EUR/USD Current price: 1.0625

View Live Chart for the EUR/USD

The EUR/USD pair trades in quite a thin range around the 1.0550 area, as the market waits for the ECB economic policy meeting this Wednesday. Earlier in the day, local data resulted mild weak, with German wholesale prices down by 1.1% in March, yearly basis, and Spain inflation still negative. In the US, Retail Sales missed expectations, up 0.9% in March against 1.1% expected, while Producer price indexes came out as expected, triggering a dollar bearish run across the board. Technically, the EUR/USD 1 hour chart shows that the price advances above a flat 20 SMA and extends above the 1.0600 figure, whilst the technical indicators head strongly up above their mid-lines. In the 4 hours chart, the price advances above a bearish 20 SMA, while the technical indicators gain upward momentum above their mid-lines, supporting additional advances, up to 1.0690, the 61.8% retracement of its latest bullish daily run.

Support levels: 1.0600 1.0550 1.0520

Resistance levels: 1.0690 1.0720 1.0755

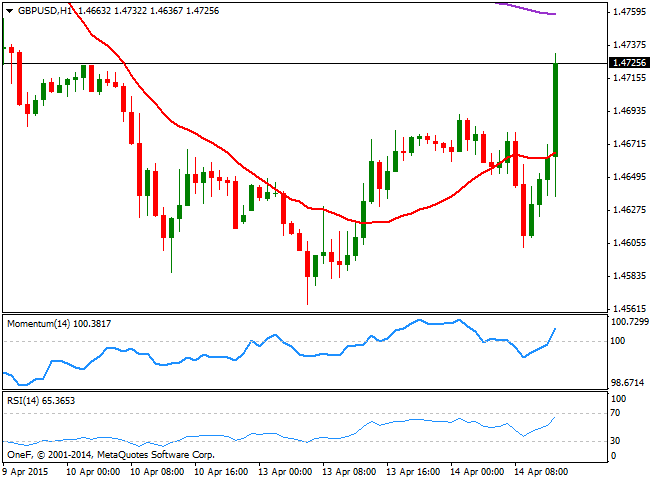

GBP/USD Current price: 1.4725

View Live Chart for the GBP/USD

The GBP/USD pair recovered earlier in the day, but stalled a few pips below the 1.4700 figure, from where it fell down to 1.4602. In the UK, inflation was unchanged at 0.0% y/y in March, while house prices rose less than expected in March, up 7.2%. The short term picture favors the upside after tepid US data, as the pair surged to a fresh 3-day high and the 1 hour chart shows that the price accelerated above its 20 SMA, whilst the technical indicators head higher above their mid-lines. In the 4 hours chart the technical indicators are accelerating above their mid-lines, supporting also a continued advance as long as the 1.4690 price zone now attracts buying interest.

Support levels: 1.4690 1.4635 1.4585

Resistance levels: 1.4750 1.4790 1.4830

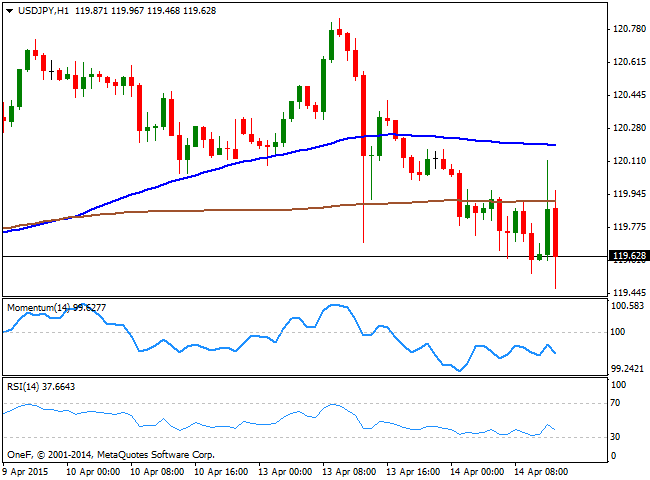

USD/JPY Current price: 119.60

View Live Chart for the USD/JPY

Abe's advisor Hamada is back on the wires, trying to correct the mess triggered yesterday after talking about an USD/JPY at 105.00. Today, he stated that 120.00 is an acceptable level, but if the price surges further up to 125/130, then that will widen the gap between purchasing power parity and spot rate, something undesirable. The USD/JPY pair recovered from a daily low at 119.54 and approached to the 120.00 level before resuming the downside, extending its daily decline down to 119.46. The 1 hour chart shows that the 200 SMA continues to cap the upside in the 119.90 level, whilst the technical indicators have turned lower in negative territory after correcting oversold readings. In the 4 hours chart the indicators stand well below their mid-lines, albeit lacking directional strength at the time being, whilst the price stands below its moving averages, favoring a downward continuation particularly if the pair breaks below the 119.35 level, the immediate support.

Support levels: 119.35 118.90 118.50

Resistance levels: 119.90 120.20 120.45

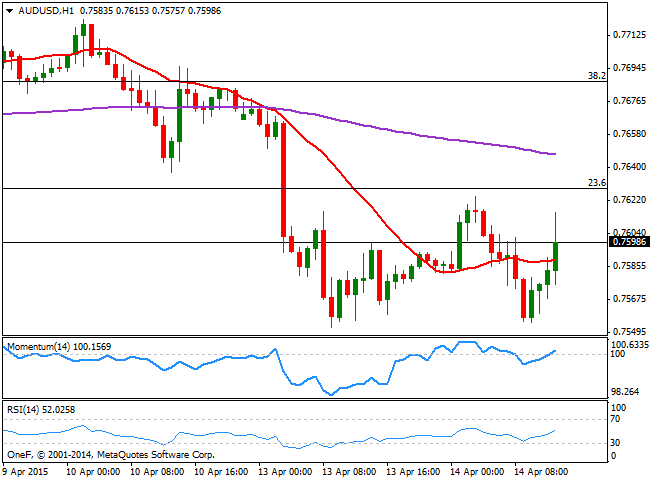

AUD/USD Current price: 0.7598

View Live Chart for the AUD/USD

The Australian dollar maintains a heavy tone against the greenback, as the pair surged up to 0.7624 during the last Asian session before regaining the downside. Falling gold prices that approached the $1,180 level, indeed weighed on the antipodean currency. Technically, the 1 hour chart shows that the price is still unable to advance above the 0.7600 level, albeit a mild positive tone prevails, with the price above its 20 SMA and indicators crossing their mid-lines to the upside. In the 4 hours chart, the 20 SMA maintains a strong bearish slope well above the current level, whist the technical indicators are barely bouncing from oversold readings, keeping the upside limited as long as the price remains below 0.7625.

Support levels: 0.7550 0.7520 0.7490

Resistance levels: 0.7625 0.7660 0.7700

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

High hopes rouse for TON coin with Pantera as its latest investor

Ton blockchain could see more growth in the coming months after investment firm Pantera Capital announced a recent investment in the Layer-one blockchain, as disclosed in a blog post on Thursday.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.