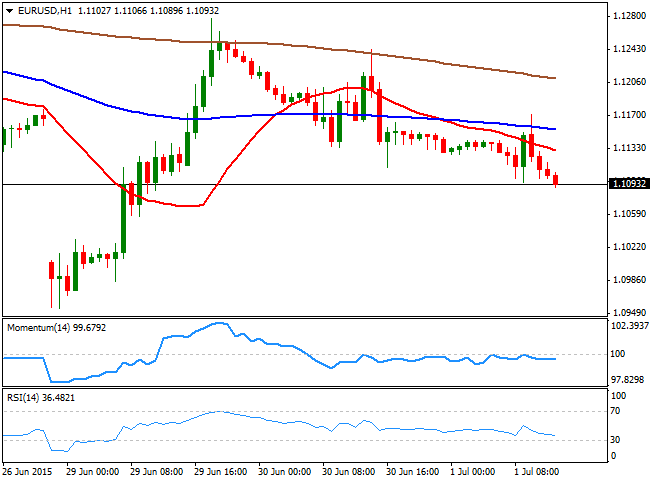

EUR/USD Current price: 1.1089

View Live Chart for the EUR/USD

And when finally the Greek default become real, and markets began to quiet down a bit, PM Tsipras sent a letter accepting the latest proposal with some conditions. Not enough, neither on time, the EU leaders are now delaying negotiations for after the weekend referendum, and then, will take time to be analyzed, and ever more time to be approved by different Parliaments across Europe, so if a deal is to be reached, will be by the ends of July. That suggest that Greek banks may not be able to reopen next Monday, and that the cap of €60 extraction a day will remain. The news however, was enough to boost local equities markets, up for the first time ever since the week started.

In the meantime, data from Europe shown local manufacturing PMIs for June came out mixed, with German and the EU readings matching expectations, but with growth limited in peripheral countries such as Italy and Spain. The EUR/USD pair traded as low as 1.1094, jumped up to 1.1170 on Greek news, and resumed its decline, down to 1.1100 ahead of the US ADP survey release, which resulted at 237K, beating expectations. The dollar jumped higher across the board, and the EUR/USD extended its intraday decline, presenting a short term bearish tone as the 1 hour chart shows that the price extends below its moving averages, whilst the technical indicators head south below their mid-lines. in the 4 hours chart, the Momentum indicator turned sharply lower around the 100 level, supporting the shorter term view, with chances of a test of the critical 1.1050 level in the upcoming hours.

Support levels: 1.1080 1.1050 1.1010

Resistance levels: 1.1120 1.1160 1.1210

GBP/USD Current price: 1.5732

View Live Chart for the GBP/USD

The Pound took a hit from the UK manufacturing PMI showing that the country grew at it slowest pace in two years in June, printing 51.4 against expectations of 52.5. The GBP/USD fell down to 1.5639, a fresh 2- week low, and held nearby ahead of US data release. The pair is accelerating to new daily lows after the positive US ADP survey, and the 1 hour chart shows a strongly bearish 20 SMA well above the current level, whilst the RSI indicator anticipated further declines, heading lower around 30. In the 4 hours chart, an early recovery was limited by a mild bearish 20 SMA, whilst the technical indicators are slowly turning south in negative territory, suggesting the pair may extend its decline over the upcoming hours. A break below 1.5600, should lead to a test of 1.5550, 50% retracement of the latest daily bullish run.

Support levels: 1.5600 1.5550 1.5520

Resistance levels: 1.5645 1.5695 1.5750

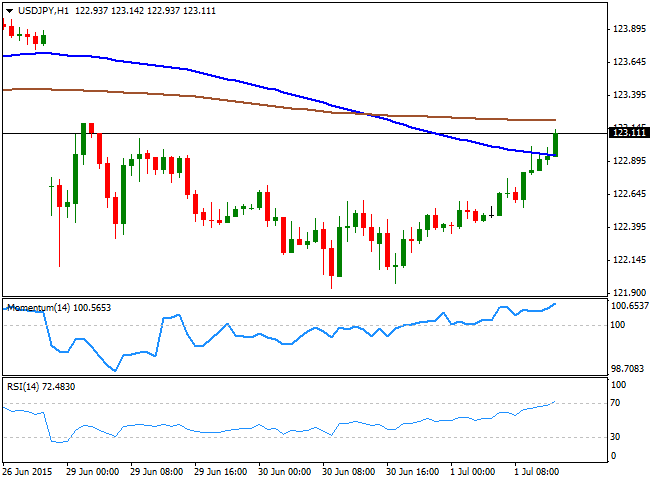

USD/JPY Current price: 123.18

View Live Chart for the USD/JPY

Market's positive mood has helped the USD/JPY regain the 123.00 level, now advancing further on positive US employment data. The 1 hour chart for the pair shows that the price has advanced above its 100 SMA, for the first time this week, with the 200 SMA now offering an immediate resistance in the 123.30 region, a strong static resistance level also. The technical indicators in the mentioned time frame head sharply higher, entering overbought territory, whilst in the 4 hours chart the technical readings are also biased strongly higher in positive territory, albeit the 100 and 200 SMAs converge a few pips above the current level, limiting chances of a stronger advance.

Support levels: 122.90 122.45 122.00

Resistance levels: 123.30 123.75 124.10

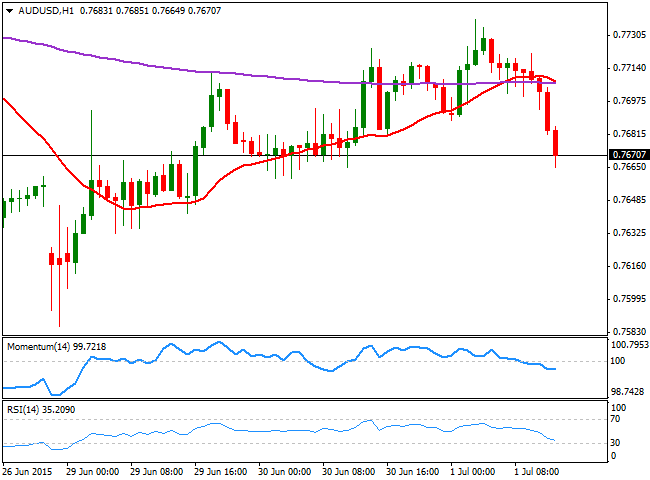

AUD/USD Current price: 0.7671

View Live Chart for the AUD/USD

The Aussie came under selling pressure as the greenback advanced across the board, accelerating down to 0.7664 ahead of the US opening. The pair has traded as high as 0.7738 early Asia, but selling interest around the level pushed it back south, with the 1 hour chart now supporting additional declines on a break below 0.7640, the immediate support, as the technical indicators head lower in negative territory whilst the price broke below its 20 SMA. In the 4 hours chart, the price is now trying to extend below its 20 SMA, whilst the technical indicators have turned lower around their mid-lines, supporting the shorter term view.

Support levels: 0.7640 0.7590 0.7550

Resistance levels: 0.7700 0.7740 0.7780

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.