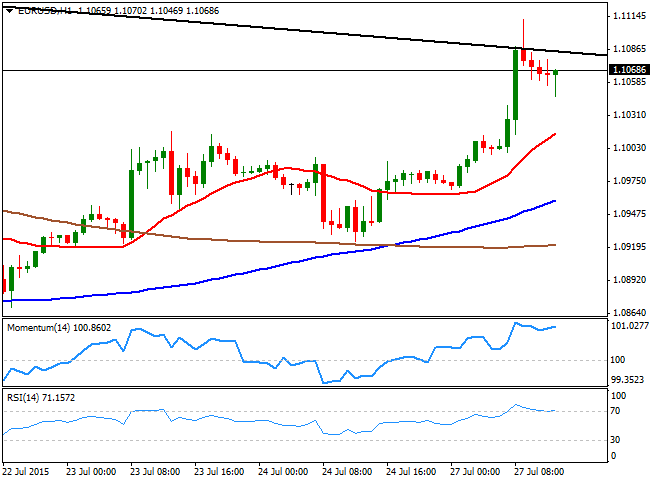

EUR/USD Current price: 1.1071

View Live Chart for the EUR/USD

The EUR/USD pair surged to a daily high of 1.1103 on the back of positive European data, with the German IFO survey showing that confidence among local investors rose beyond expected, on diminishing risk of a Grexit, and a rise in circulating in the EU region. The pair however, retreated from its high, and consolidated above the 1.1050 level, ahead of the release of the US Durable Goods Orders. The key market mover resulted better-than-expected, printing 3.4% in June against expectations of a 3.0% advance. The core reading also came out above expectations, advancing 0.8%. The reading is far from supporting the greenback however, as the EUR/USD pair bounced quickly from a short lived kneejerk, maintaining its overall positive tone. Technically, the pair is still biased higher in the short term, as the price continues to develop well above its moving averages, whilst the Momentum indicator heads slightly higher near overbought levels, as the RSI indicator hovers around 70. In the 4 hours chart, the price has retreated from a roof of a daily descendant channel, whilst the technical indicators are beginning to give signs of upward exhaustion, although remain far from suggesting a bearish move. At this point however, the price needs to extend beyond 1.1120 to confirm additional intraday gains towards the 1.1200 level.

Support levels: 1.1050 1.1000 1.0960

Resistance levels: 1.1090 1.1120 1.1160

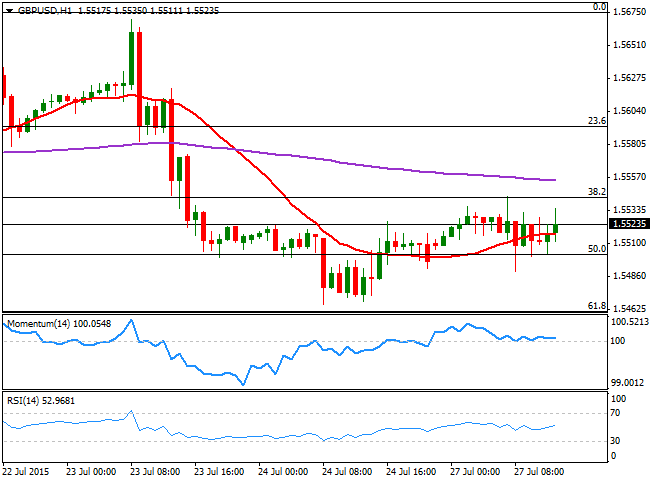

GBP/USD Current price: 1.5535

View Live Chart for the GPB/USD

The GBP/USD pair advanced up to 1.5543 this Monday, helped by dollar's broad weakness. The pair however, was unable to extend beyond the 38.2% retracement of its latest bullish run that converges with the mentioned high. The pair however, is holding above the 1.5500 level, 50% retracement of the same rally, with a brief decline below it quickly attracting buying interest. Short term, the outlook is neutral-to-bullish as the price hovers above a mil bullish 20 SMA whilst the technical indicators barely head higher above their mid-lines in the 1 hour chart. In the 4 hours one, the price remains below a bearish 20 SMA that also converges with the daily high, whilst the technical indicators aim higher, but below their mid-lines, limiting chances of a stronger advance.

Support levels: 1.5460 1.5420 1.5385

Resistance levels: 1.5545 1.5590 1.5635

USD/JPY Current price: 123.17

View Live Chart for the USD/JPY

Bearish potential towards 122.40. The USD/JPY pair fell to a fresh 2-week low, as the yen got a boost during Asian hours, from a sell-off in local share markets. Chinese shares fell 8.5% whilst the Nikkei extended its decline down to a 2-week low near 20,100. The USD/JPY pair trades around its daily low, with a spike up to 123.30, following US positive Durable Goods Orders data, attracting selling interest. The bias is south as the 1 hour chart shows that the price has extended well below its moving averages, with the 100 SMA crossing below the 200 SMA and with the technical indicators heading strongly lower, despite being near oversold territory. In the 4 hours chart, the price is now around its moving averages that converge flat a few pips above the current level, whilst the technical indicators head lower below their mid-lines. The immediate support comes at 122.90, the 38.2% retracement of its latest bullish run, with a break below it confirming additional declines towards 122.40, the 50% retracement of the same rally.

Support levels: 122.90 122.40 122.00

Resistance levels: 123.30 123.70 124.20

AUD/USD Current price: 0.7293

View Live Chart for the AUD/USD

The AUD/USD pair trades in a limited intraday range, having recovered some ground amid dollar's weakness, but unable to extend beyond the 0.7310 level the immediate intraday resistance. The short term picture suggest the downside is limited, as the 1 hour chart shows that the price is now above a mild bullish 20 SMA, whilst the technical indicators post shallow advances above their mid-lines. In the 4 hours chart, however, the bearish potential remains intact with the 20 SMA heading sharply lower around 0.7320 and the technical indicators maintaining their bearish slopes.

Support levels: 0.7260 0.7225 0.7185

Resistance levels: 0.7310 0.7345 0.7390

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.