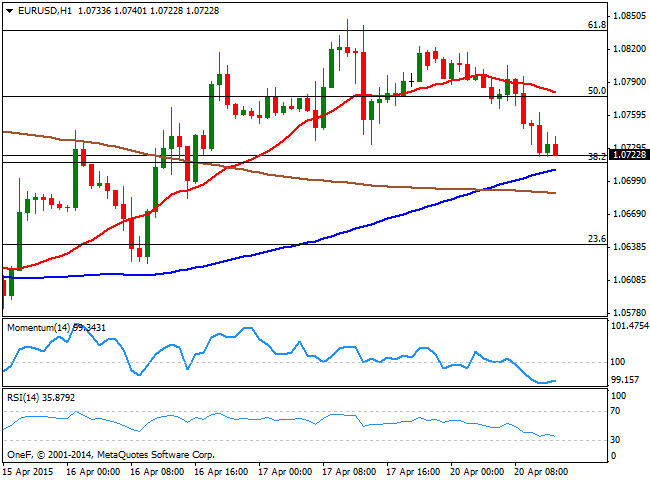

EUR/USD Current price: 1.0722

View Live Chart for the EUR/USD

The dollar advanced in the European session, helped partially by weaker than expected European data, as German PPI came out negative and Euro zone construction output fell by 1.8% in February, and increased risk aversion, triggered by the Chinese Central Bank´s decision to cut the reserve requirement ratio for all banks by 100 basis points on Sunday. Greek woes also weigh on investor's sentiment, with the dollar taking advantage of it. As for the EUR/USD pair, the 1 hour chart shows that at fresh daily lows, with the price approaching the 38.2% retracement of its latest bearish run at 1.0710, the immediate support. In the same chart, the 20 SMA turned lower above the current level, whilst the RSI indicator heads south around 35 and the Momentum indicator stands flat below 100, all of which supports further declines. In the 4 hours chart, the price broke below its 20 SMA whilst the technical indicators head lower in positive territory, and are about to break below their mid-lines, supporting the shorter term view.

Support levels: 1.0710 1.0680 1.0650

Resistance levels: 1.0740 1.0775 1.0810

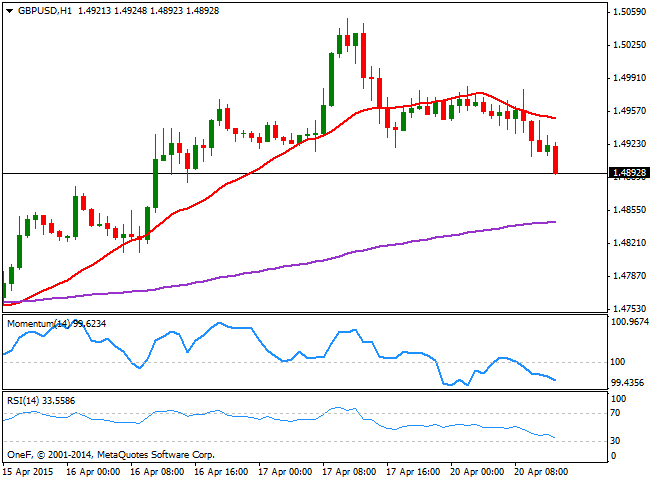

GBP/USD Current price: 1.4893

View Live Chart for the GBP/USD

The GBP/USD breaks below the 1.4900 figure ahead of the US opening, maintaining a short term bearish tone. The pair has retreated sharply from the high set on Friday in the 1.5050 region, which should discourage further buyers. Technically, the 1 hour chart shows that the price extends below a bearish 20 SMA whilst the technical indicators head lower below their mid-lines. In the 4 hours chart the price is extending below its 20 SMA and its 200 EMA, both converging around 1.4910 acting as strong dynamic resistance, whilst the Momentum indicator is crossing its 100 level towards the downside with a sharp bearish slope, signaling additional declines should the price extend below 1.4870, now the immediate support.

Support levels: 1.4870 1.4830 1.4790

Resistance levels: 1.4910 1.4950 1.5000

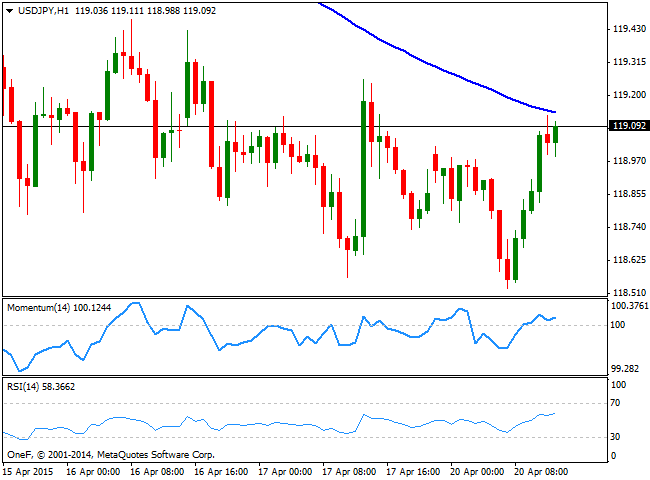

USD/JPY Current price: 119.02

View Live Chart for the USD/JPY

The Japanese yen has been steadily losing ground against its American rival, following a fresh monthly low set at 118.52 during the Asian session. The pair is aiming to establish above the 119.00 level, and the 1 hour chart shows that the technical indicators are heading higher above their mid-lines, whilst the 100 SMA provides immediate resistance in the 119.15 level. In the 4 hours chart, the Momentum indicator crosses the 100 level to the upside, albeit the RSI indicator stands flat around 48 and the price stands well below its moving averages, all of which should keep the upside limited.

Support levels: 118.90 118.50 118.15

Resistance levels: 119.35 119.80 120.10

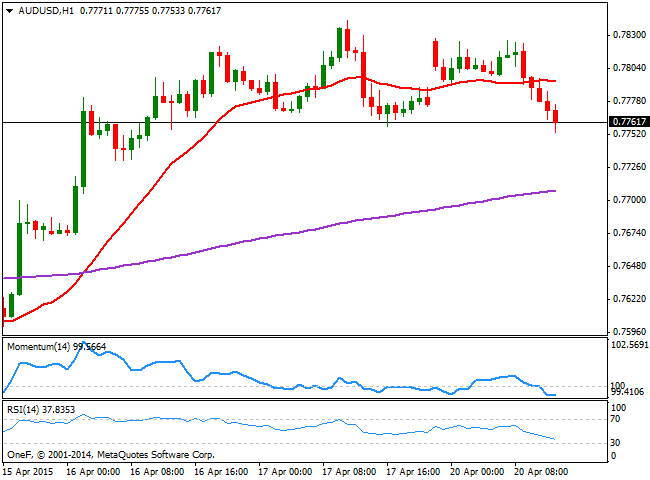

AUD/USD Current price: 0.7763

View Live Chart for the AUD/USD

The AUD/USD pair trades near a fresh daily low posted at 0.7753, amid dollar strength, after finding selling interest in the 0.7820 region earlier in the day. The 1 hour chart shows that the price extended below a flat 20 SMA, currently around 0.7800, whilst the technical indicators head lower below their mid-lines, with a limited bearish strength. In the 4 hours chart the price is struggling around a strongly bullish 20 SMA whilst the technical indicators signal additional declines as per crossing their mid-lines towards the downside. Nevertheless a downward acceleration below the mentioned daily low is required to confirm the bearish continuation in the short term, as long as the 0.7800 level continues to attract selling interest.

Support levels: 0.7750 0.7720 0.7685

Resistance levels: 0.7800 0.7840 0.7900

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.