent to 1.2800 and the EUR/JPY strengthened 0.4 percent to 136.89. The AUD/USD gained 0.5 percent to 0.8788 and the NZD fetched 0.6 percent to 0.7967 USD. Yesterday Bank of Japan Governor Haruhiko Kuroda said that policy makers would maintain monetary easing until the inflation rate stabilizes at 2 percent. Each month Japan central bank buys about 7 trillion yen ($65.3 billion) in bonds each month.

Reports showed that U.K. home prices advanced 2.6 percent in October for a second month and consumer confidence increased. Furthermore U.K. government bonds went up for the first time in three days while economists estimated that the Bank of England’s first interest-rate increase since 2007 might happen in February and not next month. Beyond that the market forecasted that reports at the end of this week will shot U.K. gross domestic product expanded for a seventh consecutive quarter. This Thursday Minutes of BOE policy makers’ most recent meeting are going to be published. The GBP rallied 0.2 percent to 1.6139 USD and the EUR/GBP strengthened 0.1 percent to 0.7922. Meanwhile yesterday Germany and France sought to paper over deep differences about how to bolster a faltering European economy. Joint proposals should be unveiled by early December.

Daily Technical Analysis

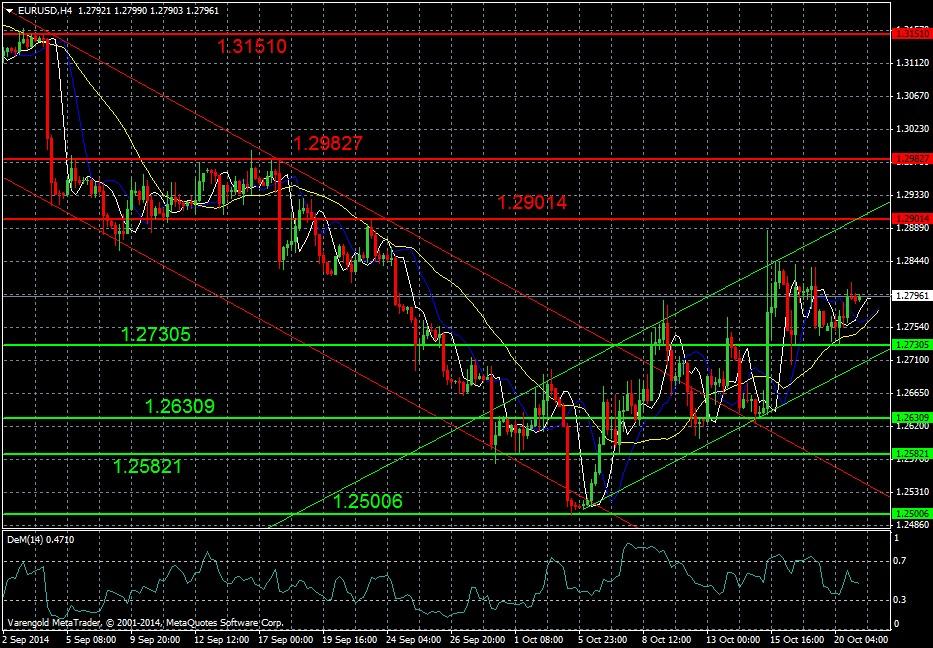

EUR/USD (4 Hours)

At the beginning of the last week the currency pair moved out of the bearish trend channel and started to increase inside a new bullish equidistant channel. According to the moving average further gains inside the channel are more than likely while the Demarker has still room to raise.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.