Currency market: USD/JPY, trade balance, intervention

For March 23, Japan reported a negative trade balance of ¥755B. Japan's largest export is Cars and biggest import is Oil and Petroluem. Japan's historic problem is oil imports as they never produced their own oil. The United States and China are Japan's largest export markets.

Between March 2022 and March 2023 the exports of Japan have increased by ¥366B (4.32%) from ¥8.46T to ¥8.82T, while imports increased by ¥656B (7.35%) from ¥8.92T to ¥9.58T. ( data from BOJ and credible sites.)

July 10th is the next Balance of Payments report and this data will answer the question to BOJ intervention. A negative Trade Balance should reveal a good shot to intervention as negative implies JPY/USD is to low and USD/JPY to high. Intervention would lower USD/JPY and raise JPY/USD to align the Trade Balalnce to positive.

The BOJ last intervened October 22 and USD/JPY dropped from 151.00's to 146.00 or roughly 4 and 500 pips. The USD/JPY drop at 4 and 500 pips is extremely light in comparison to past years interventions.

If the BOJ intervened, the drop would begin at 375 pips factored as 0.001 interest rates in relation to a 25 point change to BOJ interest rates. Take 0.001 for each USD/JPY 15 pip move X 25 points to an interest rate change.

JPYUSD is a far different instrument than USD/JPY as JPY/USD moves roughtly 1/2 the distance to USD/JPY. At 0.001 = JPY/USD at 0.71 - 0.81 pips. USD/JPY starts at a 375 pip move but JPY/USD would travel 187 pips.

The BOJ is in an impossible position to change interest rates as current interest rates, YCC and the JGB Yield curve are working so perfectly. Intervention to align the Trade Balance is the same principle as adjusting headline interest rates. The effects and end result is the exact same to USD/JPY and JPY/USD movements. The BOJ actually employs interest rates to determine how far to drop USD/JPY.

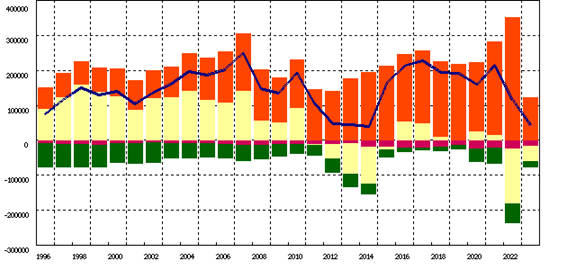

From the BOJ, here's Balance of Payment history from 1996 to 2023.

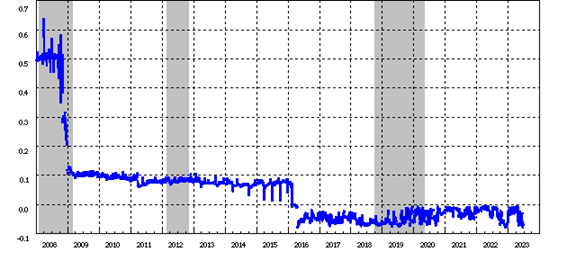

From the BOJ, here's BOJ Call Rate history from 2008 to 2023.

All see Negative Rates on a negative scale but a negative Rate is positive as Minus 0.1 = +0.9 The negative rate is an extraordinary positive for the BOJ, YCC and overall BOJ interest rates.

Author

Brian Twomey

Brian's Investment

Brian Twomey is an independent trader and a prolific writer on trading, having authored over sixty articles in Technical Analysis of Stocks & Commodities and Investopedia.