Good morning from wonderful Hamburg and welcome to our second-last Daily FX Report for this week. One year after Hugo Chavez death, Venezuela’s President Nicolas Maduro is facing the largest challenge with anti-government demonstrations that have led to 18 deaths since the past month. Meanwhile diplomatic efforts to resolve the crisis in Ukraine made only little progress at talks in Paris.

However, we wish you a greatful trading day!

Market Review – Fundamental Perspective

Yesterday the Dow Jones Index of shares weakened 0.2 percent and the Standard & Poor’s Index finished almost flat. Beyond that data showed yesterday that U.S. companies added 139,000 workers in the past month following a revised 127,000 gain in January. Economists had estimated a gain to 160,000. In addition the European Union’s statistic office in Luxembourg announced yesterday that gross domestic product in the euro-area increased 0.3 percent in the fourth quarter of the last year, coming from a 0.1 percent gain. The market forecasted that today European Central Bank policy makers will keep benchmark interest rate unchanged at a record low at 0.25 percent. It has also been estimated that data today will show U.S. initial jobless claims dropped to 338,000 in the past month. The USD climbed yesterday to a one week high versus the JPY and is recently trading at 102.36. The EUR/USD was little changed at 1.3732 and the EUR bought 140.56 JPY.

Yesterday the Bank of Canada left interest rates unchanged at 1 percent and announced that ther next move depends on the progress of economic data. In January the CAD had tumbled to a 4 1/2 year low as the market had expected lower interest rates, so yesterday the CAD climbed against the majority of its most traded peers. The USD/CAD lost 0.6 percent and was at 1.1030.

Today data showed that Australia recorded a trade surplus and retail sales advanced in the past month more that economists had expected. Retail sales climbed in January to 1.2 percent following a 0.7 percent gain. Yesterday data had already revealed that fourth-quarter economic growth was faster that expected at 2.8 percent. The AUD/USD traded at a one week high around 0.9022. The NZD/USD remained high around 0.8420.

Data yesterday showed that U.K. economy is gaining momentum after an industry report showed U.K. services output expanded in February. The GBP/USD was at 1.6717.

Daily Technical Analysis

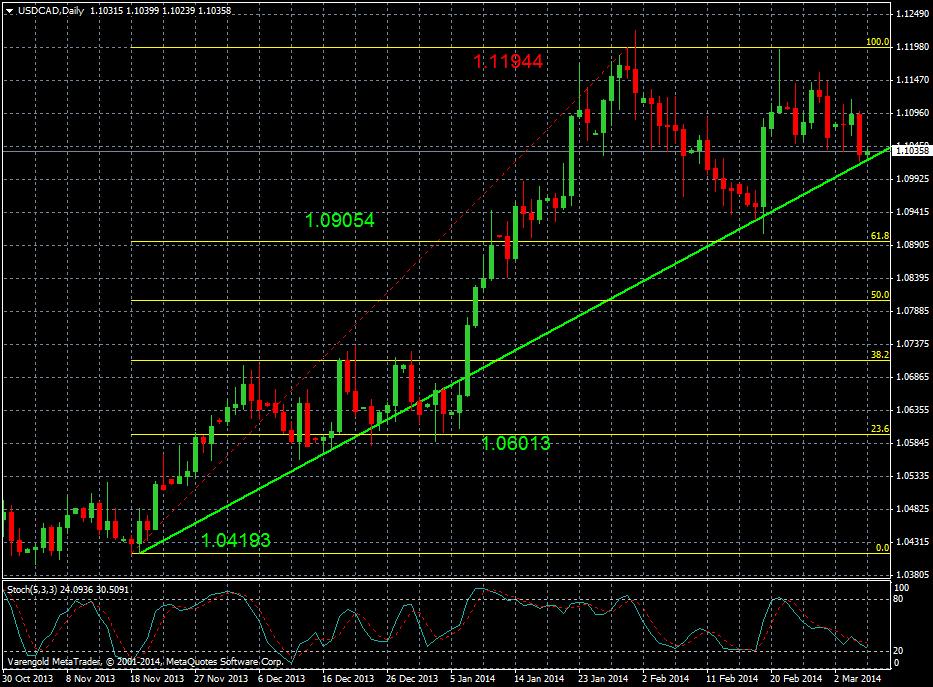

USD/CAD (Daily)

After the USD/CAD had touched a 4 1/2 year low at the resistance level 1.1194 (Fibonacci level 100) it declined back to the long term upward trend line. Based on the Stochastic, which is on a low level, more losses might be unlikely.

Support & Resistance (4 Hours)

This document is issued and approved by Varengold WPH Bank AG. The document is only intended for market counterparties and intermediate customers who are expected to make their own investment decisions without undue reliance on the information set out within the document. It may not be reproduced or further distributed, in whole or in part, for any purpose. Due to international laws/regulations not all financial instruments/services may be available to all clients. You should have informed yourself about and observe any such restrictions when considering a potential investment decision. This electronic communication and its contents are intended for the recipient only and may contain confidential, non public and/or privileged information. If you have received this electronic communication in error, please advise the sender immediately, and delete it from your system (if permitted by law). Varengold does not warrant the accuracy, completeness or correctness of any information herein or the appropriateness of any transaction. Nothing herein shall be construed as a recommendation or solicitation to purchase or sell any financial product. This communication is for informational purposes only. Any market or other views expressed herein are those of the sender only as of the date indicated and not of Varengold. Varengold reserves the right to consider any order sent electronically as not received unless it is confirmed verbally or through other means.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Ethereum may sustain trading inside key range, ETH ETFs to be delayed until 2025

Ethereum is beginning to show signs of recovery on Thursday despite a second consecutive day of poor performance in Hong Kong's spot Ethereum ETFs. Bloomberg analyst James Seyffart has also shared that a spot Ethereum ETF may not happen in the US in 2024.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.