New update: EUR/USD retreats from 1.17, toward 1.1600

Why? EUR/USD: Why is the buck getting bludgeoned?

Also on a mad move: USD/JPY Forecast: fresh 3-month low

EUR/USD Current price: 1.1653

View Live Chart for the EUR/USD

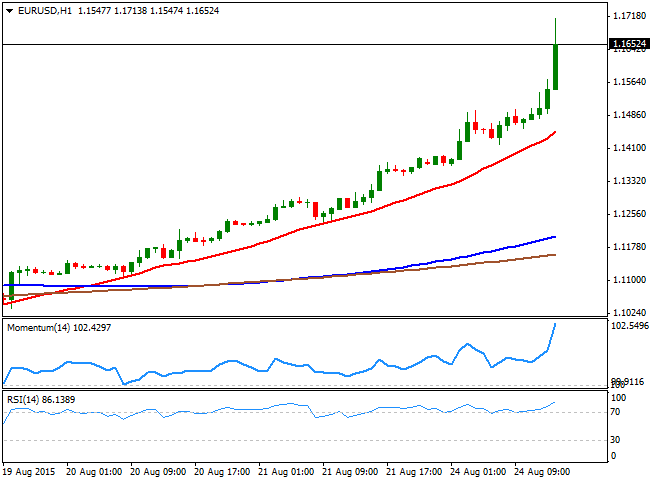

The EUR/USD pair added 170 pips in less than 30 minutes and ahead of the US opening, with the pair reaching 1.1713, levels not seen since in January this year. Wall Street collapsed at the opening, with the main US benchmarks opening hundreds of pips lower, their worst decline in decades. The DJIA opened 900 points lower, and trades now down 600, the Nasdaq is down 215 points, and the S&P is down around 80 points, following the decline in Asian share markets. The movements are brutal, as uncertainty over what the FED may do next month, adds to the chaos in China.

The EUR/USD retreated some, as stocks recovered from their lows. Higher highs seem unlikely at the time being, considering the pair has traded within a 330 pips range ever since the day started, which anyway does not guarantee the pair may correct lower. Technically, the pair is extremely overbought with the RSI in the hourly chart at 86, and around 79 in the daily chart. Given that the market is being driving purely on sentiment, the rally may extend after some consolidation, with a break above 1.1690 enough to confirm an extension towards the 1.1740 price zone, particularly if stocks resume their decline.

Support levels: 1.1620 1.1585 1.1540

Resistance levels: 1.1690 1.1740 1.1790

GBP/USD Current price: 1.5771

View Live Chart for the GPB/USD

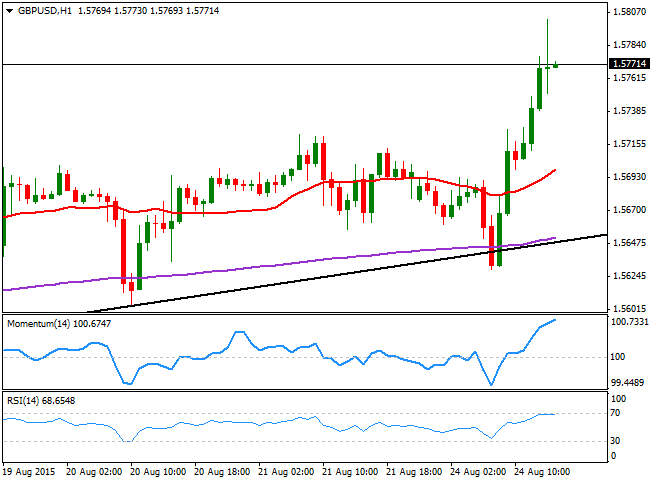

The GBP/USD pair surged to a fresh 2-month high of 1.5802, but the British Pound is under performing, compared with other European currencies that have advanced two or three times what the GBP did against the greenback. The upside is anyway favored, as the pair is well above the top of its recent range around 1.5730, and holding around 1.5770 a strong static resistance level. The 1 hour chart shows that the technical indicators are partially losing their upward strength after reaching overbought levels, limiting the upside. In the 4 hours chart however, a strong upward Momentum prevails, whilst the 20 SMA is finally gaining bullish strength below the current level, suggesting the retracement will also remain limited probably by former highs in the 1.5730 price zone. Should this last give up, the risk will turn towards the downside despite dollar's weakness, with the pair then poised to test the 1.5650 price zone.

Support levels: 1.5735 1.5680 1.5650

Resistance levels: 1.5770 1.5815 1.5840

USD/JPY Current price: 118.30

View Live Chart for the USD/JPY

The USD/JPY pair sunk to 116.13 with the American opening, a few pips above this year low set last January at 115.84. The pair recovered over 200 pips, but remains 350 pips below last Friday's close. The recovery is going alongside with Wall Street bounce, but ever since the pair has broke below its 200 DMA, the bearish trend is likely to prevail. Shorter term, the 1 hour chart shows that the technical indicators are bouncing from extreme oversold readings, going with price rather than anticipating additional recoveries. The pair has an immediate short term support at 117.80, which means it will take a break below it to confirm additional declines today. Advances up to 118.80 will likely be seen as selling opportunities, as only a clear recovery beyond 119.60 be enough to discourage bulls.

Support levels: 117.80 117.30 116.65

Resistance levels: 118.80 119.20 119.60

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

EUR/USD recovers to top end of consolidation ahead of Friday’s US NFP

EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.