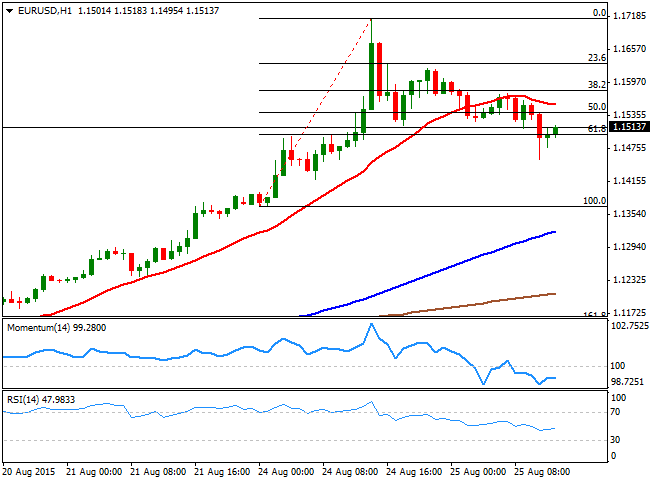

EUR/USD Current price: 1.1512

View Live Chart for the EUR/USD

China's stocks market collapse extended this Tuesday, with the Shanghai Composite closing the day down 7.63%. But the rest of the Asian markets recovered some of their recent losses, whilst European markets also opened with a positive tone that extended after the PBoC announced a 25 bp cut in key rates and a 50 bp cut in reserve requirements, in another desperate move to contain stocks' bleeding and guarantee liquidity. The dollar got benefited with the announcement, extending its recovery across the board. Earlier today, Germany released the final review of the Q2 GDP, in line with market's expectations. Also, the country offered its IFO survey data, showing that local sentiment continues to improve.

The EUR/USD pair fell down to 1.1455 after the latest PBoC rate cut, but bounced back above the 1.1500 level, where it stands ahead of the US opening. The level is the 61.8% retracement of yesterday's advance, which means that if it holds, may see the pair resuming its advance towards fresh lows, being this latest decline merely corrective. Technically, the 1 hour chat shows that the price is below its 20 SMA, whist the Momentum indicator heads lower below the 100 level, although the RSI indicator aims higher, around 48. In the 4 hours chart, the technical indicators have corrected extreme overbought readings and now attempt to recover, not yet confirming additional gains. The price needs now to advance beyond 1.1540, the 50% retracement of the same rally, to confirm additional gains this Tuesday.

Support levels: 1.1500 1.1455 1.1420

Resistance levels: 1.1540 1.1580 1.1630

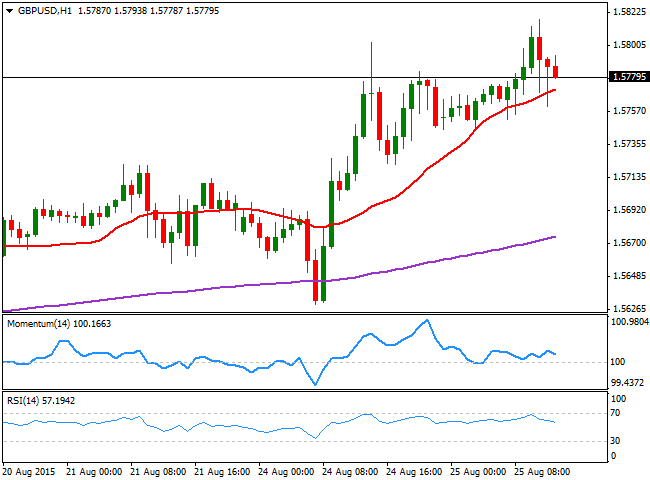

GBP/USD Current price: 1.5778

View Live Chart for the GPB/USD

The GBP/USD pair retreats from a fresh 2-month high set at 1.5817, with dollar buyers surging slowly after China's Central Bank move, and helped by a recovery in local share markets. There were no fundamental releases in the UK, but later today, the US will release housing and employment figures, which may determinate whether the greenback can extend its intraday advance. The short term picture suggests the downside is limited, as in the 1 hour chart, the price is above a bullish 20 SMA that attracted buyers on intraday dips, whilst the technical indicators have turned lower, but remain well above their mid-lines. In the 4 hours chart, the 20 SMA heads sharply higher around 1.5710, whilst the Momentum indicator aims higher well into positive territory and the RSI indicator hovers around 62, lacking upward strength, in line with the shorter term view.

Support levels: 1.5770 1.5735 1.5680

Resistance levels: 1.5815 1.5840 1.5885

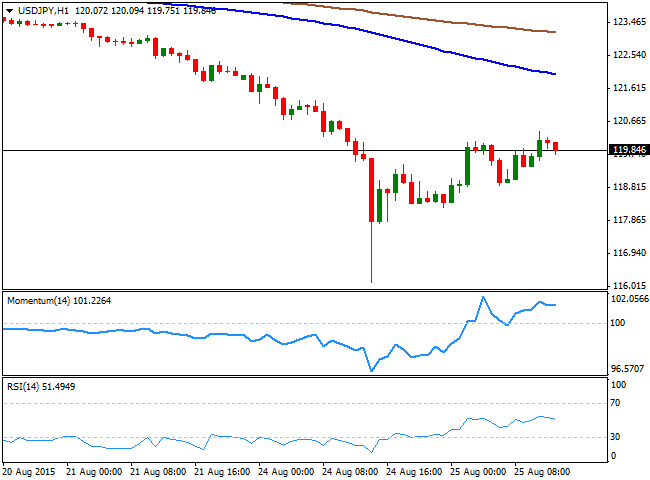

USD/JPY Current price: 119.84

View Live Chart for the USD/JPY

Bears still in control, 121.00 a line in the sand. The USD/JPY pair advanced up to 120.34 this Tuesday, with the Japanese yen weakening on Nikkei's recovery and Japan's PM Abe advisor, Hamada said that the country may need to ease further if Q3 GDP fails to grow. The pair however, retreated from its high and remains below the 120.00 figure, with the 1 hour chart showing that the price remains well below the 100 and 200 SMAs that maintain strong bearish slopes, whilst the technical indicators are losing their upward strength near overbought levels. In the 4 hours chart the technical indicators have corrected the extreme oversold readings reached yesterday, but are losing their upward strength well below their mid-lines, limiting chances of a stronger recovery, and maintaining the risk towards the downside. The pair needs to recover above the mentioned daily high to be able to extend its recovery up to 121.00, the 200 DMA, and a line in the sand for the latest bearish trend. Below 119.20 on the other hand, the pair will likely resume its decline, with 118.80 as the immediate support.

Support levels: 119.60 119.20 118.80

Resistance levels: 120.35 120.65 121.00

AUD/USD Current price: 0.7205

View Live Chart for the AUD/USD

The AUD/USD pair trades steady around the 0.7200 figure, having recovered ground amid the latest PBoC decision to cut rates. The 1 hour chart shows that the price is holding above a flat 20 SMA, whilst the Momentum indicator retraces alongside with price from a high set at 0.7249, and the RSI turns lower around 50, suggesting the upside remains limited. In the 4 hours chart, the price has stalled well below a strongly bearish 20 SMA, whilst the technical indicators have turned sharply lower after correcting oversold readings, pointing for another leg lower over the upcoming session, particularly if the pair losses again the 0.7200 level.

Support levels: 0.7200 0.7165 0.7120

Resistance levels: 0.7260 0.7300 0.7345

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.