EUR/USD Current price: 1.1126

View Live Chart for the EUR/USD

ECB's President, Mario Draghi, hammered the EUR by being far more dovish than what the market anticipated, triggering a 100 pips decline in the EUR/USD pair, down to 1.1106 so far today, a fresh 2-week low. The Central Bank lowered its growth and inflation forecasts as anticipated, and increased the issue share limit to 33% from previous 25%, although it will review it on a case-by-case basis. Additionally, the ECB indicated that it could expand its stimulus programs according to needs. With China representing no risk as per being close on holidays, European share markets are soaring alongside with a weaker EUR, and the 1 hour chart shows that the price has accelerated below its 20 and 100 SMAs, whilst the technical indicators reached oversold levels, where they stalled. In the 4 hours chart the bearish momentum is quite strong, although with US Nonfarm Payrolls in the way, the pair may enter in a consolidative stage from now on. Nevertheless the downside is favored with a break below 1.1100 exposing the 1.1050 price zone.

Support levels: 1.1100 1.1050 1.1010

Resistance levels: 1.1160 1.1200 1.1245

GBP/USD Current price: 1.5260

View Live Chart for the GPB/USD

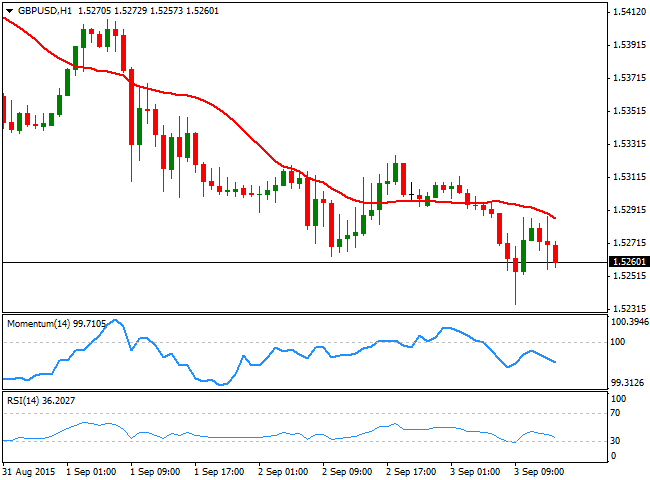

The GBP/USD maintains its bearish tone, trading near the daily low set at 1.5234 reached early Europe following the release of poor UK Markit services PMI for August. The pair saw a short lived spike on EUR/GBP slide following the ECB, but the 1 hour chart shows that the risk remains towards the downside as the 20 SMA capped the advance around 1.5290, whilst the technical indicators continue to head lower below their mid-lines. In the 4 hours chart the Momentum indicator extends to lower weekly lows below the 100 level, the RSI indicator hovers around oversold levels, whilst the 20 SMA maintains a strong bearish slope well above the current level, supporting further declines ahead, towards the 1.5200/20 price zone.

Support levels: 1.5250 1.5220 1.5170

Resistance levels: 1.5290 1.5330 1.5360

USD/JPY Current price: 119.84

View Live Chart for the USD/JPY

The USD/JPY pair came under selling pressure as the EUR/JPY sells off following the ECB dovish stance, breaking below the 120.00 level early in the US session. The USD/JPY has failed to hold beyond the 120.35 on a short term advance beyond it during Asian hours, and the 1 hour chart shows that the price is now accelerating below its 200 SMA, whilst the technical indicators head sharply lower below their mid-lines, anticipating a continued decline towards 119.40, the 38.2% retracement of the latest 2 weeks decline. In the 4 hours chart the technical picture is also bearish, although the decline can be limited on rising stocks and ahead of tomorrow US employment data.

Support levels: 119.40 118.90 118.50

Resistance levels: 120.00 120.35 120.60

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.